Dividend Aristocrats In Focus: Chubb Ltd.

Only companies with at least 25 years of dividend growth can claim the mantle of a Dividend Aristocrat. This club is so exclusive that there were only 53 such companies at the end of 2018.

Four new companies joined this group in 2019, one of which was Chubb Ltd. (CB).

Chubb is a global provider of insurance and reinsurance services. The company is headquartered in Zurich, Switzerland. The stock currently yields 2.2%, which is a slightly-above-average yield as the S&P 500 Index on average yields 2%. However, after accounting for dividend withholding taxes, Chubb has a more modest 1.4% dividend yield.

Still, Chubb is a high-quality business, with growth potential in the U.S. and the international markets, as well as a strong balance sheet and a steadily-rising dividend.

Business Overview

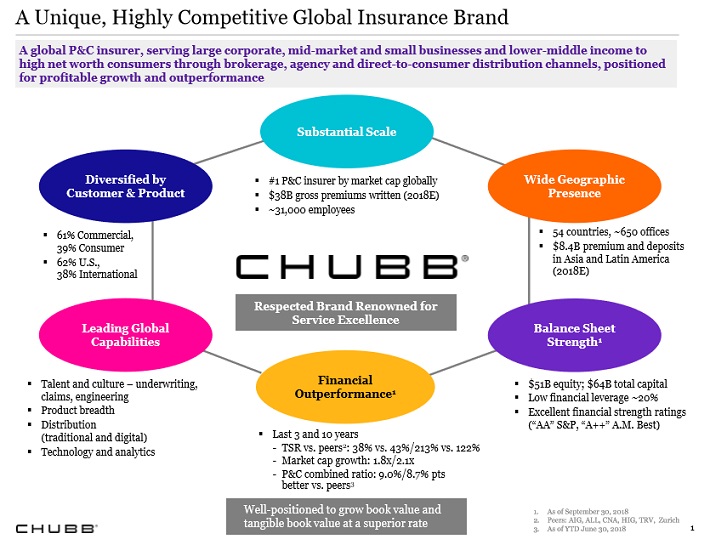

Chubb Ltd is a global provider of insurance and reinsurance services headquartered in Zurich, Switzerland. The company has operations in 54 countries and territories. Chubb provides insurance services including property & casualty insurance, accident & health insurance, life insurance, and reinsurance.

Source: Investor Presentation

The current version of Chubb was created in 2016 when Ace Limited acquired the ‘old’ Chubb and adopted its name. U.S. investors can initiate an ownership position in Chubb through shares listed on the New York Stock Exchange under the stock symbol CB.

Chubb reported (10/23/18) financial results for the third quarter of fiscal 2018 in late October. In the quarter, the company’s most widely-cited profitability metric (core operating income excluding catastrophic losses) increased by 2.9% versus the same quarter a year ago. Chubb’s book value per share grew 0.4% versus the second quarter of 2018. Importantly, Chubb’s combined ratio in the quarter was 90.9%, showing very profitable underwriting activity.

Chubb’s product offerings include property & casualty insurance, accident & health insurance, insurance and reinsurance. The previous incarnation of Chubb was purchased by Ace Limited in 2016. Ace Limited then adopted the Chubb name. Chubb has a current market cap of $61 billion.

Growth Prospects

Chubb’s earnings-per-share have barely moved over the past ten years. The company earned $8.89 per share in 2017, which was a very small improvement from 2008’s $7.72 total.

That said, Chubb has created significant value for shareholders in terms of book value per share, an important metric for insurance companies. Over the last 10 years, the company’s book value grew at a CAGR of 11%. We expect Chubb’s book value per share to grow 4.2% to $115 for fiscal 2018.

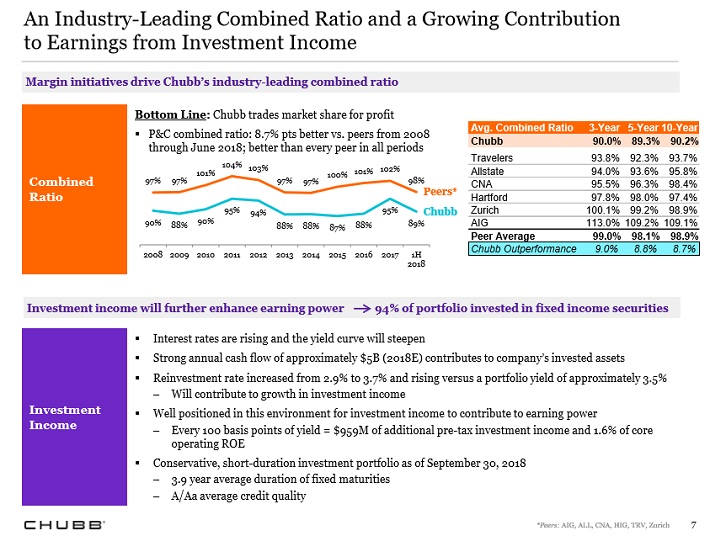

Chubb compares favorably in terms of profitability to many of its peers. The company’s combined ratio for the first half of 2018 was 89% with peers averaging 98%. In fact, Chubb has outperformed its peers on this metric over the past three, five and ten years. The company has beaten its peers by ~9% for each period of time.

