Dividend Aristocrats In Focus: Eversource Energy

Image Source: Pixabay

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

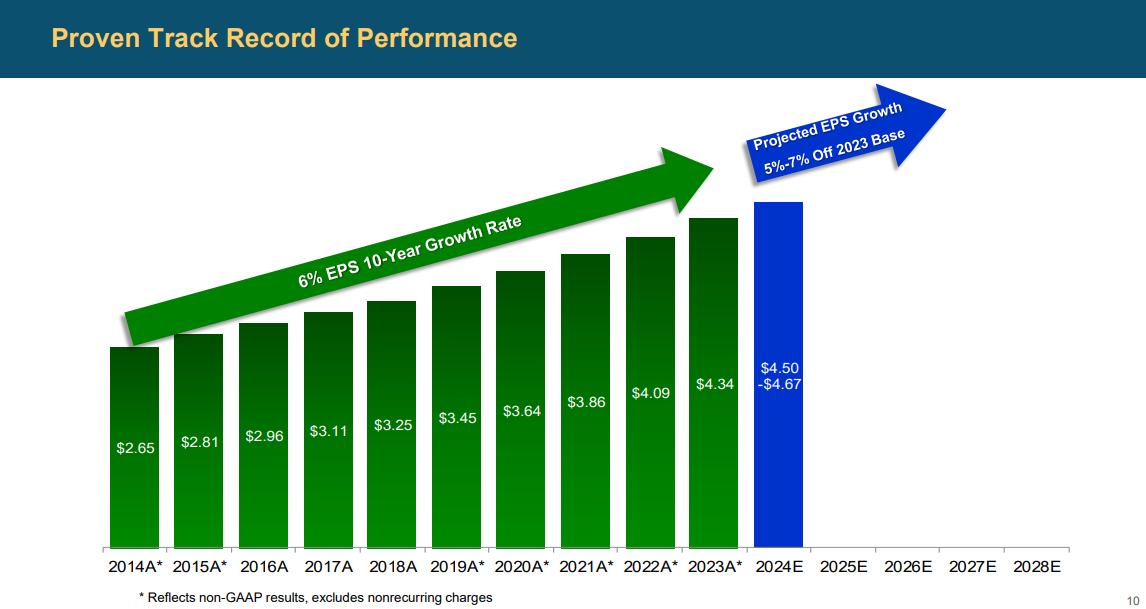

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On November 4th, 2024, Eversource Energy released its third-quarter 2024 results for the period ending September 30th, 2024.

For the quarter, the company reported a net loss of $(118.1) million, a sharp decline from earnings of $339.7 million in the same quarter of last year, which reflects the impact of the company’s exit from offshore wind investments.

The company reported a loss per share of $(0.33), compared with earnings-per-share of $0.97 in the prior year.

Earnings from the Electric Transmission segment increased to $174.9 million, up from $160.3 million in the prior year, primarily due to a higher level of investment in Eversource’s electric transmission system.

Growth Prospects

Eversource’s long-term earnings growth track record is solid, growing EPS nearly every year since 2012. Over the last 10 years, the average EPS growth rate is almost 6%.

We expect the company to grow its earnings-per-share by 6% per year on average over the next five years. The company has a good earnings track record and will benefit from rate hikes, transmission investments, and clean energy initiatives.

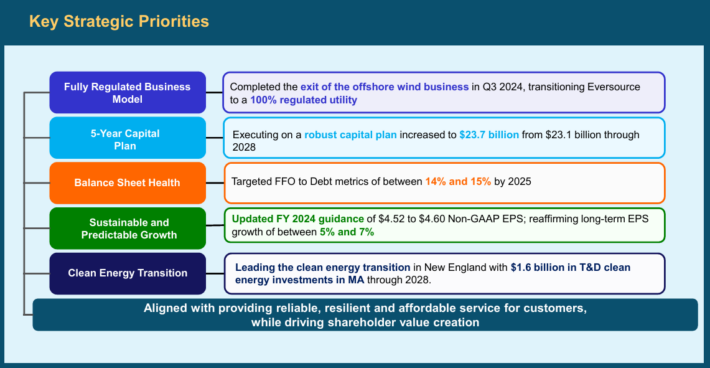

Eversource Energy continues to progress towards its updated investment goal of $23.7 billion in various projects, including transmission and electric distribution, during the 2024 to 2028 time frame.

Source: Investor Presentation

Earlier in the year, Eversource and Ørsted’s South Fork Wind farm became the first operational commercial-scale offshore wind facility in the U.S., but Eversource has since exited its offshore wind investment, refocusing as a pure-play regulated utility.

The company’s earnings-per-share growth ambition remains on a pace of 5% to 7% compound annual rate from 2023 through 2028, consistent with its dividend growth expectations.

We expect Eversource to grow its earnings-per-share by 6% per year over the next five years.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. In February 2024, the quarterly dividend increased by 5.9% from $0. 6750 to $0.7150 per share.

Over the last five years, the average annual dividend growth rate is 6.0%. Eversource’s target for yearly dividend growth is 5% to 7%.

Competitive Advantages & Recession Performance

As a utility stock, Eversource benefits from operating in a highly stable and regulated industry, meaning earnings are more consistent and predictable.

This also allows the company to be recession-resistant, and continue to increase its dividend each year, even during recessions.

Eversource’s earnings-per-share during the Great Recession are below:

- 2008 earnings-per-share of $1.67

- 2009 earnings-per-share of $1.91 (14% growth)

- 2010 earnings-per-share of $2.19 (15% growth)

During the past five years, the company’s dividend payout ratio has averaged around 64%. The company has a projected 2024 payout ratio of 63%, which indicates a sustainable dividend.

Given the expected earnings growth, there is still room for the dividend to continue to grow at the same pace and extend the track record of consecutive dividend increases which is an important factor for dividend growth investors.

Valuation & Expected Returns

Based on expected 2024 earnings-per-share of $4.55, ES shares are currently trading for a P/E ratio of 12.9. During the past decade shares of Eversource Energy have traded with an average price-to-earnings ratio of about 20.

This is also our fair value estimate for ES stock.

As a result, ES stock looks significantly undervalued today. If the valuation multiple expands to 20 over the next five years, shareholder returns would be increased by 9.2% per year over that period.

Shareholder returns would be positively boosted by earnings-per-share growth and dividends. We expect ES to generate earnings-per-share growth of 6% per year.

Next, shares are currently yielding 4.9%. Putting it all together, total returns are expected at 20.1% per year. With such high expected returns, we rate ES stock a buy.

Final Thoughts

Eversource Energy is a steady company in terms of its earnings growth track record, its earnings growth outlook, dividend growth, and its infrastructure investments related to the net-zero carbon emission target of 2030.

The company’s dividend yield is generous, and the 26 years of consecutive dividend increases is noteworthy.

We estimate a total return of 18.2% based on a 6.0% EPS growth, a 4.7% yield, and a valuation tailwind. ES shares earn a buy rating.

These qualities make Eversource Energy an ideal retirement investment stock.

More By This Author:

Dividend Aristocrats In Focus: Erie Indemnity Company3 Top Notch Dividend Stocks To Hold Forever

10 Rock Solid Dividend Stocks For Decades Of Rising Income

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more