DocuSign Earnings Preview: What's In Store?

The first quarter of 2022 was undoubtedly challenging, wearing down both investors and companies.

Sitting in a highly unique economic situation after coming out of an unprecedented pandemic, we’ve seen the Fed pivot to a more hawkish nature, cranking up borrowing rates to alleviate inflation levels not seen in decades.

Geopolitical issues, supply-chain bottlenecks, and soaring energy costs have undoubtedly added fuel to the fire. Nonetheless, the Fed remains confident in its “soft landing” plan and believes that the economy stands to flourish in the face of less accommodative monetary policy.

Time will tell, as we will have to wait and see if the Fed’s plan can come to fruition.

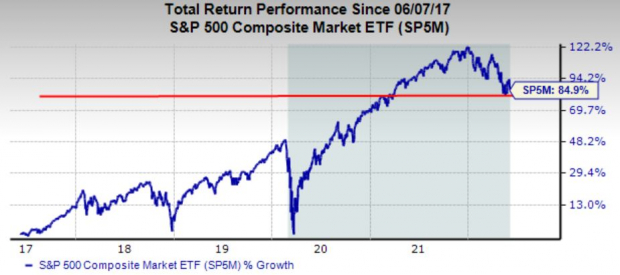

All in all, the market keeps rolling, giving investors no chance to breathe. On a more positive note, the indices are still well above their 2022 lows, which bodes well. The five-year chart below illustrates that the S&P 500 has bounced off March 2021 levels.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Perhaps the rebound has already started – something that all market participants can celebrate.

During 2022 Q1, investors witnessed double-digit valuation slashes following many earnings releases. The reports revealed that many companies underwent margin compression, negatively impacting quarterly results.

One company slated to release its quarterly results after the bell rings on Thursday is the technology player DocuSign (DOCU - Free Report). Founded in 2003 and headquartered in San Francisco, DocuSign is a global provider of cloud-based software.

Let’s get into how the company shapes up heading into the report.

Share Performance & Valuation

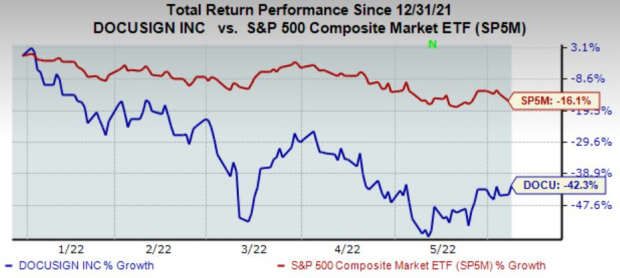

Year-to-date, DocuSign shares have tumbled in the market, losing 42% of their value and easily underperforming the S&P 500, although it has declined extensively as well. Throughout 2022, tech stocks have been hit hard – and DocuSign is no exception.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Upon stretching out the time frame over the past year, we can see that DocuSign shares have mightily struggled to catch their footing. Shares had a freefall in early December 2021 after keeping pace with the S&P 500.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The poor share performance is a concern, as it displays that buyers have entirely retreated, leaving bears to push forward freely. However, it is crucial to note that there has been a significant lack of buyers in all of the tech over the last several months – not just DocuSign.

DocuSign’s current forward price-to-sales ratio sits at 6.8X, which could be seen as a bit pricey. However, the value is nowhere near 2020 highs of 37.5X and is a fraction of its 13.5X median. Additionally, the current value represents a steep 67% premium relative to the S&P 500’s value of 4.1X.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Earnings Performance

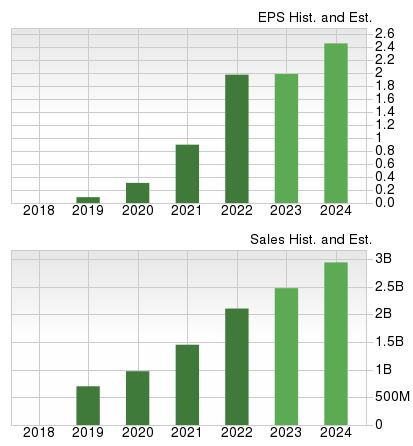

The company has reported strong earnings results, exceeding bottom-line estimates in nine out of the ten previous quarters. Over its last four quarterly releases, the company has an average EPS surprise in the double-digits of 27%, and in its latest quarter, DocuSign reported results in line with expectations.

Sales numbers have been consistently strong as well, chaining together 14 consecutive sales beats dating back to April 2018. In its latest quarter, DOCU reported quarterly revenue of $580 million – easily enough to beat the Zacks Consensus Sales estimate of $560 million by 4%.

Estimates

Analysts have primarily left their earnings estimates unchanged over the last 60 days. For the upcoming quarterly release, the $0.46 EPS estimate displays a respectable 4.5% expansion in the bottom line from the year-ago quarter.

Looking a bit forward, earnings are forecasted to remain unchanged year-over-year in the current fiscal year, but the bottom line is expected to expand by a notable 25% in FY24.

The top line appears strong, as the Zacks Consensus Sales Estimate of $581 million for the quarter displays a sizable 24% expansion in the top line from year-ago quarterly sales of $469 million. Additionally, revenue is forecasted to grow 17.5% in FY23 and an additional 19% in FY24.

Image Source: Zacks Investment Research

Microsoft Azure

For investors interested in cloud computing exposure, such as what DOCU provides, a solid bet within the industry is Microsoft (MSFT - Free Report).

MSFT’s cloud computing service goes by the name of Microsoft Azure. It’s the only consistent hybrid cloud, delivering unparalleled developer productivity and comprehensive, multilayered security.

Microsoft’s Azure cloud platform paved the way for a strong performance in its latest quarterly report. It reported better-than-expected commercial booking growth of 28%, and Azure Cloud revenue was $23.4 billion, up 32% year-over-year.

MSFT is confident that cloud technology will be a critical growth driver of the world’s economic output.

MSFT is currently a Zacks Rank #3 (Hold).

Microsoft Corporation Price, Consensus, and EPS Surprise

(Click on image to enlarge)

Microsoft Corporation price-consensus-eps-surprise-chart | Microsoft Corporation Quote

Bottom Line

The poor share performance does raise some red flags. However, the entirety of tech has been beaten down, not just DocuSign.

Valuation levels have been taken down, but they still appear to be pricey. Additionally, DocuSign is seeing an increase in expenses as it invests in sales, marketing, and technical expertise. Total operating expenses of $1.3 billion increased 35% year over year in fiscal 2022 – signaling that the bottom line will likely remain under pressure moving forward.

As with most tech, I believe it is beneficial for investors to heed caution heading into the quarterly release. Instead, if quarterly results are robust, investors should start slowly building into a position utilizing a dollar-cost-average strategy.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more