DIA - A Screaming Buy

Summary

DIA is the ticker symbol for the SPDR Dow Jones Industrial Average DJIA ETF. It is a reliable ETF for replicating the performance of the DJIA and has a history of tracking the index accurately.

DJIA is not about to collapse.

Its value relative to price is near its all-time record of July 2016.

The state of irrational pessimism is at the level of sheer terror similar to 2009, 2011, 2013 and 2016.

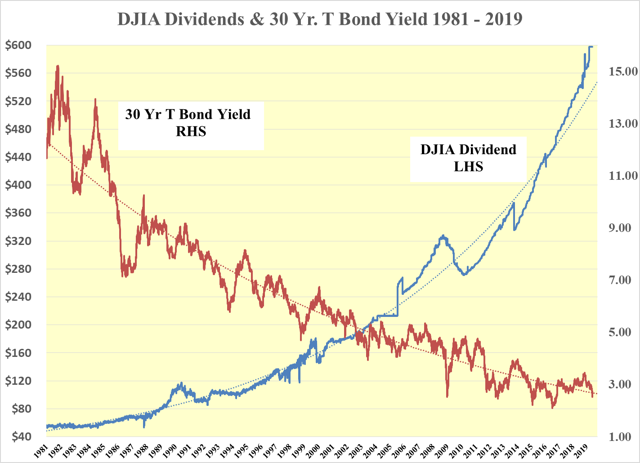

Rising Dividend and falling 30 year T Bond Yield = Potent Profit Formula

The two vectors that determine the dividend discount value of the DJIA are its actual dividend and the yield of the 30 year T bond. A rising dividend pushes up the value of the DJIA as does a falling T bond yield. These positive conditions have both been in effect for the past four decades.

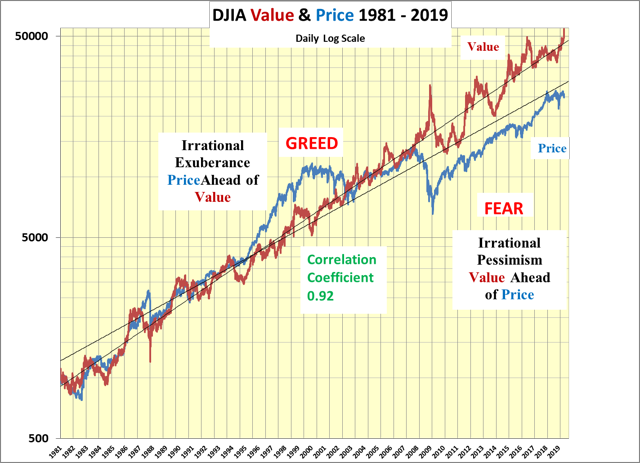

Combining these vectors the following chart shows the dividend discount value in red. Last night it stood at an all-time record of 54.567 as the 30 year T bond yield fell to 2.53%.

The price of the DJIA, shown in blue, has also risen but at 24,820 it is at a 55% discount from its value. As the correlation coefficient between the value and the price of the DJIA is 0.92 the pressure on the price of the DJIA remains decidedly up.

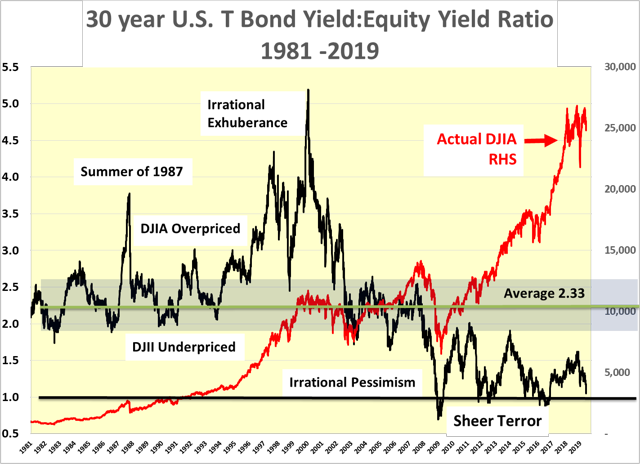

Bond Yield: Equity Yield Ratio Also Screams Buy

Another way of looking at the above is to compare the T Bond-Yield: Equity-Yield Ratio with the price of the DJIA, the red line. Since 2008 the ratio, the black line, has been below the historical average of 2.33. As such the DJIA is considered underpriced relative to its value. Prior to 2008 the ratio was mainly fairly priced except in the summer of 1987 and the latter part of the 1990s during periods of irrational exuberance.

Since Lehman, the bond yield: equity yield ratio has remained underpriced and in a state of irrational pessimism as market participants remained shell shocked from the financial crisis. There have been four occasions when the ratio has fallen to, or below, 1 when sheer terror took over the market psychic. Buying at such times has been greatly rewarded as can be seen from the red line of the actual DJIA.

Indeed, throughout the past decade, the DJIA price has been rising despite continuing irrational pessimism, which remains pervasive. A return of the ratio to the average of 2.33 would result in an advance of the actual price of the DJIA to its dividend discount value of 54.567.

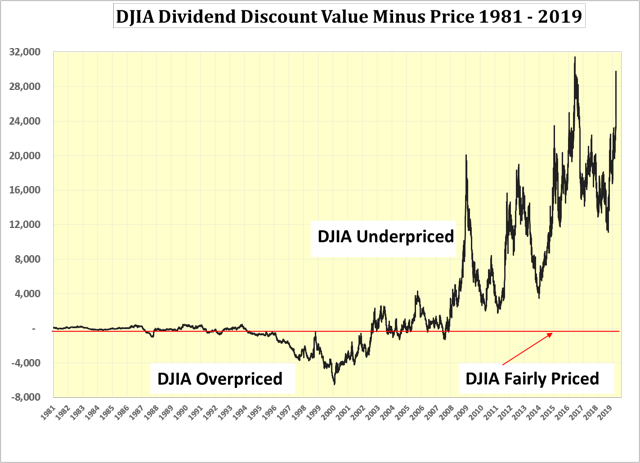

DJIA Dividend Discount Value minus its Price

By way of emphasis, the next chart shows the differential between the value of the DJIA and its price is almost at the all-time high of July 2016 and considerably higher than it was in March 2009 which was another all-time great buying opportunity.

Conclusion

The DIA should be bought now. It is not about to collapse as many bears are expecting and those, who, having missed the market advance since Lehman, are hoping for a further pullback for in order to buy.

Remember the 90% rule:

90% of market participants will miss 90% of the market moves, both up and down, 90% of the time.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not ...

more

Certainly sounds promising.