Dow Down Triple Digits, Eyeing Third-Straight Weekly Loss

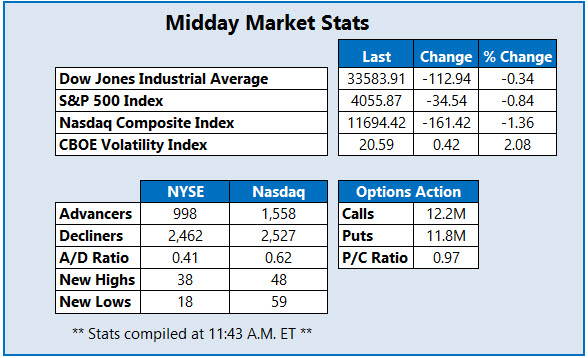

Sentiment remains sour on Wall Street as interest rate hike fears linger. Surging bond yields aren't helping, either, with rates rising to their highest level in three months. The three major benchmarks are firmly lower this afternoon and headed for weekly losses, with the Dow Jones Industrial Average (DJI) eyeing its third consecutive week in the red.

Options bulls are blasting surging DraftKings Inc (Nasdaq: DKNG) after the company raised its 2023 revenue forecast. DKNG is up 13.6% at $20.23, with no fewer than three analysts lifting their price targets. So far, 228,000 calls have crossed the tape, or times the intraday average, in comparison to 90,000 puts. The February 21 call is the most popular, with new positions opening there. On the charts, today's pop has the stock breaking above long-term pressure at its 320-day moving average.

The New York Stock Exchange's United States Cellular Corp (NYSE: USM) is up 19.5% to trade at $25.10 at last check, after the company's fourth-quarter report. The telecommunications name reported losses of 33 cents per share -- in line with analyst estimates -- alongside lower-than-expected revenue. Year-over-year, USM is down 20.8%.

Meanwhile, Axt Inc (Nasdaq: AXTI) is down 20.3% at $4.70 at last glance. The company announced fourth-quarter profits of 3 cents per share -- 1 cent higher than estimates -- and a revenue miss, after which Craig-Hallum downgraded the equity to "hold" from "buy." Plus, AXTI drew at least three price-target cuts. Year-to-date, the equity is still up 8%.

More By This Author:

5 Reasons To Steer Clear From Walgreens StockStocks Fall As Wall Street Digests Inflation, Jobs Data

Wall Street Increasingly Wary Of Hawkish Fed