Dow Jones Industrials Continue To Charge

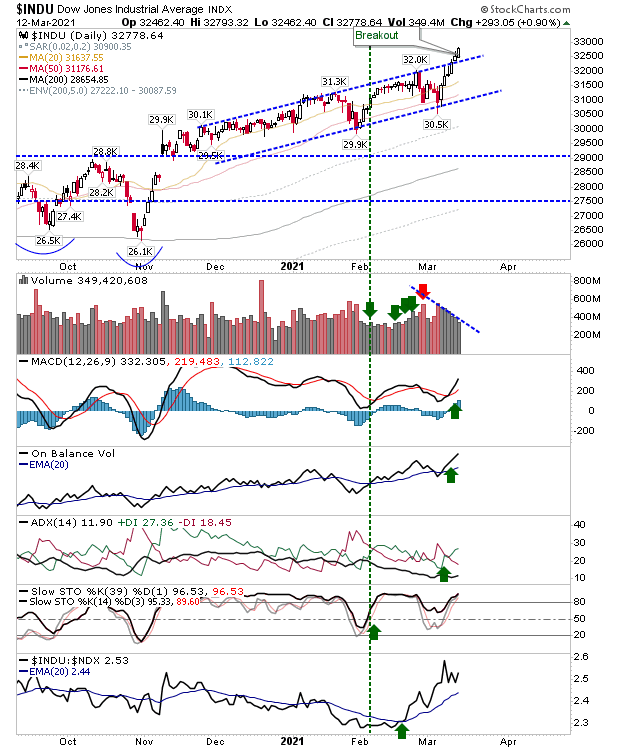

The Dow Industrials Average has grabbed my interest over the last couple of days as it continues to ascend beyond channel resistance to new all-time highs. Technicals are all net bullish, with the index sharply outperforming the Nasdaq 100. Only volume disappoints (a little).

The Russell 2000 has also made it to new all-time highs with technicals suitably bullish. Like the Dow Industrials Average, this is an index seeing falling volume at new highs - which isn't great - but price is the lead.

The Nasdaq rebounded off its 20-day MA with modest action. Technicals are still net negative as it remains a bit off of its highs.

The S&P 500 is up against resistance in a possible double top, but as the Dow Jones Industrial Average has handily pushed beyond its last swing high, the expectation would be for the S&P 500 to follow suit to new highs. I have marked it as a possible top at resistance, but tomorrow has its opportunities.

For tomorrow, the S&P 500 sits at a pivot between a breakout or a potential double top. With Large-Caps favoring a breakout and the Russell 2000 pushing new highs, the likelihood of the S&P 500 heading higher is the more probable outcome.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more