Dividends By The Numbers In April 2020

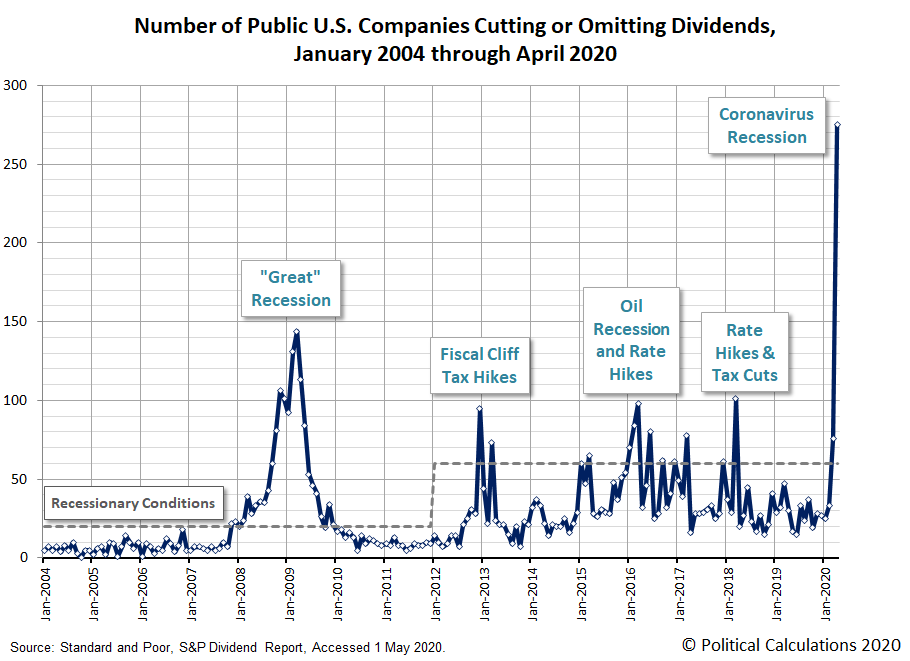

The number of dividend cuts and suspensions announced by publicly-traded firms in the United States has soared during April 2020 in one of the worst single months for dividend paying firms in stock market history.

The following chart shows the classic recessionary sign of the number of dividend reduction announcements crossing over and exceeding the number of dividend increases in April 2020, the first time that has occurred since the so-called "Great Recession".

All of the numbers in the April 2020's dividend metadata are bad:

- A total of 3,092 U.S. firms declared dividends in April 2020, a decrease of 777 from the 3,869 recorded in March 2020. That figure is also 15 lower than what was recorded a year ago in April 2019.

- 11 U.S. firms announced they would pay a special (or extra) dividend to their shareholders in April 2020, a decrease of 13 from the number recorded in March 2020 and 21 lower than what was recorded a year ago in April 2019. April 2020's figure for extra dividends is the second lowest in the available data, with the lowest value of 8 recorded in August 2009 during the so-called Great Recession.

- 53 U.S. firms announced they would boost cash dividend payments to shareholders in April 2020, a decrease of 81 from the 134 recorded in March 2020, and a decrease of 104 from the 157 dividend rises declared back in April 2019. While not a record, it is the lowest number recorded since September 2011.

- A new record high total of 120 publicly traded companies cut their dividends in April 2020, an increase of 67 over the number recorded in March 2020 and also an increase of 91 over the 29 recorded in April 2019.

- A record high 155 U.S. firms omitted paying their dividends in April 2020, an increase of 132 over the number recorded in March 2020. That figure is also an increase of 154 over the total recorded in April 2019. The previous record of 63 firms suspending their dividends was set in March 2009, when the stock market bottomed during the so-called Great Recession.

The pace at which U.S. firms have been suspending or cutting their dividend payments to their shareholding owners is unprecedented for the relatively limited period for which we have monthly data available. The following chart shows the coronavirus recession greatly exceeding what was recorded during the so-called "Great Recession", which we would suggest should be renamed as the 2008-09 Recession, because of how it pales in comparison.

