Dividend Kings In Focus: Black Hills Corporation

Companies that have at least 50 years of dividend growth are considered Dividend Kings.

The majority of the Dividend Kings list is made up of large companies like Procter & Gamble (PG), Coca-Cola (KO), and Johnson & Johnson (JNJ).

But there are also a number of small-cap and mid-cap Dividend Kings. For example, Black Hills Corporation (BKH) is a member of the Dividend Kings list, but it has a market cap below $5 billion.

This shows that smaller companies can maintain equally impressive streaks of dividend growth.

As a well-run utility stock with a recession-resistant business model, investors can expect Black Hills to continue increasing its dividend each year.

This article will discuss Black Hills’ business model, growth prospects, and valuation, in order to determine if shares are worth purchasing now.

Business Overview

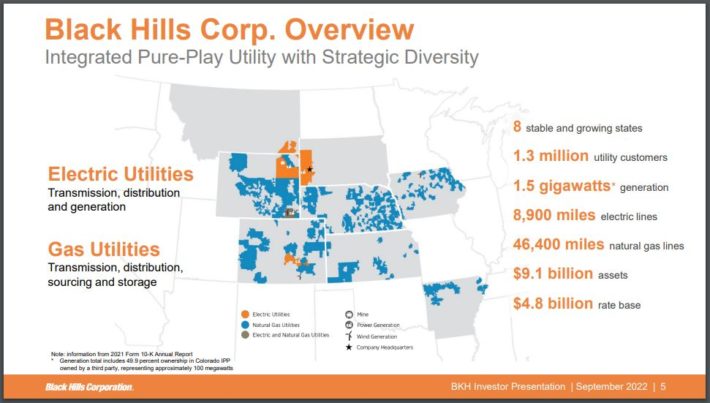

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Arkansas, Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was founded in 1941, and the company is headquartered in Rapid City, South Dakota.

The company has 1.3 million utility customers in eight states. Its natural gas assets include 46,400 miles of natural gas lines. Separately, it has ~9,000 miles of electric lines and 1.5 gigawatts of electric generation capacity.

Source: Investor Presentation

Utility stocks are typically purchased for their stable profits and low volatility. Black Hills is no exception, as 93% of its assets are regulated.

It is also a diversified business, split between complementary natural gas and electric utility businesses.

In the second quarter of 2022, adjusted earnings-per-share increased 30% year-over-year. Adjusted EPS was up 20.7% over the first two quarters of the year, compared with the same six-month period in 2021.

The company reaffirmed its guidance for the year, with management still expecting EPS in a range of $3.95 to $4.15 for 2022. At the midpoint, EPS growth would be an 8.3% improvement from the prior year.

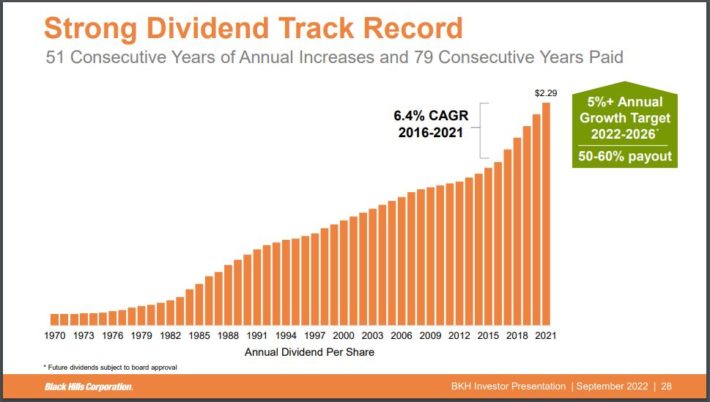

In addition to solid growth, the company has increased its dividend for 51 consecutive years. Future dividend increases are very likely, due to the company’s consistent long-term growth and a projected payout ratio of just 59% for 2022.

Growth Prospects

Overall, earnings-per-share grew by 7% annually from 2012 through 2021, a very solid rate of earnings growth in the past decade.

Going forward, we expect more modest EPS growth of 4% per year over the next five years, which would be more in line with a typical utility stock.

Black Hills’ growth over the coming years depends on several factors. This includes rate reviews, which drive revenues and profits per kWh.

