Don't Ignore The Relative Strength Of These 3 Finance Stocks

Image: Bigstock

Due to banking concerns gripping investors, the Zacks Finance sector has faced selling pressure over the recent term.

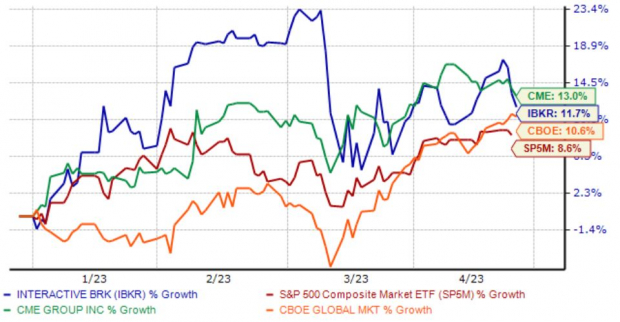

However, not all stocks within the sector have faced pressure from sellers, including Interactive Brokers (IBKR - Free Report), CME Group (CME - Free Report), and Cboe Global Markets (CBOE - Free Report). Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each.

Interactive Brokers

Interactive Brokers Group operates as an automated global electronic market maker and broker. Analysts have upped their earnings expectations across nearly all timeframes over the last 60 days, helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

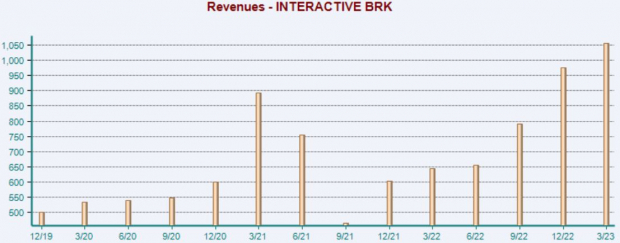

IBKR posted strong quarterly results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 12% and delivering a 5.3% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

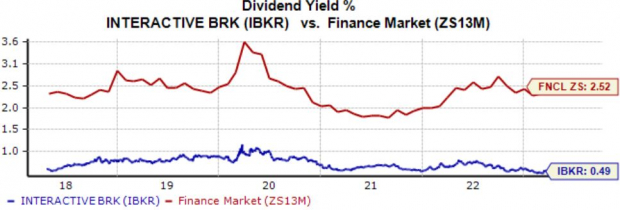

In addition, IBKR shares provide a passive income stream, limiting the impact of drawdowns in other positions; currently, the company’s annual dividend yields 0.5%, below the Zacks Finance sector average.

Image Source: Zacks Investment Research

Cboe Global Markets

Cboe offers trading across various products in multiple asset classes and geographies, including options, futures, exchange-traded products, global foreign exchange, and multi-asset volatility products based on the VIX Index.

Like IBKR, Cboe Global Markets has seen its near-term earnings outlook shift higher as of late, landing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

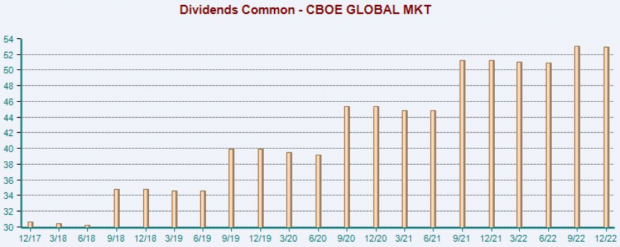

Impressively, the company has upped its dividend payout by nearly 14% over the last five years, reflecting a commitment to increasingly rewarding shareholders. CBOE’s annual dividend presently yields 1.4%, a few ticks below the Zacks Finance sector average.

Image Source: Zacks Investment Research

CME Group

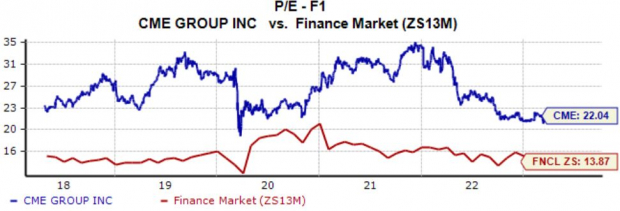

CME Group is the largest futures exchange in the world in terms of trading volume and notional value traded. Presently, the stock carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

In addition, shares aren’t expensive on a relative basis, with the current 22.1X forward earnings multiple sitting well beneath the 26.7X five-year median and highs of 34.3X in 2022.

Image Source: Zacks Investment Research

Bottom Line

While many finance-related stocks have come under pressure following banking concerns, all three stocks above – Interactive Brokers (IBKR - Free Report), CME Group (CME - Free Report), and Cboe Global Markets (CBOE - Free Report) – have all displayed relative strength. In addition, all three sport improved earnings outlooks, indicating favorable sentiment from analysts.

More By This Author:

3 Stocks To Consider With Earnings Approaching3 Reasons Why Growth Investors Shouldn't Overlook W.W. Grainger

Bear of the Day: NIO

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more