Dow Jones Industrial Average Grinds Out Another Record High But Remains Cautious

Image Source: Unsplash

- The Dow Jones touched 46,700 for the first time ever on Tuesday.

- Despite equity indexes tilted into record highs, topside momentum remains thin.

- US PMI figures came in more or less as expected, but headline figures still declined.

The Dow Jones Industrial Average (DJIA) clipped another record intraday high on Tuesday, peaking near 46,715 for the first time. The Dow is tilted into the bullish side this week, extending into a fifth straight green session. However, gains remain thin as market concerns continue to lurk just out of eyesight.

The Dow was driven into fresh record highs by a general rise in the energy sector, followed by firm gains in real estate and health services. Consumer discretionary stocks fell back on Tuesday, with the tech sector giving back some of the week’s early gains.

UnitedHealth (UNH) and Boeing (BA) drove the Dow Jones higher with UNH climbing around 3% on the day as investors step back into the health services and insurance giant. A looming investigation for Medicare fraud appears to have blown over for UnitedHealth, giving markets free run to continue bidding UNH shares back over $350.

Boeing rose over 2% on Tuesday, climbing back into $216.50 after Uzbekistani President Shavkat Mirziyoyev inked a deal with the airplane manufacturer worth over $8 billion. Boeing gained further ground after rumors accelerated that the US and China could be heading toward a “huge” deal around Boeing purchases.

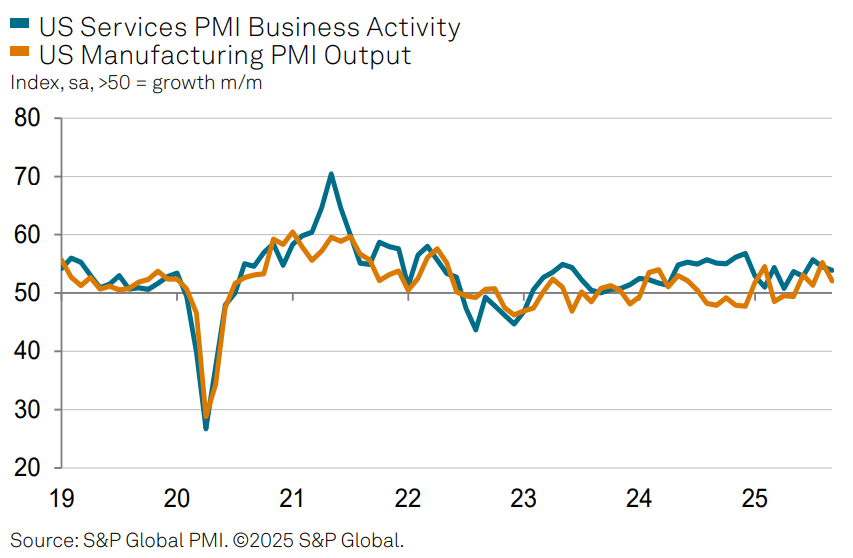

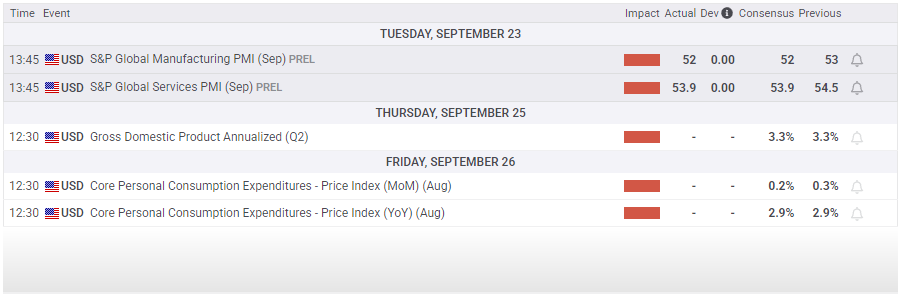

US Purchasing Managers Index (PMI) survey results eased back in September, but headline figures came in near expectations, crimping the intraday fallout. S&P Global Manufacturing PMI data from September fell to 52.0 from 53.0, as investors expected, while the Services PMI component slipped to the forecast of 53.9 from 54.5. American businesses that bothered to respond to the survey noted that overall output through September remained high, putting the US economy on pace to grow by around 2.2% on an annualized basis. However, the pace of hiring is also expected to slow in the coming months in the face of easing demand conditions, and businesses are growing uneasy about a still-growing overhang in inventory growth as signs of disappointing sales trends in the future continue to calcify.

The US’s latest round of Personal Consumption Expenditures Price Index (PCE) inflation is due on Friday, and investors will be looking to see if enough businesses are letting themselves get squeezed out of their own profit margins to avoid passing on too much of tariff costs directly onto consumers too quickly.

Dow Jones daily chart

More By This Author:

GBP/USD Clips Three-Day Losing Streak, Bounces Off Key TechnicalsCanadian Dollar Drives Lower As Loonie Races Greenback To The Bottom

Dow Jones Industrial Average Climbs On Monday As Equities Hit All-Time Highs