Dollar General Q3 Preview: Can Shares Stay Strong?

Image: Bigstock

The Zacks Retail and Wholesale sector has struggled in 2022, underperforming the general market by a fair margin. A popular company residing in the realm, Dollar General (DG - Free Report), is on deck to unveil quarterly results on Dec. 1, before the market open.

Dollar General offers a wider selection of merchandise, including consumable items, seasonal items, home products, and apparel. Currently, the company sports a favorable Zacks Rank #2 (Buy) with an overall VGM Score of a C. How does everything else stack up? Let’s take a closer look.

Share Performance & Valuation

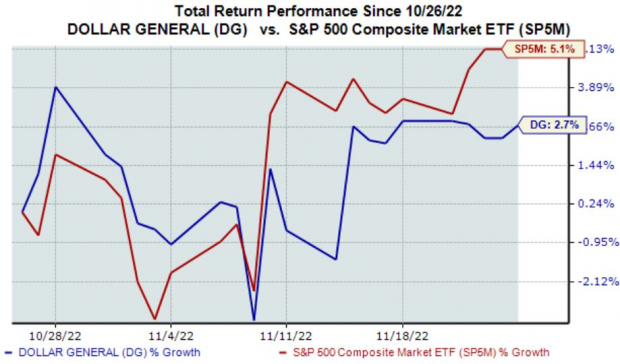

DG shares have been a brighter spot in an otherwise dim market in 2022, up 10% and outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last month, however, shares have modestly lagged behind the S&P 500’s 5% gain.

Image Source: Zacks Investment Research

DG shares have recently been seen trading at a 22.2X forward earnings multiple, above the 20.9X five-year median but below the company's Zacks sector average. The company carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

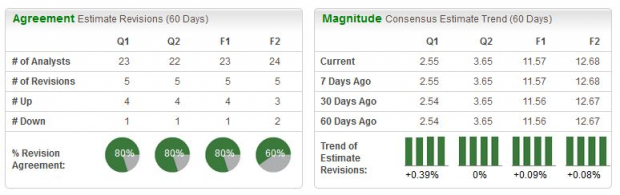

Analysts have been bullish in their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $2.55 indicating a 22.6% year-over-year uptick in earnings.

Image Source: Zacks Investment Research

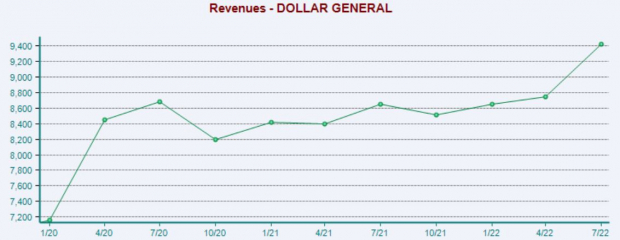

DG’s top-line is also in solid health; the Zacks Consensus Sales Estimate of $9.4 billion suggests an improvement of more than 10% year-over-year.

Quarterly Performance

DG has posted solid quarterly results as of late, exceeding earnings and revenue estimates in back-to-back quarters. In its latest print, the company registered a 1.7% bottom-line beat paired with a marginal 0.3% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Putting Everything Together

DG shares are well in the green year-to-date, but they have modestly lagged behind the S&P 500 over the last month. Shares trade above the five-year median forward earnings multiple and slightly below the Zacks Retail and Wholesale sector average.

Analysts have taken a bullish stance regarding the quarter to be reported, with estimates indicating year-over-year upticks in both revenue and earnings. Further, the company has posted strong quarterly results as of late, exceeding earnings and revenue estimates in back-to-back quarters.

Heading into the release, Dollar General (DG - Free Report) carries a Zacks Rank #2 (Buy) with an Earnings ESP Score of 1.6%.

More By This Author:

Salesforce To Report Q3 Earnings: What's In Store?3 Top Mutual Funds For Your Retirement

3 Great Mutual Funds To Maximize Your Retirement Portfolio

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more