Dividend Kings In Focus: ABM Industries

ABM Industries (ABM) has an amazing track record when it comes to paying dividends to shareholders. The company is part of the Dividend Kings, a group of stocks that have raised their payouts for at least 50 consecutive years. You can see all 45 Dividend Kings here.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash, and this article will discuss ABM’s dividend safety, as well as its valuation and outlook.

Business Overview

ABM was founded back in 1909 and since that time, it has grown into an industry powerhouse. ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. The company produces $7.8 billion in annual revenue and trades today with a market cap of $2.5 billion.

ABM counts hospitals, universities, public schools, data centers, manufacturing plants, airports, and others among its long and impressive client list. The company’s expertise and many decades of experience in facility management has earned it a terrific reputation and thus it is a true industry leader.

ABM’s strategy is to compete in industries where it can win, rather than competing everywhere. ABM has learned through the decades where it can compete successfully and where it cannot and has focused its efforts accordingly.

In 2007 ABM’s annual revenue was about $3B, but it has nearly tripled since then, currently standing at nearly $8 billion. ABM has grown organically in part but the vast majority of its growth has been purchased. And given strategic direction from ABM in terms of future cash usage, we can expect more acquisitions as the years go on.

ABM also has an exceptional dividend growth record. The company has paid more than 220 consecutive quarterly dividends and has increased its dividend for 54 consecutive years.

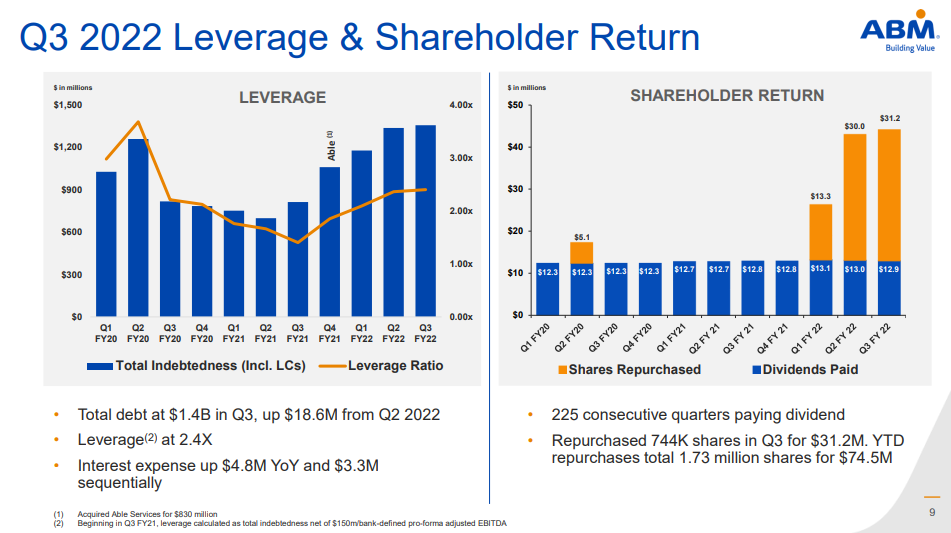

Source: Investor Presentation

Given the remarkably low payout ratio of ~22% projected for 2022, its long-term growth prospects and its resilience to recessions, ABM is likely to keep raising its dividend for many years to come. In addition, the company has bought back nearly two million shares in recent quarters, helping to drive higher earnings-per-share. This is a change from prior behavior where capital returns were almost exclusively through cash dividends.

One source of potential earnings growth going forward is international expansion as ABM entered the U.K. market with the GBM and Westway acquisitions in the past few years. Going forward, continue to look for lots of transactions from ABM in terms of both acquisitions and divestitures as it shifts its mix around further.

ABM is split into six segments that provide a wide array of facility solutions to its customers: Business & Industry, Education, Aviation, Technology & Manufacturing, Healthcare, and Technical Solutions. The company’s revenue streams are highly diversified, with janitorial services comprising the biggest single piece of the pie for ABM.

Growth Prospects

ABM’s stated strategy is to grow by acquisition, as we saw above. That’s not to say that it is ignoring its ability to grow organically, however. When it has free cash flow to spend, it looks first at organic growth. The company has deep expertise and a great reputation here in the US for facilities management and looks to exploit that where possible. That means going after national accounts first where it can gain a significant amount of business all at once as well as centralizing support services to improve margins.

ABM also specifically calls out acquisitions in its strategy, although it is behind organic investments and the dividend. Still, ABM’s recent history suggests that acquisitions are a very important part of its overall strategy and thus, we can expect ABM will continue to grow via acquisitions as well as organically.

ABM is still extremely focused on the US market and that presents potential opportunities for further international expansion. ABM could use its significant expertise in facilities management to gain access to global clients around the world. The moves into the U.K. in recent years prove ABM is willing to take a chance and this may be the most significant growth avenue ABM has going forward.

