Dole Q2 Preview: Can Shares Find New Life?

Image: Bigstock

The Zacks Consumer Staples Sector has been highly defensive year-to-date, decreasing a marginal 1% in value and easily outperforming the general market. Still, the sector’s 7% return over the last month has lagged the S&P 500.

A mega-popular stock in the sector, Dole plc (DOLE - Free Report), is on deck to unveil Q2 results on Tuesday, Aug. 23, before the market opens. Dole is a producer of fresh bananas and pineapples, with a growing presence in categories such as berries, avocados, and organic produce. We see their products on shelves everywhere.

As it stands, Dole carries a Zacks Rank #2 (Buy) with an overall VGM Score of an A. How does the agriculture giant stack up heading into the print? Let’s take a closer look.

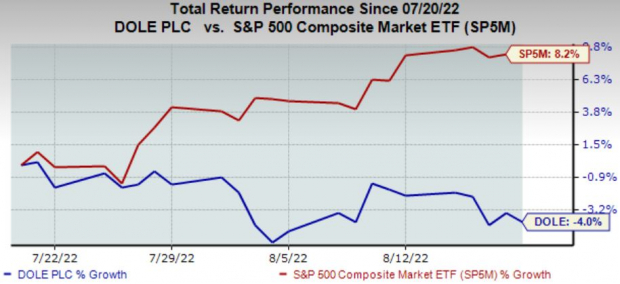

Share Performance & Valuation

Year-to-date, DOLE shares have tumbled, losing nearly a third of their value and vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

Even over the market’s rally over the last month, Dole shares have lagged notably, decreasing by 4% in value.

Image Source: Zacks Investment Research

However, shares trade at enticing multiples, further bolstered by its Style Score of an A for Value. Dole’s 7.3X forward earnings multiple is well beneath its median of 9.7X since IPO in July 2021, and it represents a steep 65% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has lowered their outlook for the quarter to be reported, with the Consensus Estimate Trend falling more than 20%. The Zacks Consensus EPS Estimate resides at $0.32.

Image Source: Zacks Investment Research

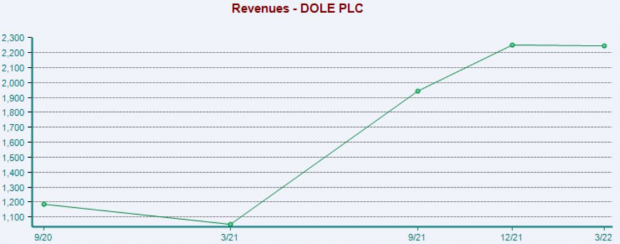

In addition, Dole is forecasted to have generated $2.5 billion in revenue throughout the quarter.

Quarterly Performance & Market Reactions

Dole has primarily reported bottom-line results above the Zacks Consensus EPS Estimate, registering two EPS beats over its three quarters since its IPO last year. Just in its latest print, the company penciled in an 11% bottom-line beat.

However, top-line results have left some to be desired, with the company registering just one top-line beat over its three quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, shares have moved downwards twice following its three quarterly reports.

Putting Everything Together

Dole shares have lagged the general market year-to-date and over the last month, signaling that sellers have remained in control. The company’s shares often trade at enticing valuation multiples, nicely below their median since IPO and Zacks Sector Average.

In addition, a singular analyst has lowered their quarterly earnings outlook. Heading into the print, Dole (DOLE - Free Report) carries a Zacks Rank #2 (Buy) with an overall VGM Score of an A.

More By This Author:

Guide To High Dividend Paying ETFs

Nvidia To Report Q2 Earnings: What's In The Cards?

Salesforce To Report Q2 Earnings: What's In The Offing?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more