Dell Stock Beyond The Expectations: Q2 Highlights

Image Source: Unsplash

Dell Stock: Strong Q2 Results and Record-Breaking Growth

On Thursday, Dell Technologies Inc. (NYSE: DELL) exceeded all analysts’ expectations, driven by strong growth in its server division.

The Infrastructure Solutions Group reported a 38% increase in revenue, reaching $11.64 billion for the fiscal second quarter, surpassing analysts’ estimates of $10.79 billion.

Additionally, revenue from servers and networking surged by 80%, reaching $7.67 billion, setting a new record for the company.

Dell’s Vice Chairman Jeff Clarke noted significant growth in AI momentum during the second quarter. He also highlighted a steady rise in enterprise customers purchasing AI solutions each quarter.

Dell Technologies Posts Strong Q2 Earnings, Stock Rises

Dell Technologies released its fiscal Q2 results, reporting $25.0 billion in revenue—a 9% increase compared to last year. Operating income reached $1.3 billion, while non-GAAP operating income climbed to $2.0 billion, reflecting a 15% year-over-year growth.

Following these results, Dell’s stock rose approximately 3% in after-hours trading on Thursday. The company’s Infrastructure Solutions Group generated $1.28 billion in non-GAAP operating income, surpassing analyst expectations of $1.12 billion.

Net income for the quarter reached $841 million, or $1.17 per share, up from $455 million in the previous year. Adjusted earnings per share reached $1.89, exceeding the FactSet consensus estimate of $1.70.

The Client Solutions Group, which includes personal computers, generated $12.4 billion in revenue, a 4% decline from the previous year. Analysts had expected slightly higher revenue of $12.6 billion, given Dell’s strong focus on the corporate market compared to some of its competitors.

Looking ahead, Dell anticipates adjusted earnings per share of $2.00 for the fiscal third quarter, with a possible fluctuation of 10 cents, falling short of the $2.19 analysts had expected. The company also forecasts revenue of $24.5 billion at the midpoint, slightly below the $24.6 billion analysts had projected.

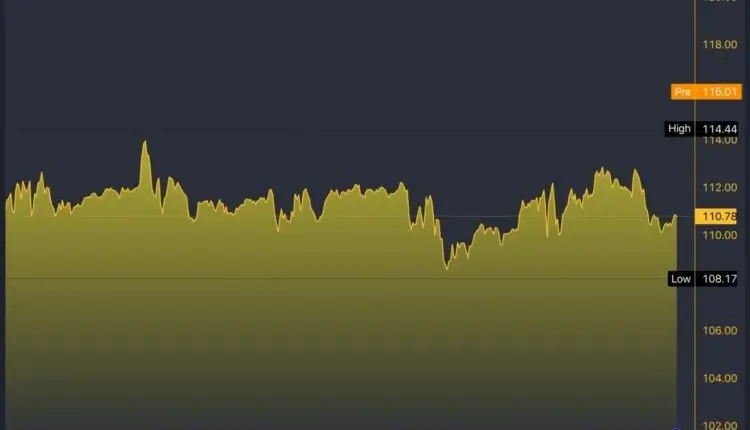

(Click on image to enlarge)

DELL/USD 5-Day Chart

Q2 Market Highlights: Notable Gains and Declines Across Sectors

Curiously, Dell’s stock futures were not the only ones with an outstanding performance this Friday. Here are some of the biggest Q2 updates:

Lululemon Athletica (Nasdaq: LULU) shares also jumped 5% after a mixed Q2 report. The company exceeded profit expectations and improved margins. However, it lowered its FY2025 revenue forecast to $10.375B-$10.475B. This falls below the previous $10.7B-$10.8B and the $10.62B consensus.

Revenue forecasts for MINISO Group Holding Ltd. (MNSO) 2024 have increased from $2.08 billion to $2.40 billion, while projections for 2025 have slightly declined from $2.45 billion to $2.44 billion. Earnings estimates for 2024 have risen from $1.06 per share to $1.09 per share, but 2025 expectations have dipped slightly from $1.23 per share to $1.22 per share. Despite these minor adjustments, MNSO stock maintains a steady ‘outperform’ rating this quarter, with analysts holding a strong ‘buy’ stance on the asset.

For a more balanced analysis, it’s important to consider stocks underperforming during this trading period. The biggest loser in the second quarter is Ulta Beauty.

Ulta Beauty (Nasdaq: ULTA) saw its shares drop by 7% after reporting weak Q2 results. The company now expects FY2024 net sales to be between $11 billion and $11.2 billion, down from its previous forecast of $11.5 billion to $11.6 billion. The new midpoint of $11.1 billion falls below the consensus estimate of $11.5 billion. Furthermore, Ulta expects comparable sales for the year to decline by 2% to remain flat. This is a significant downgrade from its previous 2% to 3% growth guidance.

The second quarter brought significant results for several companies, with Dell Technologies leading the way. Dell exceeded expectations with impressive growth in its server division and robust financial performance. Such a dynamic signals strong momentum in the tech sector. Therefore, investors are advised to keep a close eye on the further development of innovations in technology.

More By This Author:

Ethereum Is Pulling Back Again After Yesterday’s Failure

Oil And Natural Gas: Oil In A New Surge Since Yesterday

Solana And Cardano: Cardano Has Recovered To The EMA 200

Disclaimer: The Content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing ...

more