Dividend Aristocrats In Focus: Atmos Energy

The list of Dividend Aristocrats is diversified across multiple sectors, including consumer goods, financials, industrials, and healthcare. One group that is surprisingly under-represented, is the utility sector. There are only two utility stocks on the list of Dividend Aristocrats: Consolidated Edison (ED) and 2020 addition Atmos Energy (ATO).

The fact that there are only two utilities on the list may come as a surprise, especially since utilities are widely regarded as being steady dividend stocks. This article will discuss Atmos Energy’s path to becoming a Dividend Aristocrat.

Business Overview

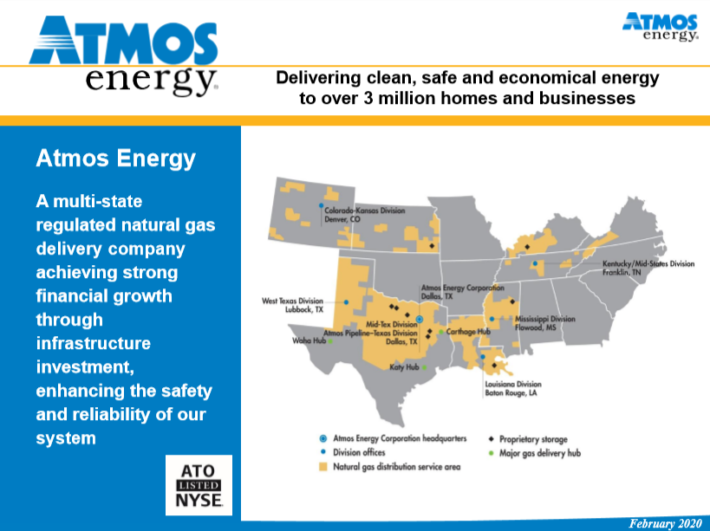

Atmos Energy is a large-cap utility. The company generates approximately $3.5 billion in annual revenue and has a market capitalization of nearly $14.5 billion.

The company serves over 3 million natural gas customers spread across eight different states.

Source: Investor Presentation

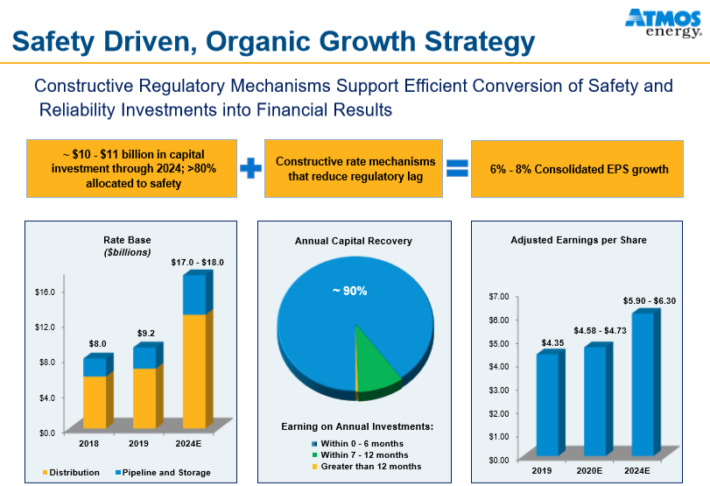

Atmos reported first-quarter earnings on 2/5/20 and results were very strong as earnings per share surged to $1.47 against $1.38 in the year-ago period. The company also expects earnings per share growth to remain strong (6%-8% annualized) through 2024.

Growth Prospects

Earnings growth across the utility industry typically mimics GDP growth. However, we expect Atmos Energy to continue outperforming this trend as low gas prices will allow the company to continue accelerating its capital investments with limited interference from regulators. As a result, the company should benefit from strong rate base growth which in turn will generate annual earnings per share growth in accordance with management’s 6%-8% guidance.

The growth drivers for Atmos Energy are new customers, rate increases, and aggressive growth capital expenditures. One benefit of operating in a regulated industry is that utilities are permitted to raise rates on a regular basis, which virtually assures a steady level of growth.

Source: Investor Presentation

The primary risk facing the company is its ability to achieve timely and positive regulatory rate adjustments. If the company achieved lower than expected allowed returns, especially in Texas which is its largest service territory, it could cause significant harm to profits.

However, since the majority of Atmos’ assets are regulated by the Texas Railroad Commission – a shareholder-friendly regulatory body given Texas’ strong pro-business political climate – the risks to company earnings and dividend per share growth are fairly minimal, making it a safe income stock.

