Dividend Kings In Focus: Illinois Tool Works

Each year, we individually review all the Dividend Kings. The next in the series is Illinois Tool Works (ITW).

Illinois Tool Works has increased its dividend for 50 consecutive years, which is especially impressive since it operates in a highly cyclical sector. This article will discuss the major factors for Illinois Tool Works’ long dividend history.

Business Overview

Illinois Tool Works has been in business for more than 100 years. It started out all the way back in 1902 when a financier named Byron Smith placed an ad in the Economist. At the time, Smith was looking to invest in a “high-class business (manufacturing preferred) in or near Chicago.” A group of inventors approached Smith with an idea to improve gear grinding, and Illinois Tool Works was born.

Today, Illinois Tool Works has a market capitalization of $68 billion and generates annual revenue of nearly $15 billion. Illinois Tool Works is composed of seven segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products, and Specialty Products.

These segments have performed very well against its peers and has allowed Illinois Tool Works to achieve “best of breed” status in its industry.

Illinois Tool Works’ portfolio is concentrated in product segments that each hold above-average growth potential in their respective markets. The overarching strategic growth plan for Illinois Tool Works is to continuously reshape its business model, when necessary. The company frequently utilizes bolt-on acquisitions to expand its reach.

Growth Prospects

While 2020 was a very difficult year for the global economy, due to the coronavirus pandemic which weighed heavily on economic growth, Illinois Tool Works continued to generate steady profits. In 2021, the company continued to grow its earnings and the stock price continued to run higher with a total year return of 23.4% for the entire year of 2021.

