Dow Jones Industrial Average Gains Ground After Not-Too-Hot CPI Print

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) caught some bullish lift on Tuesday, rising around 450 points after United States (US) Consumer Price Index (CPI) inflation data from July failed to push markets off of bets for an interest rate cut from the Federal Reserve (Fed) in September.

The Dow bounced back above 44,400 to punch in a new high for the week and pushed into the high end of near-term consolidation. The Dow Jones is still catching some lift following a bullish bounce from the 50-day Exponential Moving Average (EMA), which is now rising into 43,800, and the trick for bidders will be to muscle the major index back above 44,500. Should bullish momentum falter here, the Dow could backslide into a firm consolidation phase.

(Click on image to enlarge)

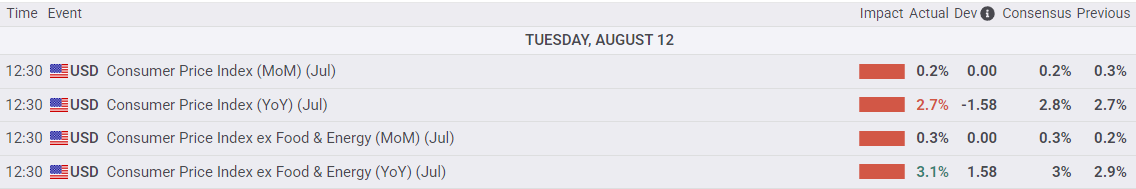

Headline CPI inflation came in better than expected, holding steady at 2.7% YoY in July versus the expected uptick to 2.8%. Despite investors maintaining their positive mood following the CPI release, the figure indicates that there has been no functional progress in taming headline CPI inflation since September 2024. Core CPI metrics further pointed to potential issues, with inflation minus volatile food and energy prices accelerating to 3.1% YoY, wiping out six months of minimal progress on core inflation.

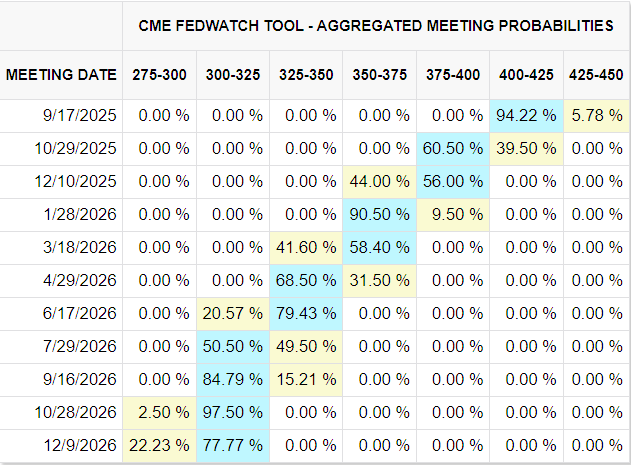

Despite still-stubborn inflation data, investors are still leaning firmly into bets of a Fed rate cut on September 17. According to the CME FedWatch Tool, rate betters see nearly 95% odds of at least a quarter-point rate trim at the Fed’s next interest rate decision. Odds of a follow-up rate cut in October also climbed above 60%, and rate traders have priced in 90% odds that the Fed will reach three-quarters of a point in rate cuts by the end of next January.

Trump team tries to steal the limelight back from inflation

Not to be outdone by market headlines, US President Donald Trump announced that not only is Fed Chair Jerome Powell “too slow” to deliver interest rates, he is considering allowing a legal case to proceed against the head of the Fed, whom he himself nominated for the position during his first term. According to Trump, the costs of the Fed building restoration, which is paid by neither the taxpayers nor the government, has become “too expensive”, which Trump ostensibly intends to use as justification for suing Fed Chair Powell for refusing to lower interest rates. Apparently, the Trump administration remains unaware that the Federal Open Market Committee (FOMC) sets rates via a majority vote at regularly scheduled meetings throughout the calendar year.

Seeding clouds to make a rainy day later, Trump’s pick to head the Bureau of Labor Statistics (BLS) suggested in an interview with Fox News that the BLS should pause publishing monthly labor data. EJ Antoni, the chief economist of the conservative political campaign group Heritage Foundation, was tapped by Donald Trump to replace the head of the BLS, whom Trump had terminated in a whiplash reaction to the latest sour patch of US labor data.

Dow Jones 5-minute chart

(Click on image to enlarge)

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

GBP/USD Momentum Falters Ahead Of Hefty Tuesday DocketDow Jones Industrial Average Trims Lower Ahead Of Key CPI Inflation Print

Canadian Dollar Steadies After Job Losses, Eyes On U.S. CPI Next Week