Don't Ignore The Relative Strength Of These 3 Homebuilders

Image: Bigstock

Investors who target stocks displaying relative strength often find themselves in favorable trends, no matter the direction of the general market. For a quick explanation, relative strength focuses on stocks or other assets that have performed well relative to the market as a whole or a relevant benchmark.

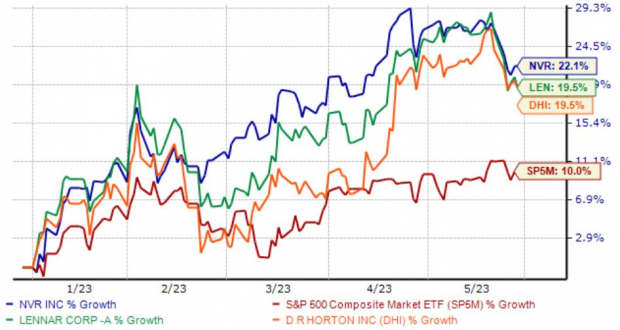

And in 2023, several homebuilders, including NVR (NVR - Free Report), Lennar (LEN - Free Report), and D.R. Horton (DHI - Free Report), have all displayed relative strength, handily outperforming the general market. This is illustrated in the chart below.

Image Source: Zacks Investment Research

For those interested in tapping into the recent momentum, here is a closer look at each.

NVR

NVR is engaged in constructing and selling single-family detached homes, townhomes, and condominium buildings. Analysts have increased their earnings expectations across nearly all timeframes, helping land the stock into a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

NVR shares aren’t stretched regarding valuation, with the current 13.3X forward earnings multiple sitting well beneath the 15.1X five-year median and the Zacks Construction sector average. The stock carries a Style Score of “B.”

Image Source: Zacks Investment Research

D.R. Horton

D.R. Horton is a leading national homebuilder primarily engaged in the construction and sale of single-family houses in both the entry-level and move-up markets. The stock also boasts the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company posted a blowout quarter in its latest release, penciling in a 44% EPS beat. Quarterly revenue totaled $7.9 billion, 20% ahead of expectations and essentially flat from the year-ago period. Impressively, the results reflected the company’s second consecutive quarter of posting a double-digit percentage EPS surprise.

Image Source: Zacks Investment Research

Lennar

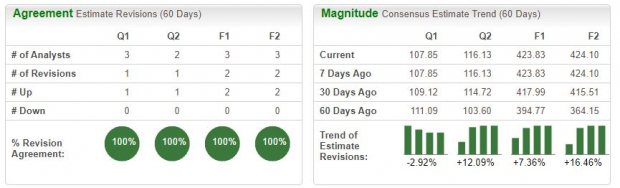

Like the stocks above, analysts have recently become bullish on Lennar’s earnings outlook, with estimates increasing across all timeframes over the last 60 days. The stock is a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

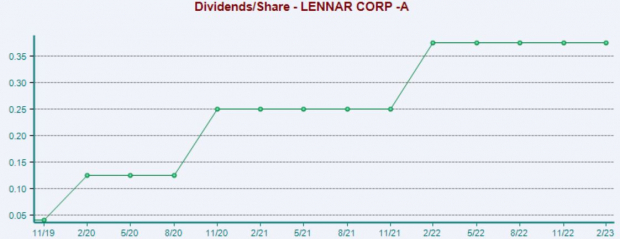

For those with an appetite for income, LEN shares have that covered; the company’s annual dividend presently yields 1.4% with a sustainable payout ratio at 9% of earnings. Undoubtedly a major highlight, LEN is committed to increasingly rewarding its shareholders, boasting a rock-solid 85% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Targeting stocks displaying relative strength is an excellent way for investors to insert themselves in favorable market trends.

And in 2023, several homebuilders, including NVR (NVR - Free Report), Lennar (LEN - Free Report), and D.R. Horton (DHI - Free Report), have all reflected relative strength, outperforming the general market handily. In addition, all three sport favorable Zacks Ranks, indicating near-term optimism from analysts.

More By This Author:

2 Top-Rated Stocks To Buy After Beating Earnings ExpectationsEarnings Preview: Dell Technologies Q1 Earnings Expected To Decline

3 Utility Mutual Funds To Buy Amid Debt-Ceiling Impasse

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more