Don't Ignore The Strength Of These 3 Large-Caps

Image: Bigstock

Large-cap stocks generally have more analyst coverage, commonly pay dividends, and often have a history of stable earnings, all perks that make them a staple in many portfolios. In addition, they tend to be less volatile than small-cap stocks, providing another beneficial advantage for investors.

And in 2023, several large-caps – Adobe (ADBE - Free Report), Meta Platforms (META - Free Report), and Analog Devices (ADI - Free Report) – have been hot year-to-date, outperforming the general market by wide margins. This is illustrated in the chart below.

Image Source: Zacks Investment Research

In addition, all three companies sport improved earnings outlooks and positive growth trajectories. For those interested in riding momentum, here is a closer look at each.

Meta Platforms

META shares had a rough showing in 2022, losing more than 60% in value amid the broader technology pullback. However, shares found new life following the company’s latest quarterly print, soaring post-earnings.

Image Source: Zacks Investment Research

The company’s earnings outlook has moved higher across all timeframes, pushing the technology titan into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

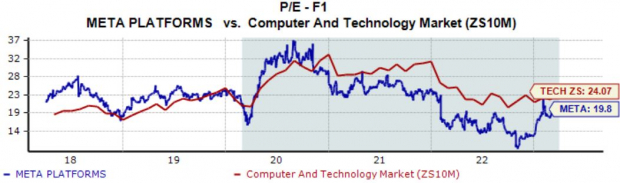

In addition, META’s valuation multiples have pulled back extensively from their steep highs, with its 19.8X forward earnings multiple sitting well below the 23.3X five-year median.

Image Source: Zacks Investment Research

The announcement of cost-cutting measures and a sizable 41% EPS beat in the company’s latest quarterly release have META shares riding the high life so far in 2023.

Adobe

Adobe is one of the biggest software companies in the world, generating the bulk of its revenue via licensing fees from its customers. The company presently sports a Zacks Rank #2 (Buy).

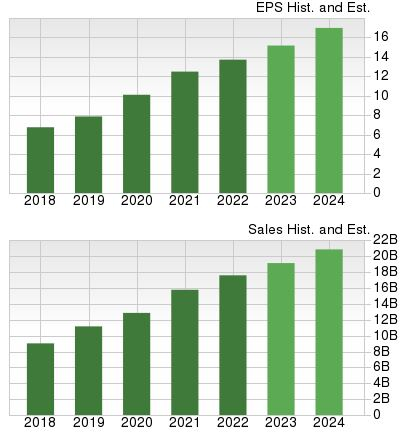

Despite a challenging business environment, Adobe is still expected to grow its bottom line nicely; the Zacks Consensus EPS Estimate of $15.40 for its current fiscal year implies growth of 12% year-over-year.

And in FY24, Adobe’s earnings are forecasted to climb a further 12.6%.

Image Source: Zacks Investment Research

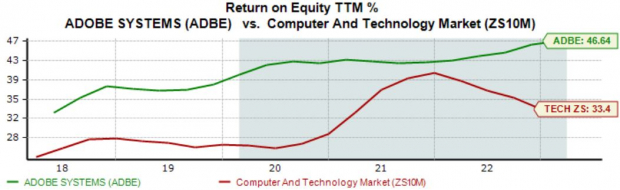

Further, Adobe’s 46.6% trailing twelve-month return on equity (ROE) is worth highlighting, reflecting a higher efficiency in generating profit from existing assets.

Image Source: Zacks Investment Research

Analog Devices

Analog Devices (ADI - Free Report) is an original equipment manufacturer of semiconductor devices, specifically analog, mixed-signal, and digital signal-processing integrated circuits. Like the stocks discussed above, ADI’s earnings outlook has recently improved.

Image Source: Zacks Investment Research

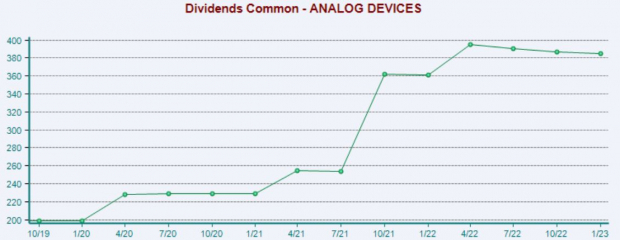

ADI shares provide exposure to tech paired with an income stream; ADI’s annual dividend presently yields 1.8%, nicely above the Zacks Computer and Technology sector average.

Reflecting its shareholder-friendly nature in a big way, the company has consistently increased its payout, boasting a 12.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Large-cap stocks can help bring stability to a portfolio, as these stocks are typically less volatile. In addition, they commonly pay dividends and carry a well-established nature, further perks that make them beloved among investors.

And all three large-caps above – Adobe (ADBE - Free Report), Meta Platforms (META - Free Report), and Analog Devices (ADI - Free Report) – have been hot in 2023, with buyers stepping up consistently.

In addition, all three have seen their earnings outlook improve recently, providing the cherry on top. For those interested in riding large-cap momentum, all three deserve a watchlist spot.

More By This Author:

Bear Of The Day: Vulcan MaterialsLululemon Q4 Earnings: Taking A Look At Key Metrics Versus Estimates

3 Large-Cap Growth Mutual Funds Worth Betting On

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more