The following chart shows how the cumulative number of dividend cuts announced per day during the current quarter to date, 2020-Q2, compares with the second quarters of 2017, 2018, and 2019. This chart is the stock market equivalent of the excess mortality charts that have been developed to more accurately assess the impact of the coronavirus pandemic.

We confirm the number of dividend cuts and suspensions announced in the quarter to date for our 2020-Q2 sampling is elevated well above the comparatively healthy quarters of 2017-Q2 and 2018-Q2, and is also considerably higher than the year ago quarter of 2019-Q2, when the oil and gas sector of the U.S. economy experienced a relatively short period of distress.

Here is the full list of U.S. firms either announcing dividend cuts or suspending their dividends in April 2020 from our sampling that accounts for 48% of the combined total of these two categories reported by Standard & Poor, which is still a very long list. Buckle up.

- Global Net Lease (REIT-Office) (NYSE: GNL)

- Gannett (NYSE: GCI)

- Elmer Bancorp (OTCPK: ELMA)

- Murphy Oil (NYSE: MUR)

- Golar LNG Partners (NASDAQ: GMLP)

- Diversified Healthcare Trust (REIT-Healthcare) (NYSE: DHC)

- Macquarie Infrastructure (NYSE: MIC)

- Brinker International (NYSE: EAT)

- Dave & Buster's Entertainment (NASDAQ: PLAY)

- Bed Bath & Beyond (NYSE: BBBY)

- BP Prudhoe Bay Royalty Trust (NYSE: BPT)

- Herman Miller (NASDAQ: MLHR)

- Group 1 Automotive (NYSE: GPI)

- Cato (NYSE: CATO)

- Continental Resources (NYSE: CLR)

- William H. Sadlier (OTC: SADL)

- Choice Hotels International (NYSE: CHH)

- Ellington Financial (Mortgage Finance) (NYSE: EFC)

- Plains All American Pipeline (NYSE: PAA)

- Plains GP Holdings (NYSE: PAGP)

- Vail Resorts (NYSE: MTN)

- Orchid Island Capital (REIT-Mortgage) (NYSE: ORC)

- CorePoint Lodging (REIT-Hotel) (NYSE: CPLG)

- SM Energy (NYSE: SM)

- American Capital Agency (REIT-Mortgage) (NASDAQ: AGNC)

- AMC Entertainment (NYSE: AMC)

- Broadmark Realty Capital (REIT-Mortgage) (NYSE: BRMK)

- Genesis Energy (NYSE: GEL)

- Eagle Materials (NYSE: EXP)

- Harvest Capital Credit (NASDAQ: HCAP)

- Mesabi Trust (NYSE: MSB)

- Gladstone Capital (NASDAQ: GLAD)

- Cleveland-Cliffs (NYSE: CLF)

- Eagle Point Credit (NYSE: ECC)

- Apache (NYSE: APA)

- Kelly Services (Staffing) (NASDAQ: KELYA)

- Plantronics (NASDAQ: PLT)

- Estée Lauder (NYSE: EL)

- Covanta Holding (NYSE: CVA)

- MTS Systems (NASDAQ: MTSC)

- Cedar Fair Entertainment (NYSE: FUN)

- Columbia Sportswear (NASDAQ: COLM)

- Dana (NYSE: DAN)

- Goodyear Tire & Rubber (NYSE: GT)

- Cedar Shopping Centers (REIT-Retail) (NYSE: CDR)

- Green Plains Partners (NASDAQ: GPP)

- Noble Energy (NYSE: NBL)

- Chesapeake Energy (NYSE: CHK)

- Permianville Royalty Trust (NYSE: PVL)

- VOC Energy Trust (NYSE: VOC)

- Service Properties (REIT-Hotel) (NASDAQ: SVC)

