Don't Overlook These Top-Ranked Stocks As Earnings Approach

TM Editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Image: Bigstock

As we progress through earnings season, some lesser-known names are set to report their first-quarter results next week after big tech companies highlighted the past week's earnings lineup.

Still, a few of those lesser-known companies are top-rated Zacks stocks at the moment. Here are two such stocks that investors may want to consider, as their quarterly reports release on Monday, May 1.

BlackRock Capital Investment (BKCC - Free Report)

First is BlackRock Capital Investment, which has landed a Zacks Rank #2 (Buy) at the moment. Additionally, its Financial-SBIC & Commercial Industry is in the top 15% of over 250 Zacks industries.

BlackRock Capital provides responsive, creative, and flexible capital solutions to middle-market companies. These flexible financial solutions include senior and junior secured, unsecured, and subordinated debt securities and loans, as well as equity securities.

Q1 Preview

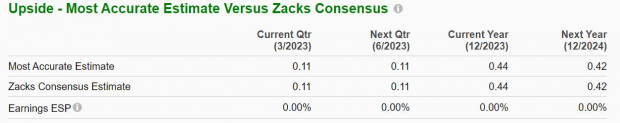

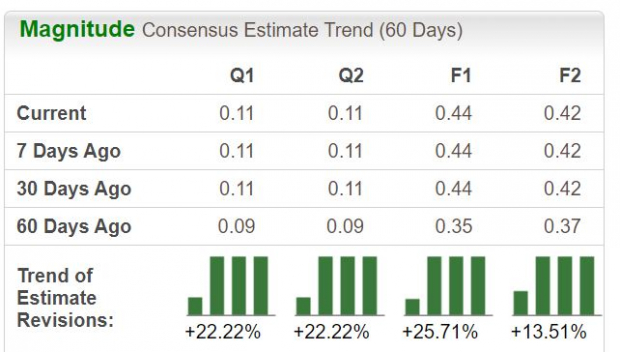

BlackRock Capital’s first-quarter earnings are expected to jump 22% year-over-year at $0.11 per share. The Zacks Expected Surprise Prediction (ESP) indicates BlackRock Capital should reach its bottom line expectations, with the Most Accurate Estimate also having Q1 EPS at $0.11.

Image Source: Zacks Investment Research

First-quarter sales are forecasted to climb 49% from the prior-year quarter at $18.12 million. Reaching these lofty quarterly estimates could give a boost to BlackRock Capital stock, and earnings estimate revisions are up for the current quarter, fiscal 2023, and FY24.

Image Source: Zacks Investment Research

The rising earnings estimates are starting to make BlackRock Capital stock look more attractive, and perhaps the stock appears undervalued as it was recently seen trading at $3 per share and 6.9X forward earnings. This is on par with the industry average and nicely below the S&P 500’s 19.1X.

Plus, BlackRock Capital stock trades 43% below its decade-long high of 12.3X and at a 34% discount to the median of 10.5X.

Image Source: Zacks Investment Research

CVR Energy (CVI - Free Report)

Among various stocks in the Zacks Oils and Energy sector, CVR Energy is starting to stand out with its Zacks Rank #1 (Strong Buy) rating. Also, its Oil and Gas-Refining and Marketing Industry is in the top 29% of all Zacks industries.

While CVR may not be as well-known as some of the larger integrated oil companies, it has a unique niche in its industry as a refiner and marketer of high-value transportation fuels, and is also a producer of ammonia and urea ammonia nitrate fertilizers.

Q1 Preview

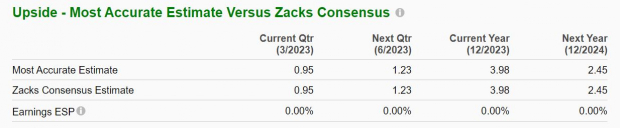

Impressively, CVR’s first-quarter earnings are expected to soar to $0.95 per share compared to EPS of $0.02 in Q1 2022. This is despite sales being forecasted to dip -6% from the prior-year quarter at $2.23 billion. The Zacks ESP indicates CVR should reach its Q1 earnings expectations, with the Most Accurate Estimate also having EPS at $0.95.

Image Source: Zacks Investment Research

Furthermore, annual earnings estimates are noticeably higher for CVR, and this may be starting to make the stock look very attractive from a price-to-earnings perspective.

Recently trading at around $26 a share, CVR stock has a forward earnings multiple of 6.5X. This is on par with the industry average and nicely beneath the benchmark. Moreover, CVR stock trades well below its decade-long highs and at a 43% discount to the median of 11.6X.

Image Source: Zacks Investment Research

Bottom Line

BlackRock Capital Investment and CVR Energy are making the case for bargain territory waiting ahead of their first-quarter reports. Both companies have a unique niche in their respective industries, and the rising earnings estimates are a good sign there may be more upside in these stocks.

More By This Author:

These 3 Large-Caps Roared In AprilKellogg Expected to Beat Earnings Estimates: Should You Buy?

Colgate-Palmolive Q1 Earnings And Revenues Surpass Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more