Dogs Of The Dow Performance Ahead Of The MAG 7 Return

Image Source: Pexels

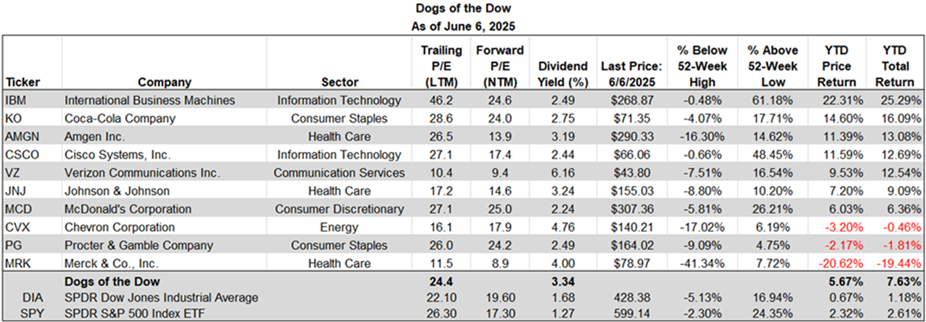

The Dogs of the Dow investment strategy has generated mixed results over the years but 2025 is proving to be a favorable one for this group of stocks. The year-to-date total return for the Dogs of the Dow through June 6, 2025, equals 7.63% and outpaces both the S&P 500 Index ETF (SPY) and the Dow Jones Industrial Average ETF (DIA) with returns of 2.61% and 1.18% respectively. The Dow Dog's return even outpaces the YTD return of the Magnificent 7 basket of stocks whose return equals -3.16%.

Readers may recall from earlier posts the Dogs of the Dow strategy is one where investors select the ten stocks that have the highest dividend yield from the stocks in the Dow Jones Industrial Average Index after the close of business on the last trading day of the year. Once the ten stocks are determined, an investor invests an equal dollar amount in each of the ten stocks and holds that portfolio for the entire next year. The popularity of the strategy is its singular focus on dividend yield.

(Click on image to enlarge)

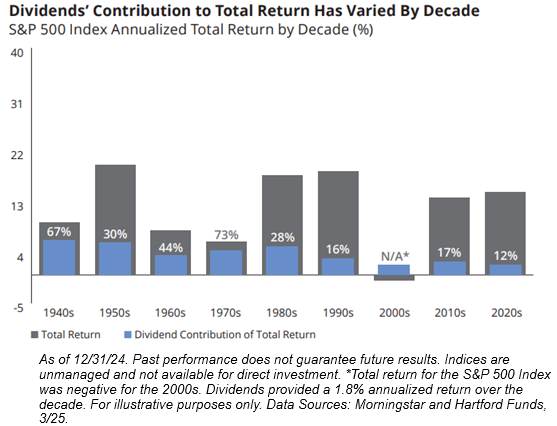

One favorable aspect of Dow Dog's strategy focusing on dividends is the fact dividends have historically been an important contributor to the overall return of equities. In a recent white paper by Hartford Funds, the analysis shows, "From 1940–2024, dividend income’s contribution to the total return of the S&P 500 Index averaged 34%." Below is a chart showing dividend contribution by decade.

(Click on image to enlarge)

In summary, the Dow Dogs strategy is a dividend focused one and dividends are an important variable in the return for equites. However, as the Hartford white paper notes, simply chasing the highest yielding stocks does not always generate the maximum reward for investors. From a positive perspective though, seeing better performance out stocks other than the MAG 7 is a favorable development.

More By This Author:

Bonds In A Portfolio Making More SenseUncertainty And Surprise

What Is Driving Longer Term Interest Rates Higher?

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more