- Kohl's (NYSE: KSS)

- Schlumberger (NYSE: SLB)

- Targa Resources (NYSE: TRGP)

- Las Vegas Sands (NYSE: LVS)

- Meredith (NYSE: MDP)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Cross Timbers Royalty Trust (NYSE: CRT)

- Permian Basin Royalty Trust (NYSE: PBT)

- Western Midstream Partners (NYSE: WES)

- RBB Bancorp (NASDAQ: RBB)

- EnLink Midstream (NYSE: ENLC)

- Mesa Royalty Trust (NYSE: MTR)

- Landmark Infrastructure (Real Estate) (NASDAQ: LMRK)

- HCA Healthcare (NYSE: HCA)

- Anworth Mortgage Asset (REIT-Mortgage) (NYSE: ANH)

- DCP Midstream (NYSE: DCP)

- STMicroelectronics (NYSE: STM)

- BBX Capital (NYSE: BBX)

- Retail Opportunity Investments (REIT-Retail)(NASDAQ: ROIC)

- Moelis (NYSE: MC)

- Manning & Napier (NYSE: MN)

- Black Stone Minerals (NYSE: BSM)

- Bluegreen Vacations (NYSE: BXG)

- Patterson-UTI Energy (NYSE: PTEN)

- Alliance Data Systems (NYSE: ADS)

- Invesco (NYSE: IVZ)

- 1st Source (NASDAQ: SRCE)

- Lifetime Brands (NASDAQ: LCUT)

- Northern Technologies (NASDAQ: NTIC)

- Blackstone Group (NYSE: BX)

- San Juan Basin Royalty Trust (NYSE: SJT)

- Holly Energy Partners (NYSE: HEP)

- USD Partners (NYSE: USDP)

- Dynamic Materials (NASDAQ: BOOM)

- Expedia Group (NASDAQ: EXPE)

- Arch Coal (NYSE: ARCH)

- Terex (NYSE: TEX)

- Community West Bancshares (NASDAQ: CWBC)

- CONSOL Coal Resources (NYSE: CCR)

- CenterPoint Energy (NYSE: CNP)

- Southern Copper (NYSE: SCCO)

- Affiliated Managers Group (NYSE: AMG)

- CONSOL Energy (NYSE: CNX)

- Kimbell Royalty Partners (NYSE: KRP)

- Global Partners (NYSE: GLP)

- Golar LNG Partners (NASDAQ: GMLP)

- General Motors (NYSE: GM)

- EQM Midstream Partners (NYSE: EQM)

- Knoll (NYSE: KNL)

- Equitrans Midstream (NYSE: ETRN)

- Noble Midstream Partners (NASDAQ: NBLX)

- NGL Energy Partners (NYSE: NGL)

- Harley-Davidson (NYSE: HOG)

- AllianceBernstein (NYSE: AB)

- CorEnergy Infrastructure Trust (REIT-Diversified)(NYSE: CORR)

- Oxford Square Capital (NASDAQ: OXSQ)

- American Assets Trust (REIT-Diversified) (NYSE: AAT)

- CNX Midstream Partners (NYSE: CNXM)

- Capital Properties (Real Estate) (OTC: CPTP)

- Rollins (NYSE: ROL)

- Fresh Del Monte (NYSE: FDP)

- Marine Products (NYSE: MPX)

- Cadence Bancorporation (NYSE: CADE)

- Plains All American Pipeline (NYSE: PAA)

- Plains GP Holdings (NYSE: PAGP)

- Winmark (NASDAQ: WINA)

- Altra Industrial Motion (NASDAQ: AIMC)

- Great Western Bancorp (NYSE: GWB)

- Methanex (NASDAQ: MEOH)

- Woodward (NASDAQ: WWD)

- Dunkin' Brands Group (NASDAQ: DNKN)

- MGM Resorts (NYSE: MGM)

- Gaming and Leisure Properties (REIT-Specialty)(NYSE: GLPI)

