Disney: The Magic Is Still There At This Entertainment Giant

Image Source: Pixabay

Each week, I try to cover one-to-two companies I have discussed in previous podcasts or videocasts – or we own for clients. Walt Disney Co. (DIS) results show the magic’s still there, advises Tom Hayes, editor of HedgeFundTips.

First, the turbocharged investment in Experiences and $30 billion in domestic parks has led to more expansion projects underway globally than at any point in Disney’s history. Return on invested capital for the segment is at record highs as land development continues to boost capacity.

Second, management sees the upcoming 18-month film slate as the strongest since 2019, which was Disney’s best year on record. Major releases include Lilo & Stitch, The Fantastic Four, Zootopia 2, and Avatar: Fire and Ash, with 2026 featuring Avengers, The Mandalorian, Toy Story, and a Moana live-action film.

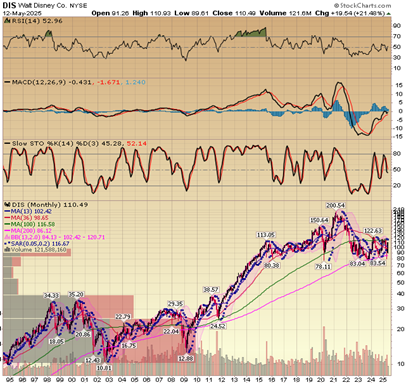

Looking back at 2019, Disney had six films top $1 billion globally and set a record $11.12 billion at the global box office. If the next year-and-a-half delivers anything close, Disney stock will be back to all-time highs.

Third, Disney continues to lean into its high-margin, accretive cruise business, which is expected to be a major growth driver in the years ahead. The newly launched Disney Treasure is in its second quarter of operations and seeing strong demand. Two more ships will join the fleet later this year, with the Singapore-based ship selling out its first quarter of bookings in just days.

Fourth, streaming remains a core growth driver for the company, delivering 8% year-over-year top-line growth to $6.12 billion, while profitability continues to improve. Entertainment DTC operating income reached $336 million (5.5% margins), up from just $47 million in the prior year.

The long-term goal is to achieve strong double-digit DTC margins. The quarter ended with over 180 million Disney+ and Hulu subscribers, marking a sequential increase of 2.5 million, with modest subscriber growth expected in Q3.

About the Author

Thomas J. Hayes is the founder, chairman, and managing member of Great Hill Capital, LLC (a long/short equity manager based in New York City). Before starting his own firm, Mr. Hayes worked with Cornwall Capital, LP (one of the firms featured in The Big Short book and movie).

On a weekly basis, he publishes his timely stock market commentary, Hedge Fund Tips with Tom Hayes videocast and podcast. He has a wide following in the investment management, hedge fund, and media community.

More By This Author:

All In On Mag 7? Look Beyond US Borders InsteadHow Are Trump's Tariffs Impacting Commodities

J.M. Smucker: A Consumer Staples Standout With An Attractive Yield

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more