Dividend Kings In Focus: H.B. Fuller

H.B. Fuller (FUL) has increased its dividend for 51 years in a row. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 30 Dividend Kings here.

H.B. Fuller has remained a relatively small company, trading at a market capitalization of just $2.4 billion. However, a small market cap is not a negative feature when investing; quite the contrary.

Despite its small size, H.B. Fuller has promising growth prospects thanks to the growth potential of the niche market it operates in. The stock has a 1.4% dividend yield, which is lower than the yield of the S&P 500 (1.8%), but there is ample room for many future dividend raises thanks to the markedly low payout ratio of 26% and the growth prospects of the company.

Business Overview

H.B. Fuller is a global market leader in adhesives. It has 72 manufacturing facilities, 30 technology centers, direct presence in 37 countries, and sells its products in 125 countries.

Adhesives is an exceptionally attractive niche market. Adhesives are critical materials in numerous applications but they comprise just a small expense for H.B. Fuller’s customers. Adhesives make up less than 1% of the cost of goods of most customers.

In addition, each adhesive has unique chemistry, with most product formulations including 3-10 chemicals. It is also uneconomical for customers to switch to another supplier. Overall, H.B. Fuller’s customers have to use its essential products without paying much attention to their cost, which is minor compared to their other costs.

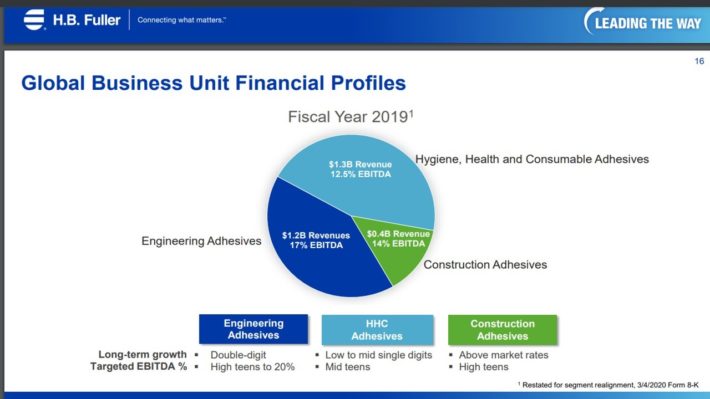

Hygiene, health, and consumable adhesives generate 45% of H.B. Fuller’s total revenue, while engineering adhesives and construction adhesives comprise 41% and 14% of total revenue, respectively.

(Click on image to enlarge)

Source: Investor Presentation

As shown in the above chart, engineering adhesives have the greatest EBITDA margin and the highest growth rate. As a result, they constitute the most critical category of adhesives, though the hygiene, health and consumable adhesives are very important as well.

H.B. Fuller is currently facing a headwind due to the coronavirus crisis, which has caused a deep global recession. Most industrial manufacturers have been severely hurt by the pandemic, as their results are closely tied to the underlying economic growth.

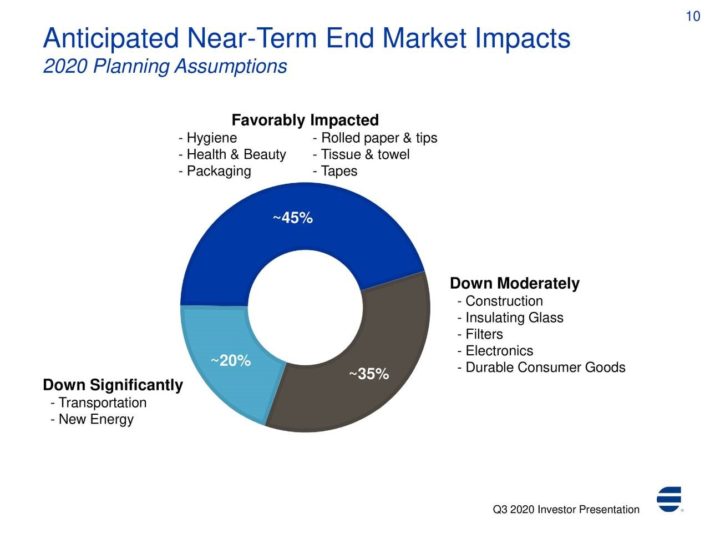

However, H.B. Fuller has proved much more resilient than most industrial manufacturers. All its factories have remained open and operational throughout the pandemic. In addition, its health and hygiene adhesives have benefited from the pandemic thanks to a steep increase in the demand for this type of products as well as packaging material and labeling.

(Click on image to enlarge)

Source: Investor Presentation

This type of adhesives has partially offset the material decrease in the demand for adhesives in the automotive industry, construction, and energy.

As a result, in the third quarter, the organic revenue of H.B. Fuller decreased by only 2.5% and its adjusted earnings per share fell only 12%, from $0.86 to $0.76. Moreover, management provided guidance for a milder than a 3% decrease in the revenue of the fourth quarter over the prior year’s quarter and flat EBITDA.

Overall, H.B. Fuller has proved remarkably resilient in the downturn caused by the pandemic, particularly given that the company is an industrial manufacturer, and thus it is normally expected to suffer much more during severe recessions.