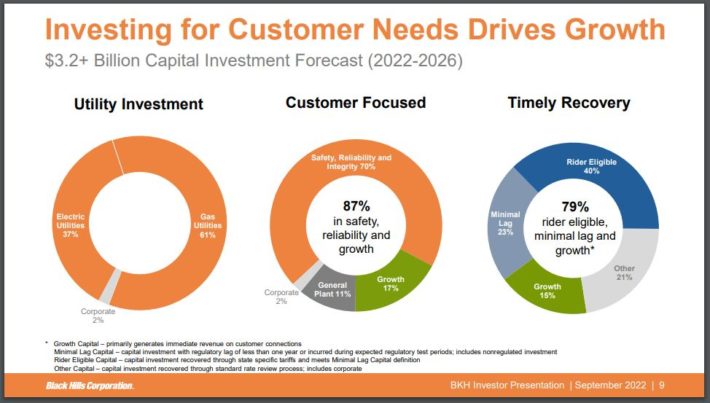

Another factor is the expansion of the company’s existing assets via new utility infrastructure. Black Hills regularly adds new projects to its growth investment backlog, which currently stands at $3.2 billion from 2022 through 2026.

The company believes its investments will bring future growth.

Source: Investor Presentation

Black Hills’ planned growth investments include new electric transmission lines, and new natural gas pipelines to service its customers.

Rate reviews will allow Black Hills to recover investments into its existing systems, thereby more or less guaranteeing increasing revenues, which should lead to rising profits down the road.

In 2018, Black Hills exited its oil business, which means that the company is now less impacted by changes in commodity prices.

Focusing on its core utility business will likely be a positive for Black Hills going forward. We forecast 4% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

To become a Dividend King, a company must inherently possess durable competitive advantages which allow it to outlast competitive threats, and also continue to perform well during recessions.

This remains true for Black Hills. Demand for electricity and gas is not overly cyclical, although it is dependent upon weather conditions to some degree.

Thus, Black Hills should remain profitable under most circumstances, which allows the company to raise its dividend for decades on end.

Source: Investor Presentation

The fact that customers tend to stick with their provider means that Black Hills operates a relatively stable business model. The company should also be able to weather future recessions well, which creates appeal for more conservative investors.

Another competitive advantage is the company’s strong balance sheet. Black Hills has a high credit rating of BBB+ from Standard & Poor’s and Fitch, which helps reduce its cost of capital.

In terms of dividend safety, Black Hills scores highly due to its competitive advantages and defensive business model. The company aims to distribute 50% to 60% of its net profits in the form of dividends. This is a healthy payout ratio. Not only has Black Hills increased its dividend for 51 years, it has paid a dividend to shareholders for the past 79 years.

Valuation & Expected Returns

Black Hills stock currently trades for a price-to-earnings ratio of 17.5, based on expected 2021 earnings-per-share of $4.05.

Black Hills’ valuation has moved in a very wide range throughout the past. The company was valued at less than 10 times profits during the midst of the financial crisis, but at as much as 30 times earnings in 2011.

Our fair value estimate for Black Hills stock is a P/E ratio of 18, which we believe is a reasonable valuation multiple for a utility company. Therefore, shares appear slightly undervalued right now.

If the P/E ratio expands from 17.5 to 18 over the next five years, shareholder returns would be boosted by 0.5% annually.

In addition, future earnings-per-share growth and dividends will add to shareholder returns.

As previously mentioned, we expect 4% annual EPS growth. The stock also has a 3.4% current dividend yield, leading to total expected returns of 7.9% per year over the next five years.

Final Thoughts

Black Hills is a relatively small utility company, but it has a compelling dividend growth track record, having raised its dividend annually for over five decades in a row. We believe it is highly likely that the company will continue to grow its earnings and its dividend over the coming years.

Utilities traditionally offer investors a high level of stability and dividend safety, and Black Hills is a good example.

The stock is currently trading below our fair value estimate, with an attractive dividend yield and a positive future growth outlook. Due to its nearly 8% expected annual returns, we rate the stock a hold, but not quite a buy as the expected returns are less than 10%.

More By This Author:

Dividend Kings In Focus: California Water Service

Dividend Kings In Focus: Federal Realty Investment Trust - Update

3 High-Yield REITs To Buy Now