Dividend Watch: Three Companies Boosting Payouts

Image Source: Unsplash

Several companies have been delivering positive news to shareholders lately, such as dividend increases.

When a company opts to raise its dividend, it indicates confidence in its current standing and future prospects. In addition, it reflects the company’s commitment to returning value to shareholders, which is undoubtedly encouraging.

Three companies – Nike (NKE), Automatic Data Processing (ADP), and Emerson Electric (EMR) – have all recently declared a dividend hike. For those with an appetite for income, let’s take a closer look at how each company currently stacks up.

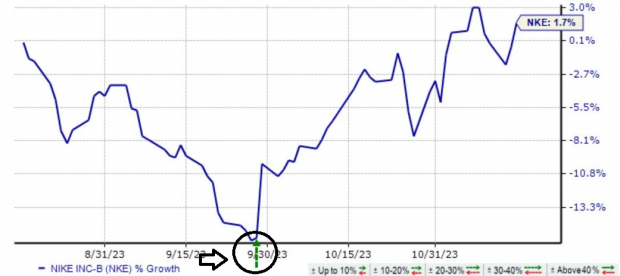

Nike

Nike’s latest quarterly results pleased investors, with shares seeing notable positive momentum following the release. Concerning headline figures, NKE exceeded the Zacks Consensus EPS Estimate by nearly 30% and posted revenue primarily in line with expectations, with both items improving from the year-ago period.

Image Source: Zacks Investment Research

The apparel titan recently announced a 9% boost to its quarterly dividend, with the payout now totaling $0.37 per share. The company has already shown a notable commitment to increasingly rewarding shareholders, carrying a 10.5% five-year annualized dividend growth rate.

In addition, Nike’s growth expectations are worth highlighting, with earnings forecasted to climb 16% in its current year on 4% higher revenues. Peeking a bit ahead, FY25 estimates call for an additional 17% earnings growth paired with an 8% revenue climb.

Image Source: Zacks Investment Research

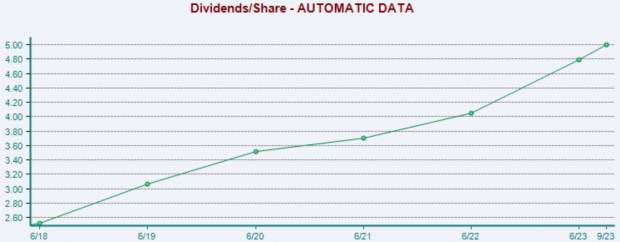

Automatic Data Processing

Automatic Data Processing is one of the leading providers of cloud-based Human Capital Management (HCM) technology solutions. The company recently unveiled a sizable 12% boost to its quarterly dividend, with the payout now totaling $1.40 per share.

As we can see below, the company has a history of consistently boosting its payout, currently carrying an impressive 10.7% five-year annualized dividend growth rate. Please note that the chart below is on an annual basis.

Image Source: Zacks Investment Research

ADP has been a consistent earnings outperformer, exceeding the Zacks Consensus EPS Estimate in 14 consecutive quarters. Just in its latest release, ADP posted a 2.5% beat relative to the Zacks Consensus EPS Estimate, reflecting growth from the year-ago period.

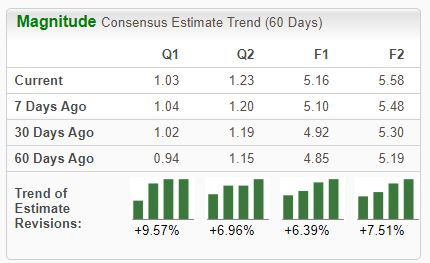

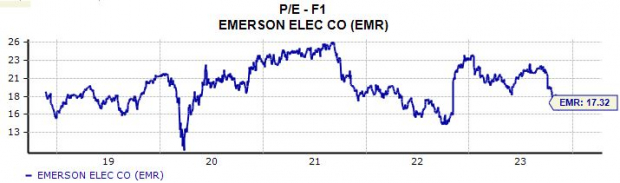

Emerson Electric

Emerson Electric Co. is a diversified global engineering and technology company providing a wide range of products and services to customers in consumer, commercial, and industrial markets. The stock is a current Zacks Rank #1 (Strong Buy), with estimates moving higher across the board.

Image Source: Zacks Investment Research

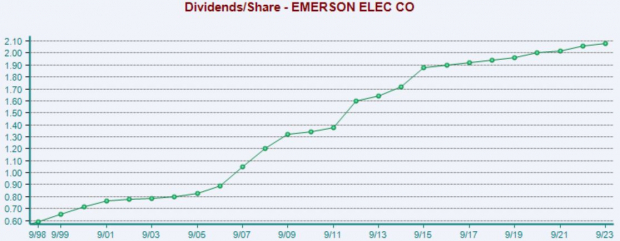

The company has long displayed a shareholder-friendly nature, with EMR’s quarterly payout recently getting boosted by 1% to roughly $0.52 per share. In fact, Emerson Electric is a member of the elite Dividend Kings club, showing an unparalleled commitment to shareholders through a minimum of 50+ consecutive years of increased payouts.

Image Source: Zacks Investment Research

Shares aren’t overly expensive given the company’s forecasted growth, with consensus expectations for its current year calling for 16% earnings growth on 14% higher sales. Shares presently trade at a 17.3X forward earnings multiple (F1), beneath the 19.8X five-year median.

Image Source: Zacks Investment Research

Bottom Line

Targeting dividend-paying stocks is an excellent strategy that investors can deploy.

Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three companies above – Nike, Automatic Data Processing, and Emerson Electric – have recently boosted their payouts.

More By This Author:

Cisco Systems Q1 Earnings And Revenues Top Estimates3 Fidelity Mutual Funds To Buy For Long-Term Gains

Advance Auto Parts Q3 Earnings: Taking A Look At Key Metrics Versus Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more