Dividend Kings In Focus: MGE Energy

Image Source: Pixabay

The Dividend Kings are a select group of 56 stocks that have increased their dividends for at least 50 consecutive years. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 56 Dividend Kings.

Each year, we individually review all the Dividend Kings. The newest member of the Dividend Kings list is MGE Energy (MGEE), which recently increased its dividend for the 50th consecutive year.

This article will provide a more detailed analysis of the company.

Business Overview

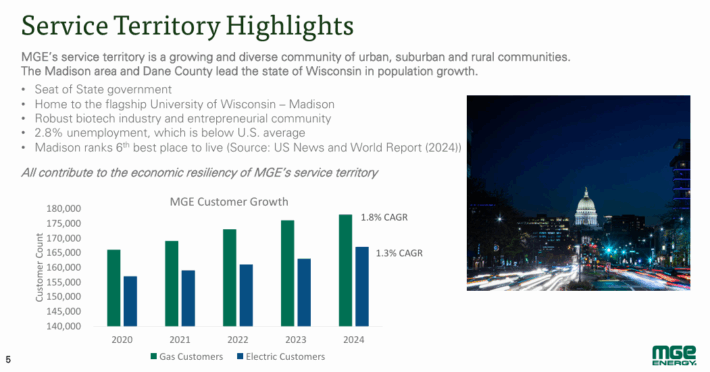

MGE Energy has grown from a small power station in Wisconsin built in 1902 to a $3.2 billion market capitalization integrated energy company.

The company has paid consecutive dividends for more than 100 years and has raised its payout for the past 50 years. MGE principally operates gas and electric utilities, in addition to transmission and construction businesses.

Source: Investor Presentation

On August 7, 2025, MGE Energy reported results for the second quarter ended June 30, 2025, showing stable utility performance and continued investment in renewable generation.

The company posted consolidated earnings of $32.8 million, or $0.89 per share, compared with $30.4 million, or $0.83 per share, in the same quarter last year.

Operating revenue was $173.6 million, down from $182.1 million a year earlier, as lower natural gas usage due to milder weather offset higher electric demand and rate adjustments.

Electric customer growth of 1.1% and increased renewable generation contributed positively to results, with wind and solar resources supplying a larger share of total energy needs. Operating income rose to $49.2 million, up from $46.5 million, reflecting cost management and efficient operations.

The company invested approximately $148 million in capital projects during the first half of 2025, primarily directed toward renewable energy facilities, grid modernization, and infrastructure upgrades to support long-term growth and reliability.

The balance sheet remained strong with equity of $1.73 billion and a debt-to-capitalization ratio of 43%, supporting continued capital investment.

Growth Prospects

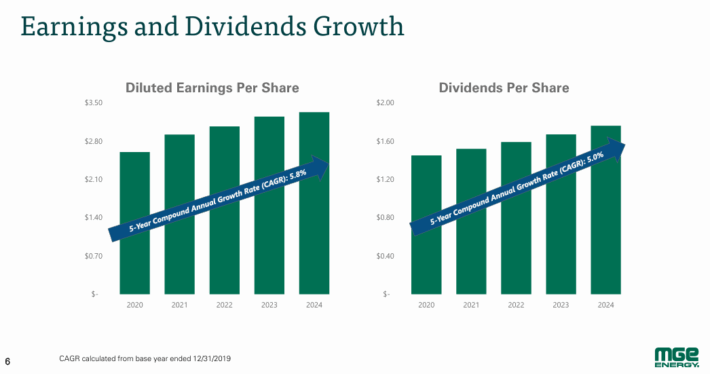

Earnings-per-share have grown consistently over the past decade, though they did encounter a brief bump in the road in 2015.

Recent results have been strong, and we believe that between its two sustainable growth catalysts of customer acquisition and renewable asset growth, the company should be able to achieve mid-single-digit earnings-per-share growth going forward.

Weather can contribute positively but can easily swing results in the other direction. We see mid-single-digit growth for the dividend as well as MGE is comfortable with where the payout ratio is today.

Competitive Advantages & Recession Performance

MGE’s quality metrics have been roughly flat over the past decade, as it does not go after growth via acquisition, and its business has not really changed. Gross margins have drifted up over time but appear to have plateaued.

MGE’s interest coverage is outstanding for a utility, and we forecast this will improve slightly over time as earnings grow and MGE keeps its debt at manageable levels.

The payout ratio should remain around 50% as dividend growth will likely lag earnings growth, but the two should be very close.

Source: Investor Presentation

Overall, MGE is conservatively financed and run basically the same way year after year, meaning changes in the quality metrics will likely be few and far between. MGE’s main competitive advantage is its virtual monopoly in its service area.

Like many other utilities, MGE has a small but profitable service area where it is continuing to grow its customer base. That helped it hold up well in the Great Recession as earnings-per-share dipped slightly but then recovered quickly.

Earnings-per-share performance during the Great Recession is below:

- 2007 earnings-per-share of $2.27

- 2008 earnings-per-share of $2.38 (4.8% increase)

- 2009 earnings-per-share of $2.21 (7.1% decline)

- 2010 earnings-per-share of $2.50 (13.1% increase)

The company remained highly profitable during the Great Recession. This allowed it to continue increasing its dividend yearly during the recession, even when earnings declined in 2009.

Valuation & Expected Returns

Using the current share price of $88 and expected earnings-per-share of $3.58 for the year, MGEE stock trades for a price-to-earnings ratio of 25.9.

Considering the company’s slow-growth nature as a utility, we believe that a valuation target of 17.5 times earnings is a fair valuation assessment.

Therefore, it seems that MGEE stock is significantly overvalued. We expect a contracting valuation multiple to reduce annual returns by 7.5% over the next five years.

Aside from changes in the price-to-earnings ratio, future returns will be driven by earnings growth and dividend yields.

We expect 5.8% annual earnings growth over the next five years, which is its average rate of EPS growth over the past 10 years.

In addition, MGEE stock has a current dividend yield of 2.2%. The dividend is also well-protected, with an estimated payout ratio for 2025 of 53%.

In total, we project that MGEE stock will provide a total annual return of just 0.5% through 2030.

Final Thoughts

MGE appears overvalued right now. We are forecasting total annualized returns for the next five years to be 0.5% as multiple contraction will offset the dividend and earnings-per-share growth.

MGE has failed to grow its earnings faster than a mid-single-digit rate for a while now and appears poised to continue growing at a mediocre rate moving forward.

However, the valuation is pricing in a bit more growth than that. MGE therefore is rated a hold right now.

More By This Author:

3 Top Dividend Kings For Retirees

10 Top Canadian Dividend Stocks, Ranked In Order

Monthly Dividend Stock In Focus: Healthpeak Properties

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more