Dividend Aristocrats In Focus: Nordson Corporation

Each year, we individually review each of the Dividend Aristocrats, a group of 68 stocks in the S&P 500 Index that has raised their dividends for at least 25 consecutive years.

To make it on the list of Dividend Aristocrats, a company must possess a profitable business model with a valuable brand, global competitive advantages, and the ability to withstand recessions. This is why Dividend Aristocrats can continue to raise their dividends in difficult years.

With this in mind, we have created a list of all 68 Dividend Aristocrats.

One of the three newest members to join this list is Nordson Corporation (NDSN). Nordson has an incredible dividend growth track record, with a remarkable 59 years of consecutive increases.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.

Today the company has operations in over 35 countries and engineers manufacture and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

The $13.5 billion market capitalization company generated $2.6 billion in sales for fiscal 2022.

Source: Investor Presentation

Nordson released the fourth quarter and fiscal year 2022 results on December 14th, 2022. Sales for the quarter were $684 million, a 14% increase over Q4 2021, led by organic volume growth of 18% and a positive acquisition impact, which was somewhat offset by negative currency effects.

Sales increased by 13%, 11%, and 21%, respectively, in the industrial precision solutions, medical and fluid solutions, and advanced technology solutions segments.

The company generated $2.44 per diluted share; a 30% increase compared to the same prior year period.

Nordson produced adjusted earnings-per-share of $9.43 for the entire fiscal year 2022, a 22% improvement over fiscal 2021’s adjusted earnings-per-share of $7.74.

The company is beginning fiscal 2023 with a $1 billion backlog, which includes the CyberOptics backlog. Management believes Nordson can deliver 1% to 7% sales growth in fiscal 2023 compared to fiscal 2022.

Additionally, fiscal 2023 earnings per share are estimated to be $8.75 to $10.10, for a midpoint of $9.43, consistent with 2022 figures.

Growth Prospects

Nordson has a solid track record, having grown earnings-per-share by almost 12% annually from 2013 through 2022.

In its investment thesis, Nordson lists factors such as best-in-class technology that boosts client production while cutting costs, a worldwide service model, a balanced income stream, and a successful track record.

Growing demand for disposable goods, productivity investments, mobile computing, an increase in the use of medical devices, and the production of lightweight/lean vehicles are all areas of growth for the company’s adhesive and coating sectors and would add to the company’s top line.

Additionally. Nordson will continue to deploy capital into research & development to create new products and improve existing ones, as well as increase capacity. And Nordson will keep making acquisitions where it can gain access to unique precision technologies and strengthen its competitive advantage.

