Dow: Is One Cut Enough For This 6.4% Yielder?

A couple of weeks ago, Dow (NYSE: DOW) cut its dividend in half due to a “prolonged industry downturn” and “to provide additional financial flexibility”.

That’s typically not what you want to hear if you’re a dividend investor.

But Dow’s new $0.35 per share quarterly dividend still equals a robust 6.4% yield. Can shareholders depend on the new lowered dividend, or is it likely to fall again?

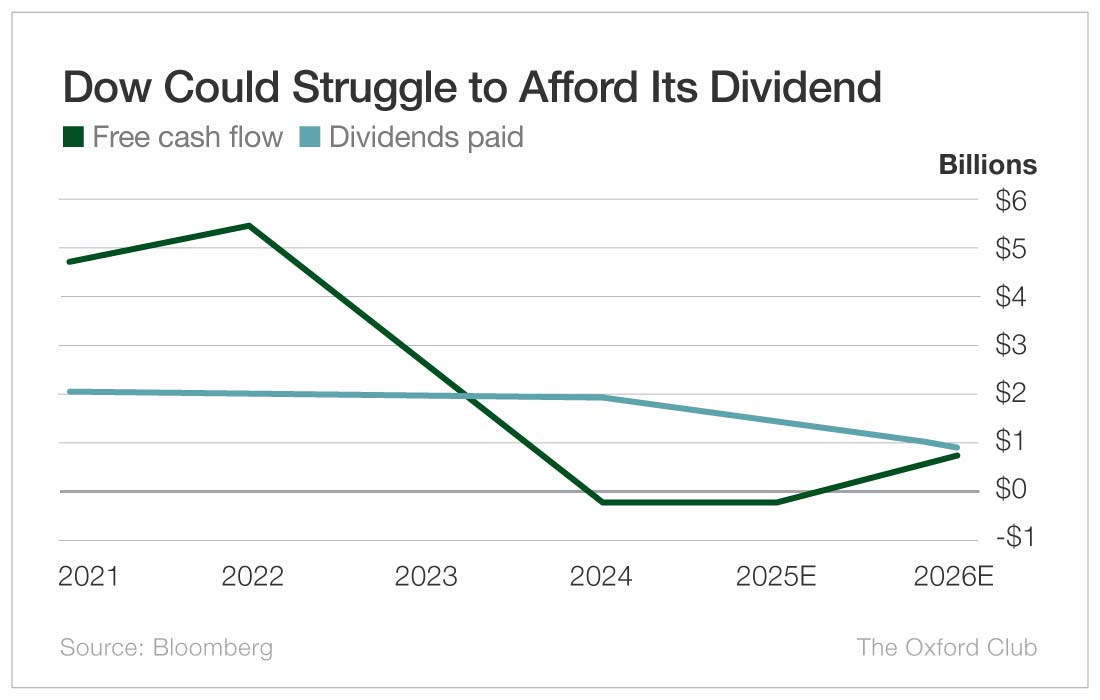

Dow had negative free cash flow in 2024 and is on pace for a repeat performance this year.

Without positive free cash flow, the company cannot afford its dividend – or really any dividend. In order to pay shareholders, it needs to pull cash from the bank or borrow money.

It does have $2.7 billion in cash, though it also has more than $15 billion in debt. Given that it’s been burning several billion dollars a year in cash from operating its business, there likely won’t be much cash left over to pay shareholders.

Next year, free cash flow is forecast to be positive. But the $718 million in expected free cash flow is still below the nearly $1 billion that Dow will pay if it keeps the dividend at $0.35.

The company’s dividend was steady for years at $0.70… until it wasn’t. And once a dividend is reduced, it means management has broken that sacred vow with shareholders and is more likely to do it again.

Given that the cash flow situation is not expected to turn around anytime soon, Dow’s dividend cannot be considered safe.

Dividend Safety Rating: F

More By This Author:

Can Icahn Enterprises Maintain Its Massive 21% Yield?

The Best Annuity Is No Annuity

Has New Mountain Finance’s 12% Yield Reached Its “Peak”?