Don't Overlook Jabil Stock After Topping Its Q3 Expectations

Image: Bigstock

Jabil Inc. (JBL - Free Report) was a notable standout in a relatively quiet earnings lineup this week, as investors eyed ongoing conflicts in the Middle East that could potentially impact markets.

That said, Jabil is one of the largest global suppliers of electronics manufacturing services and is worthy of investors' attention after posting strong results for its fiscal third quarter on Tuesday.

As it has been trading near 52-week highs of over $200 a share, here's a short look at why Jabil stock may be poised for more upside.

Jabil Customer Base Overview

Serving a wide range of major global companies across various industries, two of Jabil’s most prominent customers include Apple (AAPL - Free Report) and Amazon (AMZN - Free Report). As two of its largest clients, Apple relies on Jabil’s manufacturing components for iPhones, among other devices, with Amazon relying on Jabil’s computing and hardware services for AWS.

While Apple and Amazon have accounted for significant portions of Jabil’s revenue, the company has made significant efforts to diversify its customer base, with other noteworthy and diverse clients being healthcare giant Johnson & Johnson (JNJ - Free Report) and communication networks leader Ericsson (ERIC - Free Report).

Jabil’s Strong Q3 Results

Briefly reviewing Jabil’s strong quarterly results, Q3 sales spiked 15% year-over-year to $7.82 billion and topped estimates of $7.08 billion by 10%. More impressive, Q3 EPS of $2.55 soared 35% from $1.89 in the comparative quarter and beat earnings expectations of $2.33 per share by 9%.

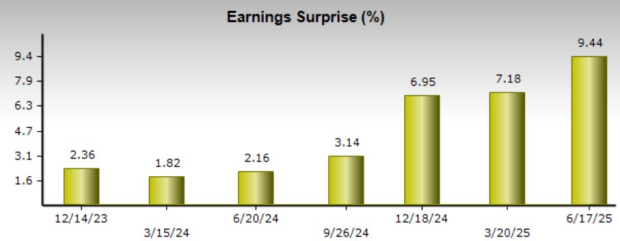

Continuing its compelling and consistent operational performance, Jabil has now surpassed the Zacks EPS Consensus for 21 consecutive quarters with an average earnings surprise of 6.68% over the last four quarters.

Image Source: Zacks Investment Research

Jabil’s Guidance & Outlook

Offering guidance for its fiscal fourth quarter, Jabil expects Q4 sales in the range of $7.1-$7.8 billion, with the current Zacks Consensus at $7.55 billion, or 8% growth. Jabil expects Q4 EPS at $2.64-$3.04, with Zacks projections currently at $2.75, or 19% growth.

Correlating with its diverse customer base and strategic alignment with secular trends such as AI, Jabil expects to see continued revenue expansion, margin enhancement, and robust free cash flow generation in the coming years.

Jabil Performance & Valuation

Year-to-date, Jabil stock is up over +40% and has blown away the performance of the broader indexes, which have been virtually flat. More intriguing, Jabil is sitting on gains of more than +200% in the last three years to impressively outpace the stock performances of its top big tech customers in Amazon and Apple, as well as the benchmark S&P 500 and Nasdaq’s returns of +60% and +80%, respectively.

Image Source: Zacks Investment Research

Despite vastly outperforming the broader market, Jabil still has been seen trading at a slight discount to the benchmark at 22.9X forward earnings. This is also a noticeable discount to the high P/E premiums that many top-performing tech stocks can command.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Jabil stock currently sports a Zacks Rank #2 (Buy) rating as earnings estimates have started to trend higher following its strong Q3 results for fiscal 2025 and FY26. Also suggesting the stock may be worthy of investors' consideration is that Jabil is on track to generate over $1.2 billion in free cash flow this year, and it has a healthy balance sheet with debt to core EBITDA levels of approximately 1.4X.

Furthermore, Jabil is on track to complete a $1 billion share repurchase plan, reflecting management’s confidence that its strong operational performance will continue.

More By This Author:

Meta Platforms Vs. Alphabet: Which Digital Ad Behemoth Has An Edge?3 Communication Stocks Poised To Ride On Sector Strength

4 Retail Home Furnishing Stocks To Watch From A Prospering Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more