Dividends By The Numbers In November 2022

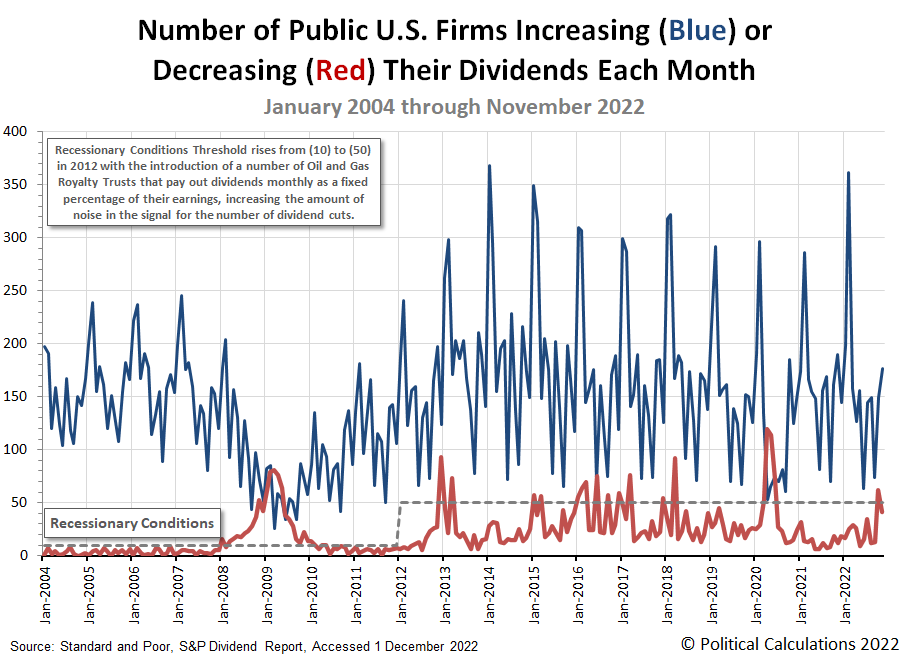

The U.S. stock market continued to show developing weakness during November 2022. Putting the bad news first, the number of companies increasing their dividends continued trending downward. The good news is that the number of firms cutting their dividends was down from October 2022, when they had sent a recessionary signal, but this figure remains elevated over the level recorded since the end of the coronavirus recession.

The following chart shows where November 2022's data for both dividend increases and decreases fits with the monthly data reported since January 2004.

Here is November 2022's metadata describing the number of dividend declarations, special dividends, increases, decreases, and omissions for the month:

- 3,604 U.S. firms declared dividends in November 2022, an increase of 334 from the 3,267 recorded in October 2022. That 1,537 less than the 5,141 recorded in November 2021.

- There were 106 firms that announced they would pay a special (or extra) dividend to their shareholders in November 2022, an increase of 47 over the number recorded in October 2022 but three less than the number recorded in November 2021.

- 177 U.S. firms announced dividend rises in November 2022, an increase of 28 over the number recorded in October 2022, but a decrease of 13 from November 2021's total.

- S&P counted 41 dividend cuts in November 2022, a decline of 21 from the 62 recorded in October 2022. Year-over-year, November 2022's count of dividend reductions is 29 higher than the figure recorded in November 2021.

- No U.S. firms omitted paying their dividends in November 2022, continuing the trend established in June 2021.

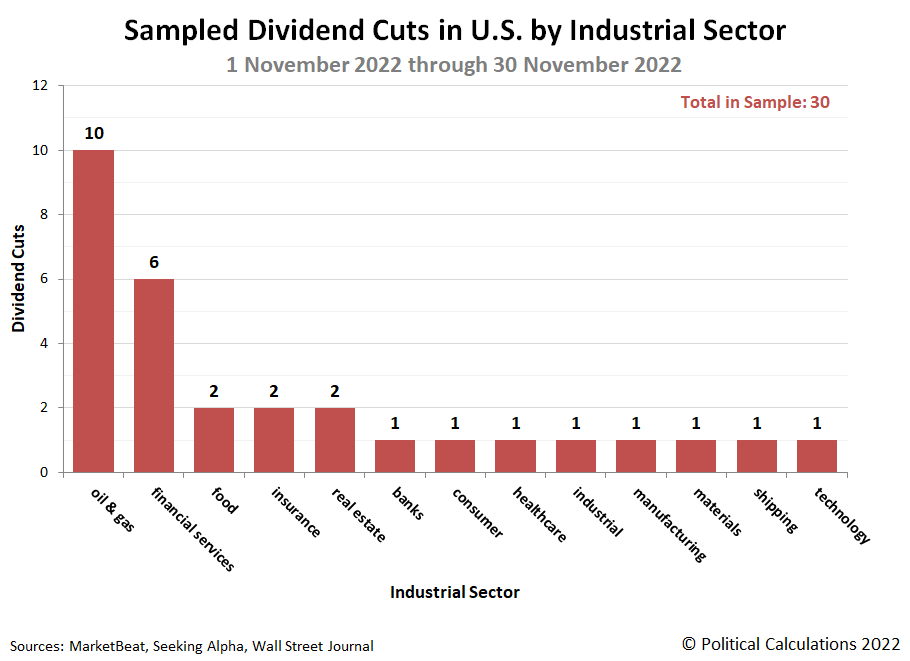

We sampled the data for 30 of the reported dividend cuts during November 2022. The next chart reveals even more signs of developing weakness throughout the U.S. economy.

What's significant in this chart is the breadth of industrial sectors in which firms have declared they will reduce their dividends. There are many more sectors represented in this chart than have been the case in recent months.

Here's the list of firms cutting dividends from November 2022's sampling:

- Devon Energy (NYSE: DVN)

- Ingersoll Rand (NYSE: IR)

- Lumen Technologies (NYSE: LUMN)

- Sturm Ruger (NYSE: RGR)

- Eagle Bulk Shipping (Nasdaq: EGLE)

- Brigham Minerals (NYSE: MNRL)

- Artisan Partners Asset Management (NYSE: APAM)

- John B. Sanfilippo & Son (Nasdaq: JBSS)

- Kimbell Royalty Partners (NYSE: KRP)

- Byline Bancorp (NYSE: BY)

- Sabine Royalty Trust (NYSE: SBR)

- Viper Energy (Nasdaq: VNOM)

- Angel Oak Mortgage (REIT-Mortgage) (NYSE: AOMR)

- Bridge Investment Group Holdings (Nasdaq: BRDG)

- Sculptor Capital Management (NYSE: SCU)

- TPG Inc. (Nasdaq: TPG)

- Hecla Mining (NYSE: HL)

- Manulife Financial (NYSE: MFC)

- B&G Foods (NYSE: BGS)

- CI Financial (NYSE: CIXX)

- National Research Corp. (Nasdaq: NRC)

- Kingstone (Nasdaq: KINS)

- Broadmark Realty Capital (REIT-Mortgage) (NYSE: BRMK)

- Investcorp Credit Management (NYSE: ICMB)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Permian Basin Royalty Trust (NYSE: PBT)

- Marine Petroleum Trust (Nasdaq: MARPS)

- Permianville Royalty Trust (NYSE: PVL)

- PermRock Royalty Trust (NYSE: PRT)

- United-Guardian (Nasdaq: UG)

The pace of dividend cuts stands to be interesting going into the final month of 2022.

Reference

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. Accessed 1 December 2021.

More By This Author:

Median Household Income In October 2022The Seeds Of Soybean Inflation

U.S. New Homes Market Cap Continues Plunging In October 2022

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more