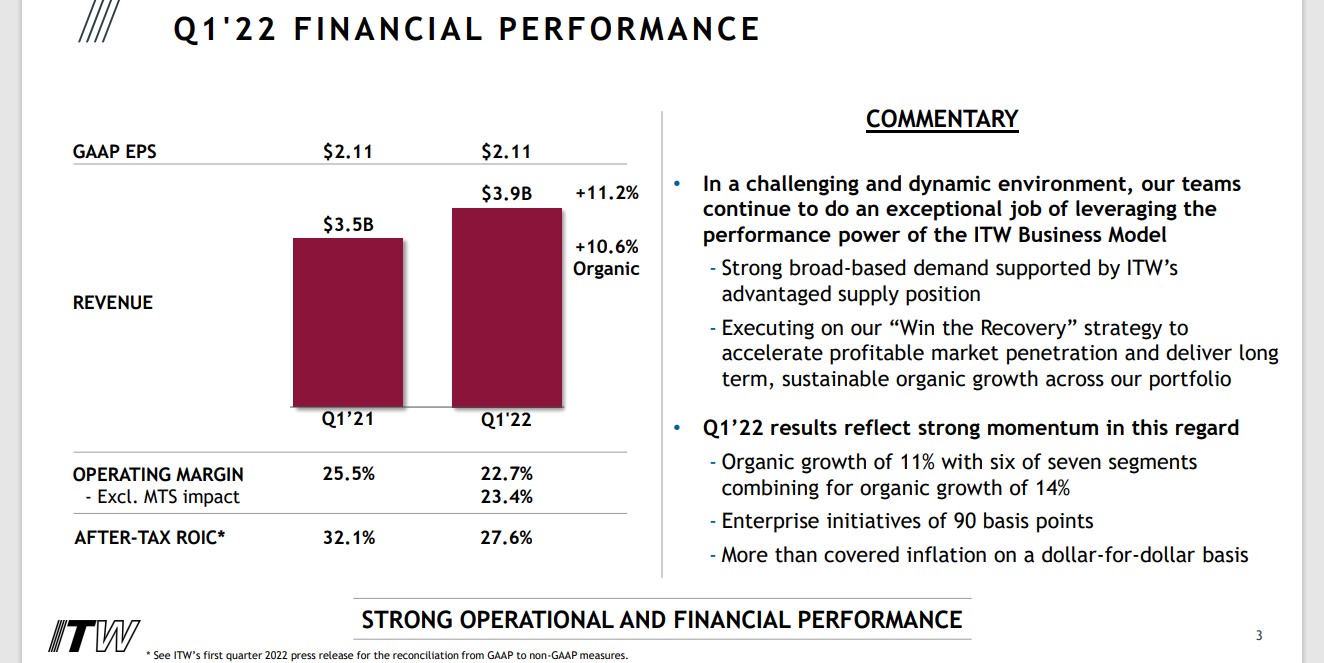

On May 3rd, 2022, the company reported first-quarter financial results. Total revenue of $3.9 billion rose 11.2% year-over-year. Organic growth was 10.6% for the quarter. GAAP EPS was $2.11 for the quarter.

Source: Investor Presentation

Six of the company’s seven segments showed positive organic growth for the quarter. Food Equipment and Construction Products grew 28% and 21% respectively, followed by Welding and Polymers & Fluids at 13% growth each.

Test & Measurement and Electronics grew 8%, and Specialty Products was up 1%. Organic revenue was down 1% in the Automotive OEM segment due to supply shortages causing production constraints.

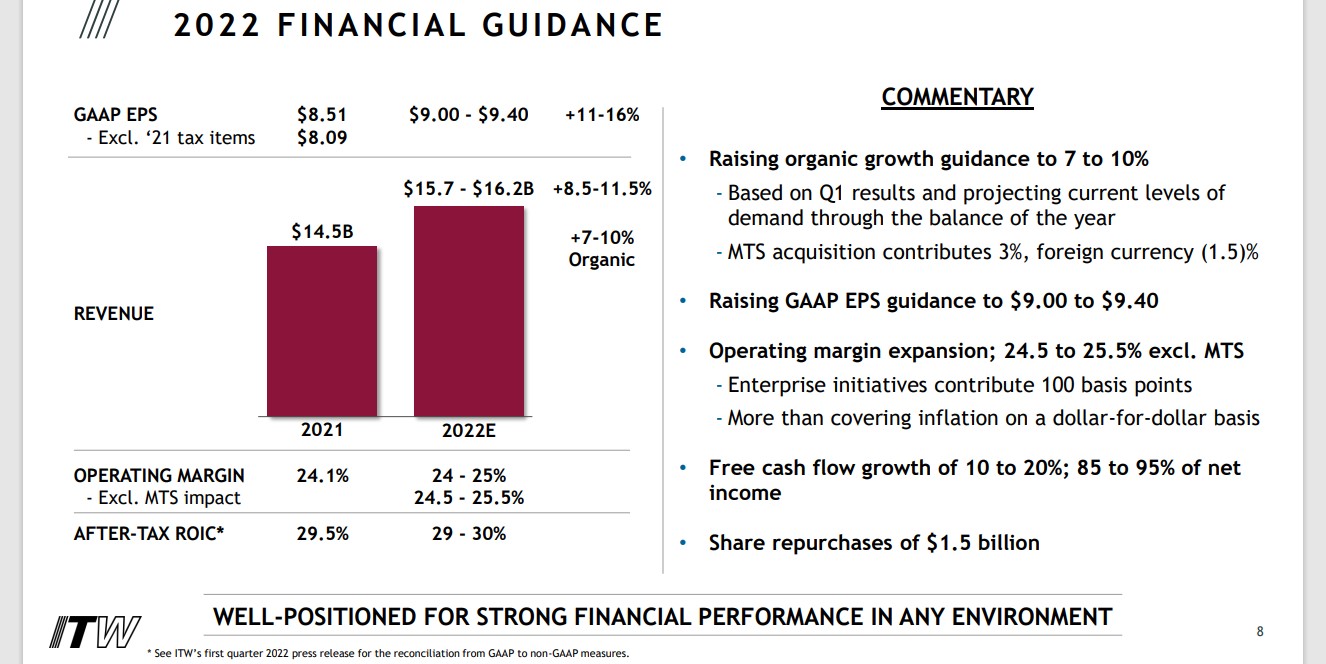

Along with quarterly results, the company raised full-year EPS guidance.