Source: Investor Presentation

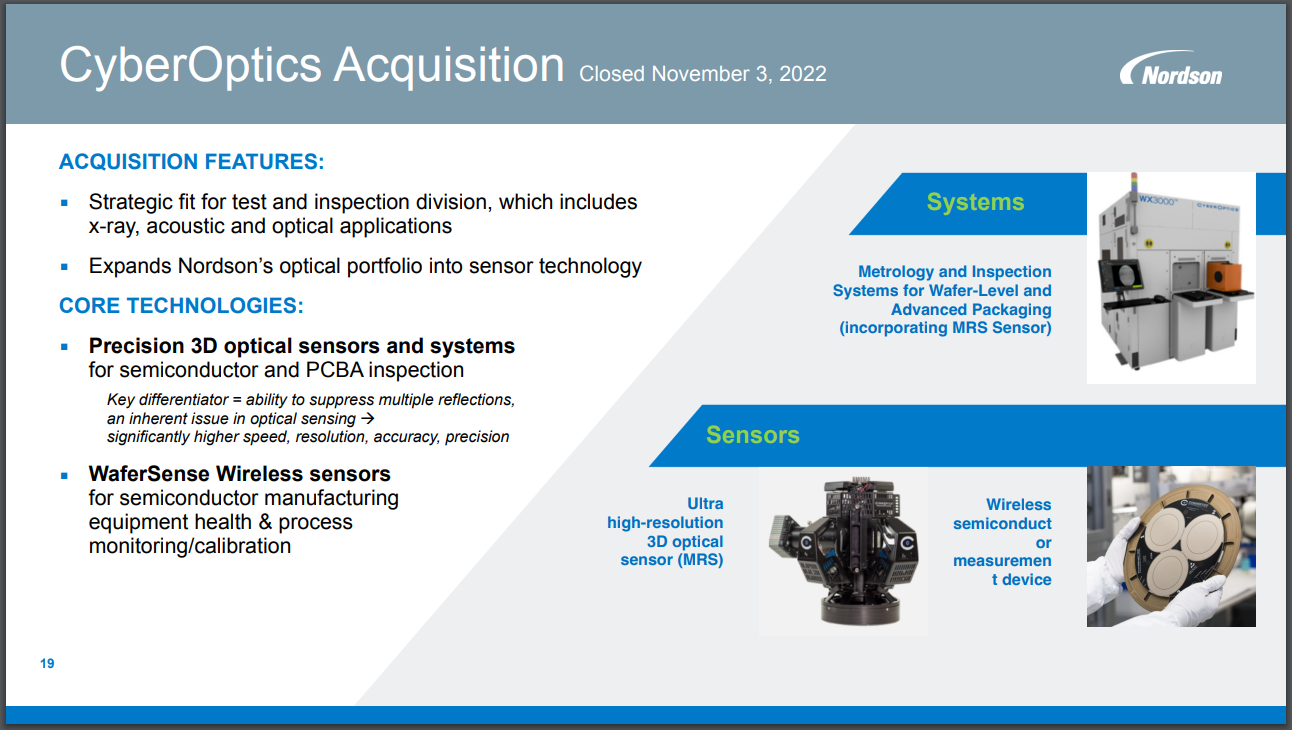

For example, Nordson extended its foothold in the semiconductor and electronics sectors by purchasing CyberOptics Corporation. The company was acquired by Nordson on November 3rd, 2022, and is a global developer and manufacturer of high-precision 3D optical sensing technology solutions.

Our projection for 2023 earnings, based on management’s guidance midpoint, is $9.43 per share.

We also project 4.0% growth beyond 2023 forecasts, driven by an increase in top-line revenue, modest margin expansion, and the favorable effects of acquisitions.

Competitive Advantages & Recession Performance

The competitive advantage for Nordson lies in its proprietary precision technologies. The business offers specialized and essential components used in various manufacturing processes.

This has enabled Nordson to muster an enormous installed base of customers spread all over the world. Due to its extensive global presence, Nordson has been able to diversify its revenue both geographically and by industry and segment.

Source: Investor Presentation

However, this does not imply that Nordson is immune to economic downturns. Earnings decreased by -32% for the year during the Great Financial Crisis before rapidly increasing. Given the company’s reliance on global expansion, another recession could reduce its projections for near-term growth.

Earnings-per-share took a tumble during the coronavirus pandemic, falling 6.6% on the year. However, earnings-per-share went on to grow by 41% in 2021 and 22% in 2022. Using guidance for the year, it is clear that management is expecting earnings-per-share to remain roughly flat in 2023.

Valuation & Expected Returns

Nordson’s current price-to-earnings ratio is 24.9 based on our 2022 forecasted earnings-per-share of $9.43. This valuation is slightly elevated compared to the company’s trailing decade average P/E ratio of about 23.0. We believe that 22.5 times earnings is a reasonable fair value estimate for Nordson given its solid prospects.

Nordson experienced periods of cyclicality in its valuation, ranging from 17.0 times earnings to 31.6 times earnings over the last decade. Given shares trade above our fair value estimate today, Nordson stock could experience losses of roughly 1.6% per year over the next five years.

Nordson also sports only a small 1.1% dividend yield, which is below the average of the S&P 500 Index. However, this dividend has increased every year for 59 years, an incredible accomplishment by Nordson. Furthermore, we forecast a payout ratio of only 28% for 2023, leaving ample room for continued increases in the years ahead.

Combining the company’s 1.1% dividend yield with the 4.0% forecasted growth rate, and the potential valuation headwind, we see Nordson stock generating total returns of 3.6% per year in the intermediate term. As a result, Nordson receives a hold rating at this time.

Final Thoughts

The company’s growth prospects seem promising, and Nordson has an impressive track record in terms of earnings and dividends in the past. However, the company is currently trading at a high level, which reduces the attractiveness of the stock.

The company may continue its incredible earnings-per-share growth this year, or it may take a breather and remain flat. However, we believe Nordson will continue growing over the long term. This long-term earnings growth, coupled with the very conservative dividend payout ratio, should see the company increasing its dividend for many more years ahead.

More By This Author:

Dividend Aristocrats In Focus: C.H. Robinson WorldwideDividend Aristocrats In Focus: The J.M. Smucker Company

Dividend Kings In Focus: S&P Global

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more