- Fidus Investment (NASDAQ: FDUS)

- United Bancshares (NYSE: UBOH)

- NuSTAR Energy (NYSE: NS)

- Apollo Global Management (NYSE: APO)

- Weyerhauser (NYSE: WY)

- Hanmi Financial (NASDAQ: HAFC)

- Fluor (NYSE: FLR)

- PacWest Bancorp (NASDAQ: PACW)

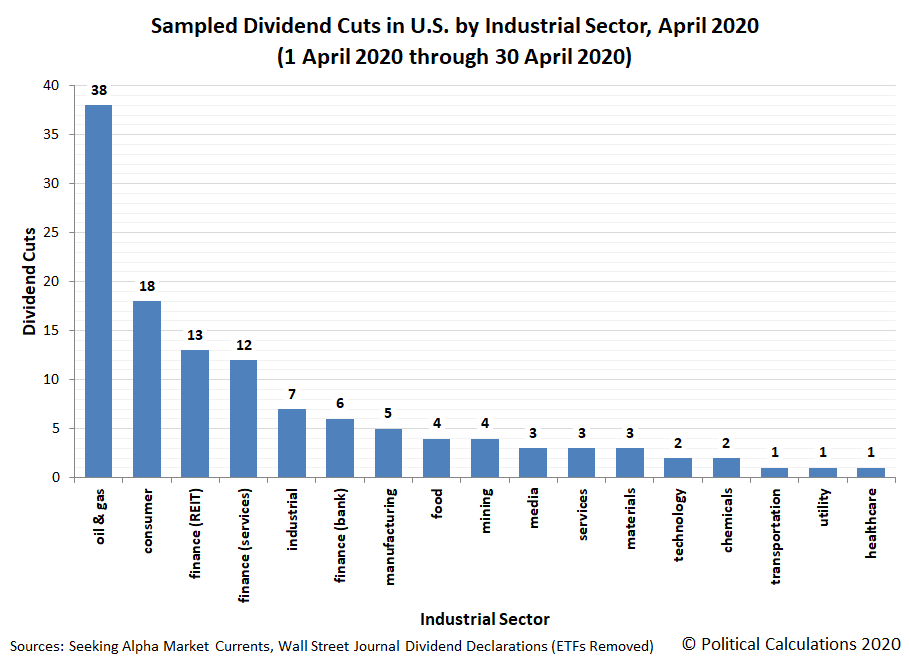

The following chart illustrates where economic distress is being concentrated within the U.S. economy by industrial sector during the month of April 2020.

Given Saudi Arabia-Russia price war during 2020-Q1 and the coronavirus pandemic-related collapse in global oil demand, the oil and gas sector of the U.S. economy is heavily represented among the firms that have declared dividends, with consumer products and service-related firms, which includes restaurants, resorts, and travel-based businesses, placing second.

Real Estate Investment Trusts (REITs) are also well represented, since this category includes firms that use the REIT business structure for holding real estate assets for hotels and for rentals, which encompasses office, retail and residential operations. Financial services came in fourth, which includes a number of asset management firms impacted by investment losses.

That rounds out the industrial sectors that recorded double-digit levels of dividend cuts and omissions in April 2020. The remainder of the list indicates the breath of industrial sectors that have been impacted by the coronavirus recession, adding 13 sectors to the 17 total in our accounting.

Within this group, the industrials, manufacturing, and materials firms that have cut or suspended their dividends are closely related to the collapse of the global aerospace and automotive industries in the response to the pandemic, which has crushed demand for travel and transportation.

We anticipate the next several months will see an elevated number of dividend cuts and suspensions as the impact of the coronavirus pandemic ripples through the global economy.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 30 April 2020.

Seeking Alpha Market Currents Dividend News. [Online Database]. Accessed 1 May 2020.

Wall Street Journal. Dividend Declarations. [Online Database]. Accessed 1 May 2020.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more