Did Main Street Capital Keep Its Perfect Rating?

Image Source: Pixabay

Last July, I reviewed Main Street Capital (MAIN) for dividend safety. The company received an “A” rating. Now that more than a year has passed, is the dividend just as safe?

Main Street Capital is a business development company, or BDC. It invests in or lends money to privately held companies.

Its portfolio companies include…

- IG Holdings, an 82-year-old company based in Providence, Rhode Island, that designs insignias

- PPL RVs, which has been around since 1972

- Willis Group, which provides staffing and recruitment services and is based in Houston.

When we measure dividend safety for BDCs, we use a metric of cash flow called net interest income, or NII.

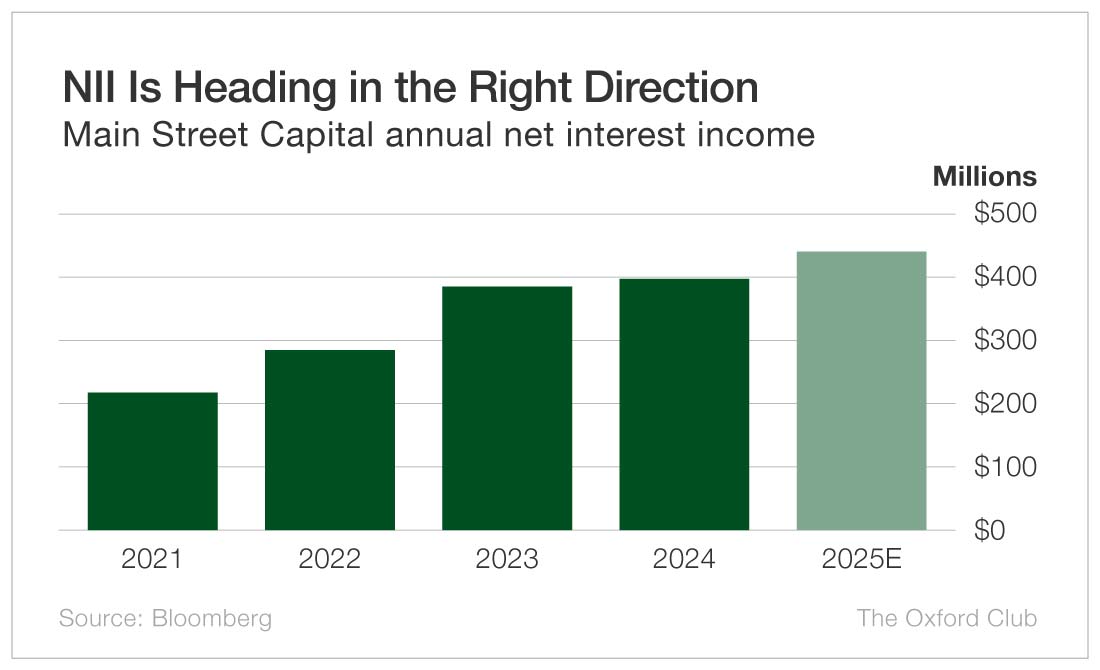

Main Street Capital’s NII has been steadily rising for a number of years.

In 2024, NII rose 3% from $384 million to $395 million. This year, NII is projected to grow 11% to $438 million.

By law, BDCs must pay out 90% of their profits to shareholders in the form of dividends. NII is different from profits, but as a result of that law, BDCs often pay out all or nearly all of their NII in dividends.

For that reason, I’m comfortable with a payout ratio of 100% of NII or lower. If it’s above 100%, the company isn’t generating enough cash flow to pay the dividend. But as long as it’s below 100%, that’s okay.

Last year, Main Street Capital paid shareholders $320 million, or 81% of NII. This year, the forecast is $362 million, which comes out to a safe payout ratio of 83%.

Main Street also continues to pay a special dividend each quarter. For the past two years, the quarterly special dividend was $0.30 per share.

We don’t take into account the special dividend when determining dividend safety, because it is an irregular dividend (even though Main Street has been paying it consistently for a while now).

We only consider the regular dividend, which is $0.255 paid each month. That comes out to a 4.7% yield. Add in the $0.30 special dividend, and the yield climbs to 6.5%.

Main Street has raised the monthly dividend every year since 2011.

Given its stellar dividend-paying track record, steady NII growth, and reasonable payout ratio, Main Street Capital’s dividend remains very safe.

Dividend Safety Rating: A

More By This Author:

Rate Cuts Are Coming… And So Is Inflation

OneMain Financial: A Fresh Look At A Popular 7.3% Yielder

Are Record Stock Buybacks A Good Thing For Investors?