We also expect Chubb to generate strong earnings growth over the next five years, due to multiple factors. Chubb will benefit from new policies, price increases, and rising interest rates.

Source: Investor Presentation

First, Chubb’s net premiums written increased 4.6% over the first nine months of 2018, which indicates strong demand for policies. The company also has a leading industry position across its product categories, which gives it the ability to raise prices to boost revenue growth.

In addition, rising interest rates will also help boost profits by growing investment income. The Federal Reserve raised interest rates four times last year, and could hike rates at least twice in 2019. This would be a growth tailwind for all insurance companies with large investment portfolios, including Chubb.

As an insurance company, Chubb has a large pool of accumulated premium income that has not been paid out in claims to customers. This is known as float. Insurers invest premiums as soon as they are collected, to earn addition interest or other income. Chubb had an investment portfolio of $101 billion at the end of the most recent quarter, invested primarily in investment-grade fixed income securities. Rising interest rates will boost fixed income yields, and will naturally help Chubb’s earnings growth.

Chubb can also generate earnings growth through share buybacks, which reduce shares outstanding and help increase the earnings-per-share calculation. In November, Chubb authorized a new $1.5 billion share repurchase program. The authorization will be completed in the current year, and represents approximately 2.5% of the company’s current market capitalization.

Overall, we expect Chubb to grow earnings-per-share by 8% per year over the next five years.

Competitive Advantages & Recession Performance

Chubb’s competitive advantages are its leading industry position, as well as its financial strength. First, Chubb is the world’s largest publicly traded property and casualty insurance company, and the largest commercial insurer in the United States. It has a dominant position across its product categories, which helps it to retain customers.

It is also in strong financial position. Chubb is rated AA from Standard & Poor’s, AA from Fitch, and Aa3 from Moody’s, the three major U.S. credit ratings agencies. A healthy balance sheet and high credit rating provides the company with the financial security necessary to retain clients and invest for growth.

Chubb is also a fairly diversified company, with roughly two-thirds of net premiums written occurring in North America. The remainder of net premiums written are spread out across 51 other countries, making Chubb a global business. This competitive advantage provides Chubb with growth potential in the international markets.

The insurance industry can be incredibly cyclical. As the economy strengths, people tend to have more discretionary capital that can be used add to their insurance policies. As the economy weakens, customers may decide to pullback on their spending. This occurred during the last recession for Chubb.

- 2007 earnings-per-share of $8.07

- 2008 earnings-per-share of $7.72 (4.3% decline)

- 2009 earnings-per-share of $8.17% (5.8% increase)

- 2010 earnings-per-share of $7.79 (4.7% decrease)

- 2011 earnings-per-share of $6.96 (10.7% decrease)

Although Chubb didn’t see quite the profit declines that other financial firms, earnings-per-share did experience some variability. As noted above, earnings-per-share results for 2017 were less than 4% above 2008’s total. However, Chubb remained highly profitable during the Great Recession, which allowed it to continue raising its dividend even through the steep economic downturn.

While earnings-per-share haven’t grown much in the last decade, the company’s book value has increased every year since 2008. The only exception was 2015. We expect that book value will continue to grow in the coming years but at the slightly slower than average rate of 8% per year.

Valuation & Expected Returns

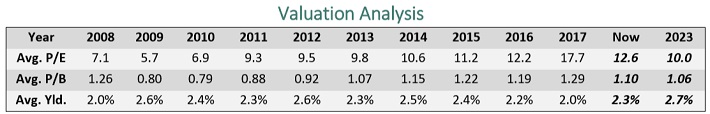

Using Chubb’s most recent closing price of $132 and expected earnings-per-share of $10.50 for 2018, the stock has a price-to-earnings ratio of 12.5. The average price-to-earnings ratio for the S&P 500 is 20.4, making Chubb undervalued against the market index. On the other hand, Chubb has a ten-year average price-to-earnings ratio of 10 so the current valuation is well above its historical average.

You can see a detailed view of Chubb’s historical valuation multiples in the table below:

We believe that valuing Chubb solely through the lens of earnings-per-share does not paint the full picture of the company’s worth. In addition to earnings-per-share, investors should also consider book value per share when performing valuation on insurance companies.

When using expected book value of $115 for 2018, Chubb has price-to-book ratio of 1.15. The stock has an average price-to-book ratio of 1.06 over the last decade. If shares were to revert to this average value by 2023, investors would see total returns reduced by 1.6% per year.

Chubb can generate returns from book value growth and dividends as well. A breakdown of total returns is as follows:

- 8% book value growth

- 1.6% book value multiple reversion

- 1.4% yield

From these values, we forecast that investors can expect 7.8% annual returns over the next five years. This is a satisfactory rate of return for a high-quality company, although investors can find better buying opportunities among the Dividend Aristocrats.

Final Thoughts

While Chubb is a well managed, diversified insurance company with a long history of growing book value, we find that the total projected return to be below other companies in the insurance industry. We would encourage investors looking to enter the insurance sector to either seek out other investment opportunities or wait for Chubb to pullback before purchasing shares.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more