Dow Heads For Worst Week Since March

The Dow Jones Industrial Average (DJI) is near breakeven this afternoon, while the S&P 500 (SPX) and Nasdaq Composite (IXIC) are lower, with all three major indexes headed for weekly losses. The blue-chip benchmark is pacing for its worst week since March, while the SPX could mark its longest weekly losing streak since February with three straight. Meanwhile, oil prices are on track to snap their seven-week streak of gains.

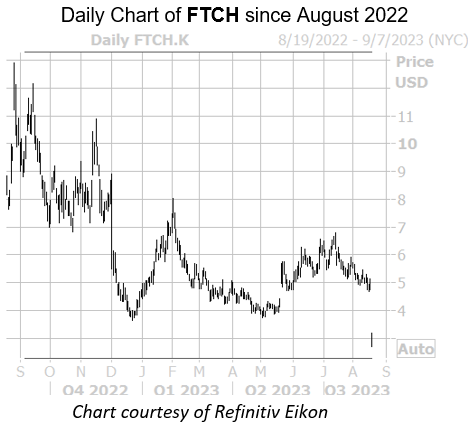

Options bears are chiming in on Farfetch Ltd (NYSE: FTCH) stock after it hit a record low. So far today, 190,000 puts were traded in comparison to 38,000 calls -- already 24 times the average daily options volume. The June 2 put is the most popular by far, with new positions being opened there. The retail platform reported worse-than-expected second-quarter results and cut its 2023 sales forecast, leading several firms to issue bear notes. At last check, FTCH was down 38.8% at $2.92.

Aditxt Inc (Nasdaq: ADTX) is at the top of the Nasdaq today, up 18.1% at $18.86 at last glance, after the biotech company provided a shareholder update and strategy for achieving commercial scale, and yesterday announced a 1-for-40 reverse stock split. Year-to-date, the equity is down 58.2%.

Vinfast Auto Ltd (Nasdaq: VFS) was last seen down 28.9% at $14.23, as it continues to fall from an early week surge, when it began publicly trading. VinFast's founder, Pham Nhat Vuong, controls 99% of the company's market share, leaving it open to volatility. On the short sell restricted (SSR) list today, VFS is up 38.4% year-to-date.

More By This Author:

Stocks Dragged As Economic Deluge Distracts Wall StreetStocks Slip After Latest Batch of Economic Data

Stocks Surrender Gains After Hawkish Fed Minutes