Competitive Advantages & Recession Performance

Atmos Energy’s main competitive advantage is the high regulatory hurdles of the utility industry. Gas service is necessary and vital to society. As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides a great deal of certainty to Atmos Energy and its annual earnings.

Another competitive advantage is the company’s stable business model and sound balance sheet, giving it an attractive cost of capital. This enables it to fund accretive acquisitions and growth capital expenditures, driving outsized earnings per share growth.

In addition, the utility business model is highly recession-resistant. While many companies experienced large earnings declines in 2008 and 2009, Atmos Energy’s earnings per share kept growing. Earnings-per-share during the Great Recession are shown below:

- 2007 earnings-per-share of $1.91

- 2008 earnings-per-share of $1.99 (4% growth)

- 2009 earnings-per-share of $2.07 (4% growth)

- 2010 earnings-per-share of $2.20 (6% growth)

The company still generated healthy growth even during the worst of the economic downturn. This resilience allowed Atmos Energy to continue increasing its dividend each year.

Valuation & Expected Returns

Atmos Energy is expected to earn $4.65 this year. Using the current share price of $118 and the midpoint of updated guidance, the stock trades with a price-to-earnings ratio of 25. This is well above our fair value estimate of 16, which is equal to the 10-year average price-to-earnings ratio for the stock.

As a result, Atmos Energy shares appear to be significantly overvalued. If the stock valuation retraces to the fair value estimate, the corresponding multiple contraction would reduce annual returns by 8.5%. This could be a significant headwind for future returns.

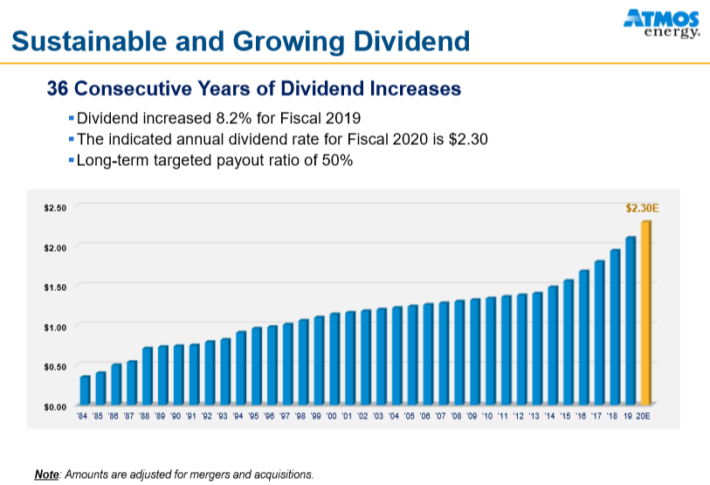

Fortunately, the stock could still provide positive returns to shareholders, through earnings growth and dividends. We expect the company to grow earnings by 6% per year over the next five years. In addition, the stock has a current dividend yield of 1.8%. Consolidated Edison last raised its dividend by 9.5% in November 2019. This marks the 36th year of dividend growth.

Source: Investor Presentation

Atmos Energy’s inclusion to the Dividend Aristocrats list is based on the fact that the company joined the S&P 500 Index last year, replacing Newfield Exploration Co. which was acquired.

Putting it all together, Atmos Energy’s total expected returns could look like the following:

- 6% earnings growth

- -8.5% multiple reversion

- 1.8% dividend yield

Added up, Atmos Energy is expected to generate negative annualized total returns over the next five years, making the stock unattractive for investors interested in total returns.

Income investors will also find the yield attractive, though the growth and reliability of payouts makes it like an inflation resistant bond. The company has a projected 2020 payout ratio of ~50%, which indicates a sustainable dividend.

Final Thoughts

Atmos Energy stock is overvalued currently, making it relatively unattractive for value investors today. The run-up in utility stocks over the past several years has far exceeded their earnings growth in the same period, resulting in bloated valuation multiples across the utility sector.

That said, Atmos Energy can still serve a valuable purpose in an income investor’s portfolio as the stock offers a very secure and rapidly growing dividend income stream, and its dividend yield is roughly level with the average dividend yield of the S&P 500 Index.

Atmos Energy is also a Dividend Aristocrat and should raise its dividend each year. Therefore, risk-averse investors looking primarily for income right now–such as retirees–could see greater value in buying utility stocks like Atmos Energy.

That said, shares are quite expensive at the moment. With a very low expected rate of return, Atmos Energy gets a sell recommendation from Sure Dividend.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more