Dividend Kings In Focus: Lowe’s Companies

Increasing dividends for five decades is no easy task. A company must possess durable competitive advantages and an ability to outlast recessions. This explains why there are relatively few stocks that qualify as Dividend Kings. One of them is home improvement retailer Lowe’s Companies (LOW), a Dividend King that has declared a cash dividend every quarter since going public in 1961.

Lowe’s stock has had a tremendous run off the 2020 lows. But despite the recent rally, we still believe Lowe’s stock can deliver solid returns over the next several years, thanks in large part to the company’s dividend and impressive earnings growth.

Business Overview

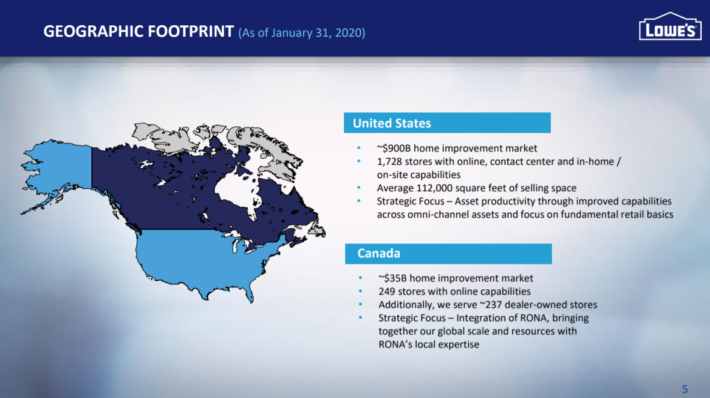

Lowe’s traces its roots back to 1921 when LS Lowe founded a hardware store in North Wilkesboro, North Carolina. The company remained a single store operation until 1949 when a second store was opened in Sparta, North Carolina. Since then, Lowe’s has grown to more than 1,700 stores in the US, and a further 450 in Canada.

The company’s stores generate $84 billion in annual revenue, with its 300,000 employees serving 18 million customers every week. Lowe’s is a large-cap stock today at a market capitalization of $125 billion after another strong performance in 2020.

Source: Investor presentation, page 5

Lowe’s has made its mark in the US with its 1,700+ stores by focusing on merchandising excellence, supply chain efficiency, operational efficiency, and engagement of customers. Lowe’s fell behind rival Home Depot (HD) in recent years as Home Depot focused on professional customers, building out digital capabilities, and an intense focus on the customer experience. Lowe’s, for its part, has made necessary investments in recent years to close the gap.

It has also been able to successfully translate this success into Canada, which many retailers have tried to do without success. The company has a handful of banners it sells under in Canada and has tapped into a $35 billion home improvement market.

The current business environment remains strong for Lowe’s despite the impact of the coronavirus pandemic. Lowe’s reported second-quarter results on August 19th, and recorded net earnings of $2.8 billion, compared to net earnings of $1.7 billion in the prior-year period. Diluted earnings per share increased 75% to $3.74, while adjusted earnings per share rose 74% to $3.75.

Year-to-date, adjusted earnings per share of $5.52 is significantly higher than last year. The company generated revenue of $27.3 billion, with comparable sales increasing 34.2%. Comparable sales specifically in the U.S. increased a bit more by 35.1%. Of note for the second quarter, Lowes.com sales increased 135% year-over-year as the retail landscape moves even more online.

We expect Lowe’s to continue generating positive sales and earnings growth for many years.

Growth Prospects

Lowe’s has kept its store base fairly constant in recent years, as it appears the company is happy with the footprint it possesses at the moment. The number of markets Lowe’s can enter is somewhat limited by the massive size of the stores it operates; small markets generally cannot support a Lowe’s store. However, despite this lack of footprint growth, Lowe’s has plenty of runway for additional earnings expansion.

One way Lowe’s expands its earnings is through strong comparable sales. The company has managed to produce positive same-store sales growth each year for the past decade and is slated to produce a huge comparable sales gain this year due to COVID-19-driven demand. Lowe’s has been able to grow through a variety of economic situations and changes in consumer spending habits, and we think that will continue.

The second growth driver for Lowe’s is margin expansion. Gross margins tend not to move much in the home improvement business, and Lowe’s is no exception. However, it has seen SG&A costs leveraged down over time as revenue has risen, and so long as comparable sales are rising, this should continue to be a tailwind.

Third, Lowe’s spends freely on share repurchases, although those have slowed in 2020. We expect Lowe’s to continue buying back stock in 2021 and beyond, as the company has plenty of cash on hand and earnings strength to do so.

Combined, these factors should see Lowe’s grow earnings-per-share by 10% annually in the coming years.

Competitive Advantages and Recession Performance

Lowe’s main competitive advantage is one it shares with Home Depot; size and scale that affords it superior buying power over smaller rivals. Lowe’s and Home Depot operate a duopoly in the US, and thus, Lowe’s is competitively positioned by virtue of its scale.

Source: Investor presentation, page 4

Apart from that, Lowe’s has focused its energy in recent years on building out a customer base that is more durable and less cyclical. Pro customers are about one-quarter of revenue, and Lowe’s has gone after those customers aggressively to try and take share from Home Depot. Pro customers tend to spend heavily throughout the year as they complete customer jobs, and are therefore quite lucrative. Lowe’s continues to build digital tools and pro-only shopping experiences to lure this customer away from its main rival.

Lowe’s tends to be somewhat cyclical given recessions generally result in lower discretionary spending and lower rates of construction. This recession is actually proving to be a boon for Lowe’s as consumers are spending more time in their homes than ever and therefore, are spending to improve them. We see the next recession as having the ability to be harsher to Lowe’s if it is accompanied by a slowdown in housing and commercial construction since those are huge drivers of revenue for Lowe’s.

Valuation and Expected Returns

We see Lowe’s producing $8.50 in earnings-per-share this year, so at the current price, Lowe’s trades for 19.7 times earnings. That is almost exactly in line with our estimate of fair value, which stands at 20 times earnings. Indeed, we see fair value at $170 per share, and the stock trades for $167. Given this, we see virtually no impact from the valuation on total returns.

The dividend yield stands at 1.5% despite more than 50 years of payout growth, as the share price continues to rise, driving the yield down. The yield, combined with 10% estimated earnings-per-share growth and a small tailwind from the valuation, should produce 11.6% total returns in the years ahead. With a double-digit expected rate of return, we view Lowe’s stock as a buy.

Final Thoughts

Lowe’s has an impressive track record of increasing its dividend each year, regardless of the state of the broader economy. This trend has continued in 2020, as the company recently increased its dividend by 9% despite operating in a recession. Home improvement retail has continued to benefit from a strong housing market, buoyed by rock-bottom interest rates.

As interest rates are expected to remain low for the foreseeable future, we expect the strength of the housing market to continue. In turn, this will continue to benefit Lowe’s through higher sales and earnings, and investors through a higher share price and rising dividends.

Lowe’s is not the cheapest stock around, but it is not unusual for the best businesses to command a higher valuation multiple. While we believe investors would benefit by waiting for a lower share price before buying Lowe’s, current investors should still earn satisfactory returns through earnings growth and dividends.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more

Very interesting indeed! My experience with Lowe's is a bit different, in my location it is immediately adjacent to a Home Depot store, and my observation is that there is usually much more choice of parking spots in the Lowe's lot. Inside the stores, many product choices and prices are identical. But the layout and emphasis of products are quite different, and the Home Depot scheme has won, in my view. Of course I am one of those that HD courts and so that makes sense. But certainly Lowe's sounds like a good investment. so thanks for the educational article.