Growth Prospects

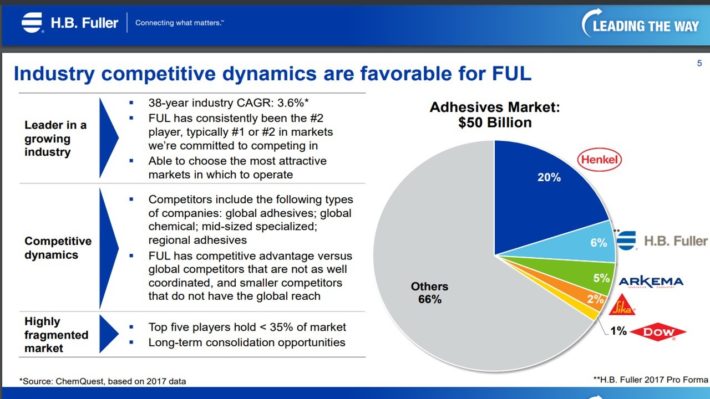

The adhesives market has exhibited a 3.6% average annual growth rate over the last 38 years. It has become a $50 billion market that is highly fragmented, with the top 5 companies generating less than 35% of the total sales.

(Click on image to enlarge)

Source: Investor Presentation

Thanks to the high fragmentation of this market, there is significant growth potential for H.B. Fuller, which has consistently been the second-largest player in the market behind Henkel. ChemQuest forecasts the annual adhesive sales to grow approximately 40% over the next decade, from $50 billion to $70 billion.

Moreover, H.B. Fuller enjoys economies of scale that its smaller competitors cannot match while the latter also lack the global reach to compete directly with H.B. Fuller. As a result, H.B. Fuller is likely to grow by gaining market share from its small competitors over time.

H.B. Fuller is also likely to keep growing via major acquisitions. In 2017, it acquired Royal Adhesives & Sealants for $1.6 billion. As the value of that acquisition is two-thirds of the current market capitalization of H.B. Fuller, it is evident that the merger, the largest in the history of the company, was critical. The acquisition enhanced the product range of H.B. Fuller to more specialized adhesives and boosted its annual sales by about $735 million (32%).

Since the acquisition, H.B. Fuller has been reducing its debt load at a fast pace and thus it is likely to reduce its leverage (Net Debt to EBITDA) to its long-term target range of 2.0-3.0 next year. When that happens, H.B. Fuller will shift its focus again on potential takeover targets.

H.B. Fuller has grown its earnings per share at an 8.4% average annual rate over the last decade. Given the promising growth prospects of the company and the somewhat low comparison base formed this year due to the pandemic, we expect the company to grow its earnings per share at an 11.0% average annual rate over the next five years.

Competitive Advantages & Recession Performance

H.B. Fuller’s customers manufacture of a wide range of products. Consequently, the performance of H.B. Fuller greatly depends on the prevailing economic conditions, and thus the company is vulnerable to recessions. In the Great Recession, its earnings per share plunged 79%, from $1.68 in 2007 to $0.36 in 2008, and the stock lost two-thirds of its market capitalization in less than six months.

Still, the wide range of the applications of its adhesives provides some diversification. As mentioned above, strong growth in demand for health and hygiene products amid the pandemic has mostly offset the decrease in the demand for adhesives in other categories.

Moreover, H.B. Fuller is the #1 or #2 player in most of its markets and thus it can endure a downturn more readily than its small competitors thanks to its economies of scale. It is also worth noting that its top 10 customers comprise less than 15% of its revenue and thus the company has limited risk from any specific customer.

Finally, it is impressive that an industrial manufacturer closely tied to the underlying economic growth has raised its dividend for 51 consecutive years. This is a testament to the strong growth of this niche market and the great business execution of the company. H.B. Fuller has achieved this exceptional dividend growth record partly thanks to its low payout ratio.

The company has always targeted a payout ratio around 25% and thus it has been able to keep raising its dividend even in years in which its earnings have temporarily plunged. Due to the low payout ratio, the dividend is safe but the resultant 1.4% dividend yield is somewhat lackluster.

Valuation & Expected Returns

H.B. Fuller is currently trading at 18.4 times its expected earnings per share of $2.50 this year. While the historical earnings multiple of the stock is 16.5, we believe that a fair price-to-earnings ratio is 15.0 due to the cyclical nature of the stock. If the stock reaches our fair valuation level over the next five years, it will incur a 4.0% annualized drag in its returns.

Given 11% expected earnings-per-share growth, the 1.4% dividend, and a 4.0% annualized contraction of the price-to-earnings ratio, we expect H.B. Fuller to offer a 7.8% average annual return over the next five years. This is a satisfactory projected rate of return, but not high enough to warrant a buy recommendation at this time. Instead, we maintain a hold rating.

Final Thoughts

H.B. Fuller is highly vulnerable to recessions but it has proved markedly resilient in the current downturn, which has been caused by the pandemic, thanks to a strong increase in adhesives demand used in health and hygiene products.

Moreover, thanks to the reliable long-term growth of its niche market and its high fragmentation, H.B. Fuller is likely to grow its earnings per share at a double-digit rate in the upcoming years. That said, the stock currently has rich valuation and it is offering an uninspiring 1.4% dividend yield. As a result, investors should wait for a modest correction of the stock before purchasing.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more