Dividend Trap: What Income Investors Need To Know

Dividend investors have so much choice when it comes to what stocks to buy to meet their needs. Depending upon those needs – whether it is capital appreciation, dividend growth, dividend safety, or high dividend stocks – investors would do well to avoid certain types of stocks.

While many high dividend stocks are sound long-term investments, investors should be on the lookout for dividend traps.

These are stocks that have dividends that are too good to be true, and are unsustainable for one reason or another.

A dividend cut or suspension is among the worst outcomes for income investors. Not only does a dividend cut result in less dividend income, but it is also typically accompanied by a steep decline in the share price.

For this reason, investors should do as much research before buying a stock, to avoid buying a dividend trap.

In this article, we’ll delve into what a dividend trap is, how to identify a future dividend trap, and an example of one that actually occurred.

What Makes A Dividend Trap?

A dividend trap is pretty simple; it is a stock that has a payout that is unsustainable. This can be for a variety of reasons, including high payout ratios, earnings contraction making less cash available for dividends, or financial burdens such as massive debt.

Any of these factors, or a combination of these factors, can cause a dividend to be unsustainable and eventually, force the company to cut the payout.

Stocks like this tend to have uncharacteristically high dividend yields before the cut, because investors are generally quite good at pricing in dividend safety. In other words, the share price will almost certainly decline in advance of a dividend cut because the “writing is on the wall”, so to speak.

One warning sign with dividend traps is that the current yield moves meaningfully higher, indicating the market sees some measure of uncertainty with the payout.

Essentially, spotting a dividend trap is the opposite of spotting a great dividend stock.

We look for stocks to buy that have reasonable balance sheet leverage, durable competitive advantages, solid earnings growth, and reasonable payout ratios. These are the hallmarks of a great dividend stock, so if you see the opposite of these conditions, the stock could be a future dividend trap.

Now, let’s take a look at a high-profile dividend trap that occurred in the recent past.

General Electric (GE): A Case Study

Our target is industrial conglomerate General Electric, a stock that was very famously part of the original Dow Jones Industrial Average more than a century ago.

To say General Electric was an important dividend stock for many people over the past century would be a gross understatement, but even that couldn’t save General Electric from shifting business conditions that caused what has amounted to essentially an elimination of its dividend.

The first warning sign was years of declining earnings-per-share. If a company’s earnings are in steady decline, the odds of the company being able to continue to pay its dividend – let alone raise the dividend – diminish greatly.

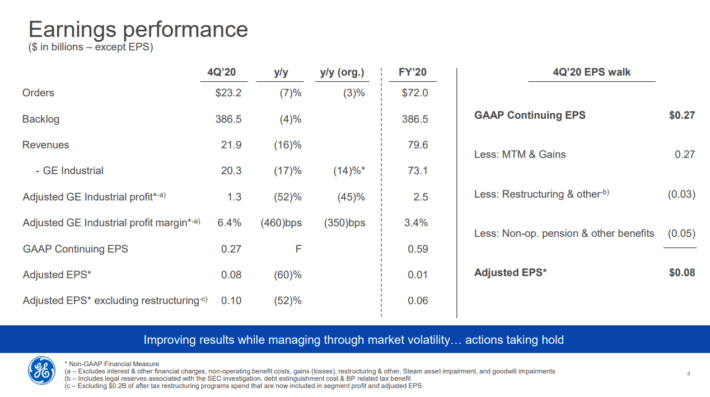

General Electric posted lower earnings in each year from 2017 to 2020, with 2020 results being shown below.

Source: Investor presentation, page 4

Adjusted earnings-per-share came in just over breakeven for 2020, highlighting just how far the company’s fortunes had fallen since earning $1.49 per share just four years prior.

We can see above the cause for the earnings collapse was a combination of weak revenue and plummeting profit margins, both of which are typically present in the case of dividend traps.

This set of circumstances meant that the company’s available cash to pay the dividend continued to dwindle until it became very clear the payout was simply unsustainable, and it was virtually eliminated.

General Electric now pays a token one penny per-share each quarter as it tries to rebuild its business, and income investors now have little reason to own the stock.

Now, let’s take a look at a stock that is a potential dividend trap today.

A Potential Dividend Trap

A stock that we see as a potential dividend trap today, is business development company Oxford Square Capital (OXSQ). This is a company that invests in early and middle-stage companies through debt instruments, borrowing from the capital markets and investing the proceeds at higher yields.

The business model is a common one but carries with it significant risks, and we see Oxford Square as vulnerable to being a dividend trap.

Oxford Square has cut its dividend in the past, which sets a precedent that management may be willing to do it again. We don’t recommend stocks that cut dividends for this reason, and Oxford Square did just that in the summer of 2020.

However, despite the cut, the company is vulnerable to another one.

The company’s investment income per-share, which is the BDC equivalent of earnings-per-share, has declined sharply in the last decade. It was 81 cents per share two years ago, but we see less than half that value for 2021 estimates.

In practice, that means the company has less than half the earnings available to distribute to shareholders, which is what prompted the 2020 dividend cut. Even with this reduced dividend, Oxford Square is in danger of needing to cut again.

The current dividend of 3.5 cents per share per month means Oxford Square needs 48 cents per-share of investment income annually to pay the dividend. We forecast just 36 cents per share in investment income in 2021, down from 40 cents last year.

That puts Oxford Square’s current payout ratio at 117%, which is unsustainable, particularly in light of how weak the company’s ability to produce earnings growth has been in recent years.

Oxford Square has many of the typical traits of a dividend trap. Its earnings are contracting at a swift rate, it has no competitive advantages, it has cut the dividend before, and its payout ratio is well over 100%.

These factors combine to create a situation where we do not see the payout as safe. Despite its huge dividend yield and monthly dividend payouts, we see Oxford Square Capital as a potential dividend trap.

Final Thoughts

While there are plenty of great dividend stocks to choose from, such as the Dividend Aristocrats, just as important as picking great stocks is avoiding weak ones.

For investors looking to build a dividend portfolio, avoiding dividend traps like Oxford Square Capital is critical, because dividend stocks that cut their payouts tend to be punished severely by investors via a lower share price.

We can use lessons of the past, such as General Electric, to identify future potential issues, like Oxford Square Capital. In doing so, it can help us avoid these dividend traps and the damage they can do to our investment returns.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more