Dividends By The Numbers For April 2021

April 2021 marks an unusually strong month for dividend-paying firms in the U.S. stock market, which is especially true if you look at year-over-year comparisons. Let's get straight to the month's dividend metadata:

- 2,019 U.S. firms declared dividends in April 2021, a decline of 1,160 from the 3,179 recorded in March 2021. That figure is also a decrease of 1,073 from the 3,092 recorded in April 2020. This is the second-lowest figure on record, falling only behind January 2021's record low of 1,466.

- Some 39 U.S. firms announced they would pay a special (or extra) dividend to their shareholders in April 2021, a decline of 26 from the 65 recorded in March 2021, and an increase of 28 over the 11 recorded in April 2020.

- 155 U.S. firms announced they would boost cash dividend payments to shareholders in April 2021, a decline of 11 from the 166 recorded in March 2021, but a year-over-year increase of 102 over the 53 recorded in April 2020.

- A total of 16 publicly traded companies cut their dividends in April 2021, an increase of 3 over the number recorded in March 2021. It is also a decrease of 104 from the 120 recorded a year ago in April 2020.

- Zero companies omitted paying their dividends in April 2021, a decline of one from March 2021. By comparison, the figure for April 2020 was 155. That's the difference between an economy plunging into a recession because of pandemic fears and government-imposed lockdowns and one finally emerging from both.

The following chart shows the monthly number of dividend rises and falls from January 2004 through April 2021.

The number of dividend-cutting firms is perhaps the simplest economic indicator for the U.S. economy, where April 2021's figures are consistent with a rebounding economy.

Our sampling of dividend cuts from our real-time sources of dividend declarations for April 2021 counted just four dividend cuts during the month. Of these, three involve firms that pay variable dividends to their shareholders, which is well within the range we would expect for typical month-to-month noise for these firms. The fourth is a retail-oriented real estate investsment trust (REIT), Weingarten Realty Investors (NYSE: WRI), which is merging with Kimco Realty (NYSE: KIM). Its dividend cut reflects a final partial-month payout to WRI shareholders, whose shares are being converted into shares of Kimco Realty.

Here's the very, very short list of dividend cuts in April 2021:

- Blackstone Group (NYSE: BX)

- Weingarten Realty Investors (REIT-Retail) (NYSE: WRI)

- SandRidge Permian Trust (OTC: PERS)

- AllianceBernstein (NYSE: AB)

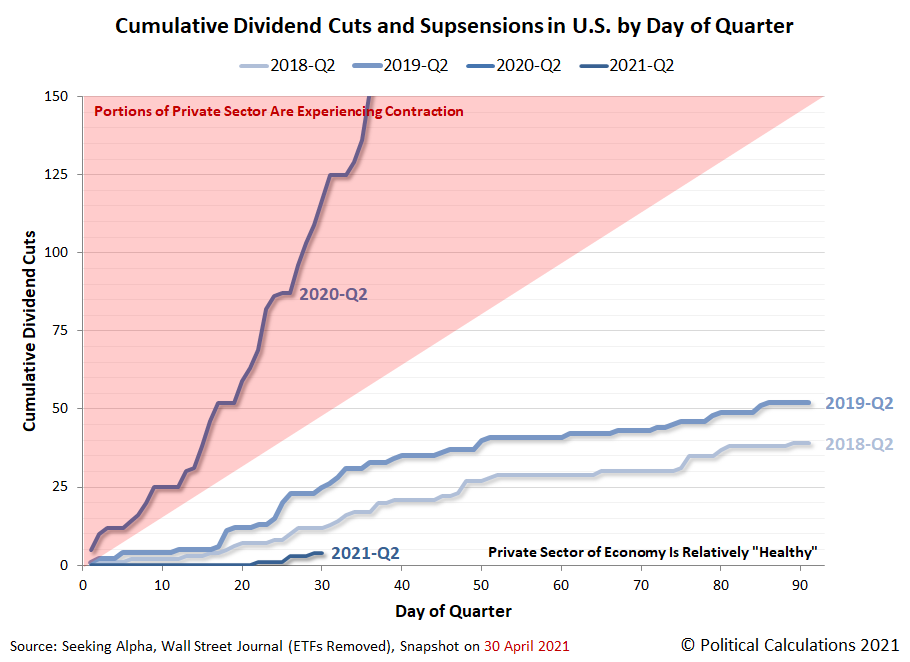

The following chart reveals how the measure of cumulative dividend cuts and suspensions by day of the quarter to date for 2021-Q2 compares with the second quarters of 2018, 2019, and 2020. Pay close attention to the difference between 2020, when companies were slashing dividends in response to the coronavirus recession, and 2021.

The vertical scale on the chart is set to capture dividend cuts in the U.S. stock market during a "typical" recession. 2020's Coronavirus Recession was anything but typical.

References

Standard and Poor. S&P Market Attributes Web File. [Excel Spreadsheet]. 30 April 2021.

Seeking Alpha Market Currents. Filtered for Dividends. [Online Database].

Wall Street Journal. Dividend Declarations. [Online Database when searched on the Internet Archive].

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more