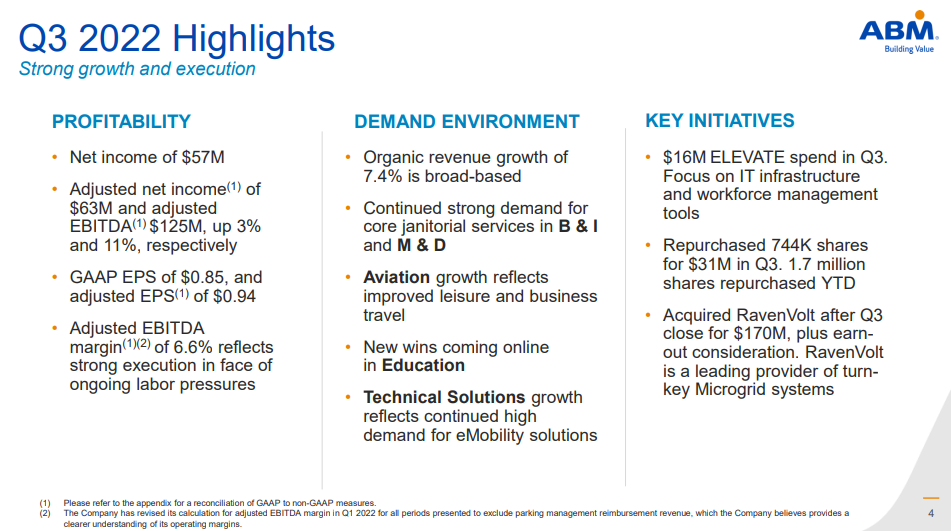

Source: Investor presentation

It is expected that ABM Industries will be highly profitable again this year, and following third-quarter earnings, we now expect $3.60 in earnings-per-share for the year. The company’s Q3 results showed revenue growth of 27% year-over-year, hitting $1.96 billion. That was also $50 million better than expectations. Adjusted earnings-per-share came to 94 cents in Q3, which was four cents better than expected.

As noted above, the company acquired RavenVolt, an electric microgrid company that is focused on helping businesses and governments achieve sustainability goals. This acquisition is a bit outside of ABM’s typical acquisition in that it isn’t a service provider.

Overall, ABM’s growth is likely to be moderate as the economy normalizes. We expect 5% annual earnings-per-share growth over the next five years.

Competitive Advantages & Recession Performance

ABM’s competitive advantage is its size and the resultant economies of scale it enjoys. It has a 100+ year history of providing facility solutions for a wide array of customers and that expertise is what sets ABM apart. It is a true industry leader in the facilities management space and that affords it not only the ability to more easily attract new clients but also to expand relationships with the ones it already has.

In addition, since ABM operates in low-margin businesses, smaller competitors are at a disadvantage in terms of leveraging down back office and support costs. ABM may be in some competitive lines of work but it is certainly better positioned than its competitors to overcome some of those obstacles.

ABM Industries is one of the biggest companies in its industry, and its history of making acquisitions has enhanced its scale advantages further. It is likely that ABM Industries will continue to make acquisitions to increase its size further.

Recessions are painful for ABM just like any other company, but its performance during the Great Recession was remarkable. ABM’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.99

- 2008 earnings-per-share of $1.10 (11% increase)

- 2009 earnings-per-share of $1.33 (21% increase)

- 2010 earnings-per-share of $1.34 (0.7% increase)

Impressively, ABM grew earnings-per-share in each year of the Great Recession. Very few companies were able to accomplish this. Moreover, ABM has proved once again its resilient nature in the coronavirus pandemic.

Thanks to an increase in high-margin work orders from resilient customers, ABM has easily offset the effect of the pandemic on its customers in the aviation industry and education. As a result, it is poised to grow its earnings per share to an all-time high level this year.

Overall, ABM enjoys thin operating margins and lackluster growth rates during normal economic times but it is exceptionally resilient during rough economic periods.

This resilience is very important, as it supports the long-term returns of the stock and makes it easier for the shareholders to retain the stock during broad market sell-offs.

Valuation & Expected Returns

ABM is expected to generate record earnings-per-share of $3.60 in its fiscal 2022. As a result, the stock is currently trading at a price-to-earnings ratio of just 10.8. This is significantly lower than the average price-to-earnings ratio of ~17.5 for the stock in the past 10 years. We consider 16 times earnings to be a reasonable estimate of fair value for this stock.

ABM’s valuation has plummeted throughout 2022, and the stock is as cheap as it has been at any point in the past decade. If the stock trades at our assumed fair valuation level in five years, it will generate 8.3% annualized returns thanks to the expansion of its earnings multiple.

Moreover, the stock is offering a 2% dividend yield. This yield is somewhat higher than the yield of the S&P 500 but it is still a relatively low yield.

In addition, recent dividend raises have been very small, with typical increases in the 2% or 3% range. While ABM has an impressive history of paying dividends, it lacks both a high current yield and a high dividend growth rate.

Lastly, we expect annual EPS growth of 5.0% over the next five years. Combined with a 2% dividend and an 8.3% annualized expansion of the price-to-earnings ratio, total annual returns could approach 15% per year.

Final Thoughts

ABM is certainly not a high-yield income stock, nor is it a high dividend growth stock. But what it lacks in excitement, it makes up for with consistency. ABM’s long and impressive history of paying a dividend should be respected, as the Dividend Kings are rare in comparison to the thousands of publicly-traded stocks in the market.

ABM’s organic growth is intact, and acquisitions add to growth. Growth from here depends upon potential international expansion as well as continued margin gains. In addition, the company has the relatively new tailwind of share repurchases.

With a very cheap valuation and reasonable growth ahead, total annual returns could be strong at 15% annually through the next five years. ABM is a buy due to its high expected return, and long history of dividend increases.

More By This Author:

Dividend Kings In Focus: Genuine Parts Company Update

Dividend Kings In Focus: Lowe’s Companies Update

Dividend Kings In Focus: Commerce Bancshares