Dow Extends Rebound Despite Lingering Covid-19 Concerns

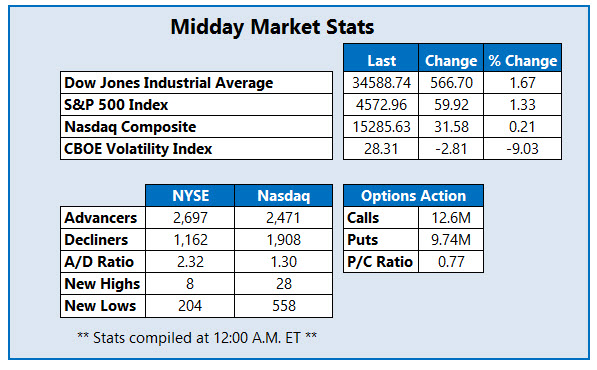

The Dow Jones Industrial Average (DJI) is continuing to scrape together a solid rebound off yesterday's selloff, last seen up over 560 points as investors attempt to brush off some of the volatility the Covid-19 omicron variant is causing. The S&P 500 (SPX) and Nasdaq Composite (IXIC) are both higher as well, as airline stocks get a boost from Boeing (BA). Also leading the charge higher are casino and energy stocks, while a better-than-expected round of jobless claims is contributing to today's optimism.

Phunware Inc (Nasdaq: PHUN) is seeing a surge in options activity today. So far 40,000 calls and 7.023 puts have exchanged hands -- six times the intraday average. The most popular is the weekly 12/3 4-strike call, followed by the 3.50-strike call in the same series, with positions being bought to open at both. This suggests investors are expecting additional upside for PHUN by the time contracts expire tomorrow. The stock is up 8.6% at $3.53 at last check, getting a boost on news that former President Donald Trump's new social media venture is looking to raise $1 billion in funding. Phunware was hired by Trump's 2020 campaign to design a phone app. The security is up 173.7% year-to-date, though its running into pressure from its 30-day moving average today.

One of the best stocks on the Nasdaq is CF Acquisition (Nasdaq: CFVIW). The security is up 198% to trade at $2.95 at last check, after inking an agreement to take YouTube competitor Rumble public in a $2.1 billion deal. In turn, the penny stock earlier notched a record high of $5.23.

One of the worst-performing stocks on the Nasdaq, on the other hand, is Context Therapeutics Inc (Nasdaq: CNTX). The equity is down 25.4% at $5.35 after the company agreed to definitive securities purchase deals for a private placement with accredited investors of 5 million shares of common stock, which will be worth roughly $31.25 million. The equity touched a fresh high of $10.87 yesterday, though this surge was short-lived. The stock is now trading just shy of its all-time lows near the $4.30 area.

Disclaimer: Schaeffer's Investment Research ("SIR" or "we" or "us") is not registered as an investment adviser. SIR relies upon the "publishers' ...

more