Source: Investor Presentation

Illinois Tool Works expects full-year organic growth of 7% to 10% and full-year revenue growth of 8.5% to 11.5%. Earnings-per-share are now expected in a range of $9.00 to $9.40 (compared with previous guidance of $8.90 to $9.30). EPS is expected to grow 11% to 16% from 2021.

Overall, we expect 7% annual EPS growth over the next five years, comprised mainly of revenue growth and share buybacks.

Competitive Advantages & Recession Performance

Illinois Tool Works has a significant competitive advantage. It possesses a wide economic “moat”, which refers to its ability to keep competition at bay. It does this with a massive intellectual property portfolio. Illinois Tool Works holds over 17,000 granted and pending patents.

Separately, another competitive advantage is Illinois Tool Works’ differentiated management strategy. The company has employed a management process called “80/20”. This is an operating system that is applied to every business line at Illinois Tool Works. The company focuses on its largest and best opportunities (the “80”) and seeks to eliminate costs or divest its less profitable operations (the “20”).

At the same time, Illinois Tool Works has a decentralized, entrepreneurial corporate culture. This also sets the company apart from the competition. Illinois Tool Works empowers its various businesses with significant flexibility, to customize their own approaches to serving customers in the best way possible.

One potential downside of Illinois Tool Works’ business model, is that it is vulnerable to recessions. As an industrial manufacturer, Illinois Tool Works is reliant on a healthy global economy for growth.

Earnings-per-share performance during the Great Recession is below:

- 2007 earnings-per-share of $3.36

- 2008 earnings-per-share of $3.05 (9% decline)

- 2009 earnings-per-share of $1.93 (37% decline)

- 2010 earnings-per-share of $3.03 (57% increase)

That said, the company remained highly profitable during the Great Recession. This allowed it to continue increasing its dividend each year during the recession, even when earnings declined. And, thanks to its strong brand portfolio, the company recovered quickly. Earnings-per-share soared 57% in 2010. By 2011, earnings-per-share surpassed 2007 levels.

A similar pattern was seen in 2020 as the coronavirus pandemic caused an economic recession. Illinois Tool Works’ earnings-per-share declined in 2020, but the decline was manageable and the company continued to raise its dividend.

Valuation & Expected Returns

Using the current share price of ~$204 and the midpoint for earnings guidance of $9.20 for the year, Illinois Tool Works trades for a price-to-earnings ratio of 22.2. Given the company’s cyclical nature, we feel that a target price-to-earnings ratio of 19 is appropriate. This is roughly in line with the company’s 10-year historical average.

As a result, Illinois Tool Works is currently overvalued. Returning to our target price-to-earnings ratio by 2027 would reduce annual returns by 3.1% over this period of time. Aside from changes in the price-to-earnings multiple, future returns will be driven by earnings growth and dividends.

We expect 7% annual earnings growth over the next five years. In addition, Illinois Tool Works stock has a current dividend yield of 2.4%.

Total returns could consist of the following:

- 7% earnings growth

- -3.1% multiple reversion

- 2.4% dividend yield

Illinois Tool Works is expected to return 6.3% per year through 2027. As a result, we have a hold recommendation on Illinois Tool Works, though the company’s ability to raise dividends through multiple recessions is impressive.

The company now has 50 consecutive years of dividend growth after increasing its dividend by 7% in August 2021.

Final Thoughts

Illinois Tool Works is a high-quality company and an even better dividend growth stock. It has a strategic growth plan that is working well, and shareholders have been rewarded with rising dividends for 50 years.

The stock also has a decent 2.4% dividend yield, which could make it an appealing choice for long-term dividend growth investors. Shares are not attractively priced at the moment, and it is likely the company will struggle if and when a recession occurs.

Despite its status as a Dividend King, we suggest investors wait for a better entry point prior before purchasing shares of Illinois Tool Works.