Digital Coupon Leader Quotient Turning The Corner

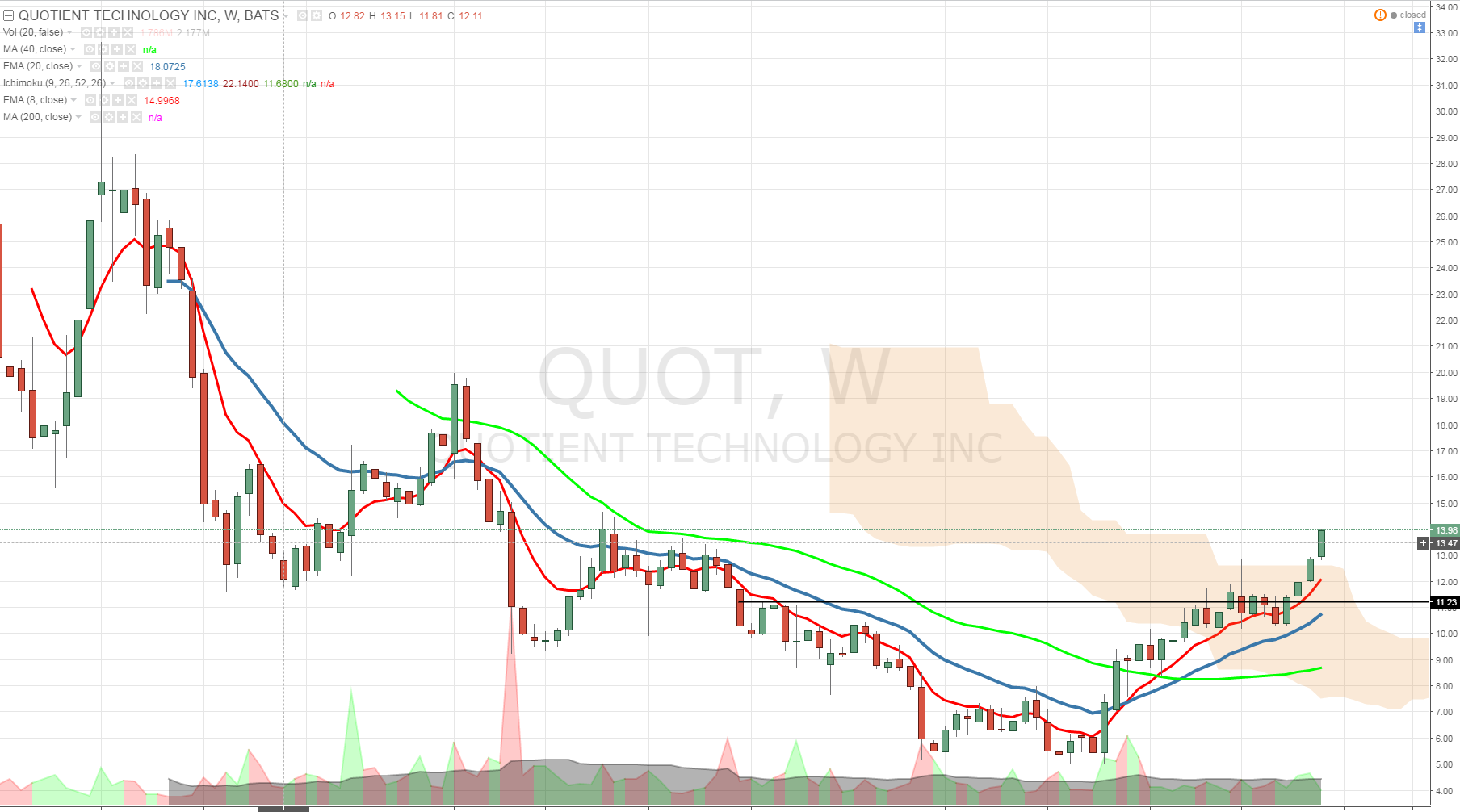

Quotient Tech (QUOT) is an under the radar $1.09B growth name in Tech that provides digital promotions that connect brands and retailers with consumers via digital coupons, coupon codes, and media/advertising. QUOT shares came public in March of 2014 trading above $30 and trended lower the next two years hitting $5/share in February of 2016. Shares have recently seen a resurgence jumping to $13.50 and doing so on above average volume accumulation, clearing the 2 year downtrend with the move above $10 in late March. QUOT is also seeing its business turnaround posting its best growth in 5 quarters in its latest report.

The Company owns properties such as Coupons.com, Grocery iQ, and Shopmium as well as ~ 30,000 website publishers. QUOT is capitalizing on the trend of lower newspaper circulation to households with a shift to digital. Its technology benefits the Retailers offering targeting capability, short integration times, monetization via suppliers and real time data on transaction and customer behavior. Its Retailer iQ product has shown strong early results resulting in 50% shopper basket growth for program users.

QUOT shares trade 55.8X Earnings, 4.4X Sales, and 7.3X Cash with no debt. A better valuation technique for a small tech growth company such as QUOT is EV/Sales, and shares trade just 3.2X FY17 EV/Sales, while we have seen 6X multiples in many recent M&A deals. Last quarter QUOT only posted an 8% revenue growth with promotions +5% and media +17%. QUOT has operated with a 35% CAGR since 2011. QUOT is set to become EBITDA positive in FY16 and by 2020 grow EBITA more than 300% with EBITDA margins rising from current levels near 0% to 16%.

The closest comparable to QUOT are RetailMeNot (SALE) and Groupon (GRPN). SALE may be another pure value to look at trading just 1.9X FY17 EV/Sales and 1.47X cash value with minimal debt. SALE also beat estimates last quarter and seems to be turning a corner if it can up its presence in mobile. Although cheaper on valuation, SALE does not have as positive of a forward growth outlook for EBITDA or Revenues.

Analysts have an average target on QUOT shares of $13.25 with 3 Buys and 3 Holds. Maxim started coverage on 6-16 with a Hold rating seeing shares full valued for the long-term growth potential. William Blair upgraded shares to Outperform on 5-4 seeing upside potential to $17, seeing the business turning a corner. Short interest is at 12.4% of the float, but declining steadily since peaking at 27.5% in September of 2015, and short interest down 35% just since the beginning of March.

After the recent surge in shares QUOT is not as attractive, but on a move back down to $11.50 it makes for an interesting investment as its new products should accelerate growth allowing it to trade at a higher multiple. With a strong balance sheet and overall strong presence in a space seeing more and more adoption by consumers, it makes QUOT a potential long term investment.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more

It would be a mistake to own this stock. This stock is burning cash each quarter, increasing the accumulated shareholder deficit. There is no way the high EV/Sales is justified. This firm has no earnings, so your article is wrong to state that $QUOT shares trade 55.8X Earnings. Don't mislead investors. This firm is not even positive on EBITDA, let alone on EPS. The problem is most people just follow a pump and dump line that is going up and that's why its price has been going up.

I disagree and believe $QUOT has value. #Groupon ($GRPN) lost a billion dollars before it eked out a profit yet no one would accuse it of being a pump.