Dow Eyes Another Triple-Digit Win As Sentiment Turns Sunny

Stocks are eyeing even more upside this Thursday afternoon, with the Dow Jones Industrial Average (DJI) last seen up 170 points, while the Nasdaq Composite (IXIC) is quietly higher, and the S&P 500 Index (SPX) is eyeing notable gains of its own. Sentiment remains sunny following yesterday's cooling consumer price index (CPI) reading, while this morning's producer price index (PPI) saw a drop in July. Plus, an impressive earnings report from Walt Disney (DIS) is also buoying Wall Street's outlook.

Meanwhile, oil prices are back on the rise after the International Energy Agency (IEA) hiked its growth forecast for oil demand for this year. At last check West Texas Intermediate (WTI) crude futures were seen up more than 1.6%.

Matterport Inc (Nasdaq: MTTR) is seeing a surge in its options pits today, with 47,000 calls and 1,860 puts exchanged so far, which is 42 times the intraday average. The most popular position by far is the August 8 call, where positions are being bought to open. MTTR was last seen up 30.1% at $6.75 after the company reported stronger-than-expected subscription growth for its second quarter, and lifted its full-year revenue forecast. Year-to-date, the stock still suffers a 65.3% deficit, though its looking to clear a recent ceiling at the 100-day moving average for the first time this year.

Meanwhile, a top performer on the New York Stock Exchange (NYSE) is Ginko Bioworks Holdings Inc (NYSE: DNA). The equity was last seen up 28% at $4, following the firm's announcement that it initiated validation on a monkeypox virus test. DNA is trading at its highest level in over five months, though it's sitting at a year-over-year loss of 54%.

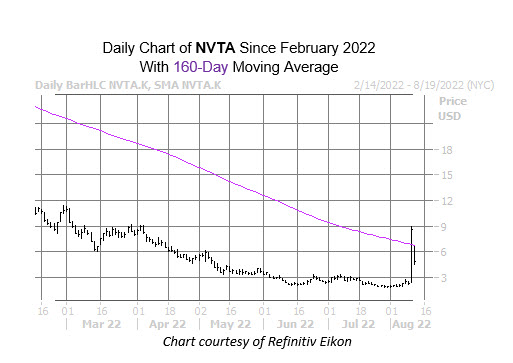

On the other end of the NYSE is Invitae Corp (NYSE: NVTA), which has shed 45.6% so far today to trade at $4.76. The security is cooling from yesterday's incredible 276.9% post-earnings surge, which put it at its highest level since April, and marked its first close above the 160-day moving average since February 2021. The stock has dipped back below here today, and the trendline could serve as a ceiling going forward.

More By This Author:

Stocks Log Solid Wins As Inflation Concerns EaseDow Extends Post-CPI Jump Into Midday Trading

S&P 500 Logs 4th-Straight Loss, Nasdaq Sheds 150 Points