Did You Play Nvidia Earnings Correctly?

Image Source: Pixabay

Nvidia (NVDA) just blew out earnings.

The stock rallied hard.

Were you a bull or a bear? Did you buy calls or puts?

From my perspective, your bias doesn’t matter.

This isn’t about taking risks…it’s about taking calculated risks.

You see, it’s not about playing the game but how to play it.

Let me demonstrate using Nvidia as an example.

The Setup Nobody Wants to Acknowledge

Nvidia has carried this market for two years. When it goes up, the S&P follows. When it stumbles, everything bleeds.

That concentration risk just became a structural problem.

Look at what's brewing beneath the surface. Nvidia has been financing customer purchases. That business model has a terrible track record. It always looks genius during the growth phase.

Until it doesn't.

Insider selling spiked hard last quarter. The people running the company liquidated positions while retail piled in. That's not a bullish signal.

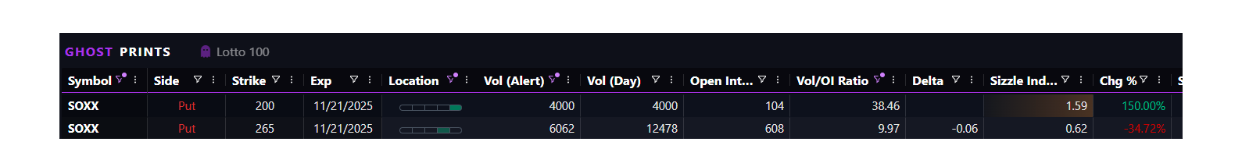

And not just NVDA, we saw a large 12K put buy in the SOXX 21 NOV 25 $265 strike.

This was indicative of hedging or bearish sentiment ahead of NVDA earnings after the close.

The Conversation You Don't Want to Have

Here's what would have happened had Nvidia disappointed and you’d been fully exposed.

Your long positions would have bled. Not just your Nvidia shares if you own them. Your entire tech exposure. Your index funds. Your growth stocks.

The concentration risk that worked in your favor on the way up becomes a wipeout on the way down.

You'll watch your account drop 5%, maybe 8%, in a matter of days. And you'll have to decide whether to sell at a loss or hold and hope it recovers.

That's the conversation with Morris. And it's avoidable.

How to Trade Through Uncertainty

You don't need to predict what Nvidia does. You need to define your risk regardless of the outcome.

A put spread costs you a defined amount and protects your downside. If Nvidia had rallied, you would have lost only the premium. If it collapsed, you'd make money.

A contrarian call spread does the opposite. If you think the fear is overblown, you can position for upside with limited risk.

Either way, you're trading with certainty. You know exactly what you can lose. You know exactly what you can make.

That's what separates systematic traders from gamblers. The gamblers hope. The systematists hedge.

And when you're holding positions through a report that could swing 10% in either direction, hope is expensive.

More By This Author:

Did NVDA Help The Market Find it's Mojo?Healthcare's 60% Surge Changes Everything

Banks Crashed After This Morning Trade