Defense And Volatility

Image Source: Pixabay

As the equity market has waned and waxed in 2022, investor interest has naturally turned toward ways of mitigating portfolio losses. Some factor indices can serve this goal, but investors searching for a defensive strategy need to define their search carefully.

It’s natural to think that defensive strategies will be less volatile than the market as a whole, and this is a useful intuition. Some factor indices, in fact, have produced lower-than-market volatility with a greater-than-market return. When such indices are combined with fixed-income securities, the resultant efficient frontier often dominates combinations of fixed-income with a cap-weighted market index.

That said, the essential requirement of a defensive index is not that it reduces volatility, but rather that it demonstrates a particular pattern of relative performance. Defensive factor indices aim to reduce losses in a declining market while also participating in rising markets. We often summarize this by referring to the “two Ps”—protection (in down markets) and participation (in up markets), while stressing that neither P is perfect.

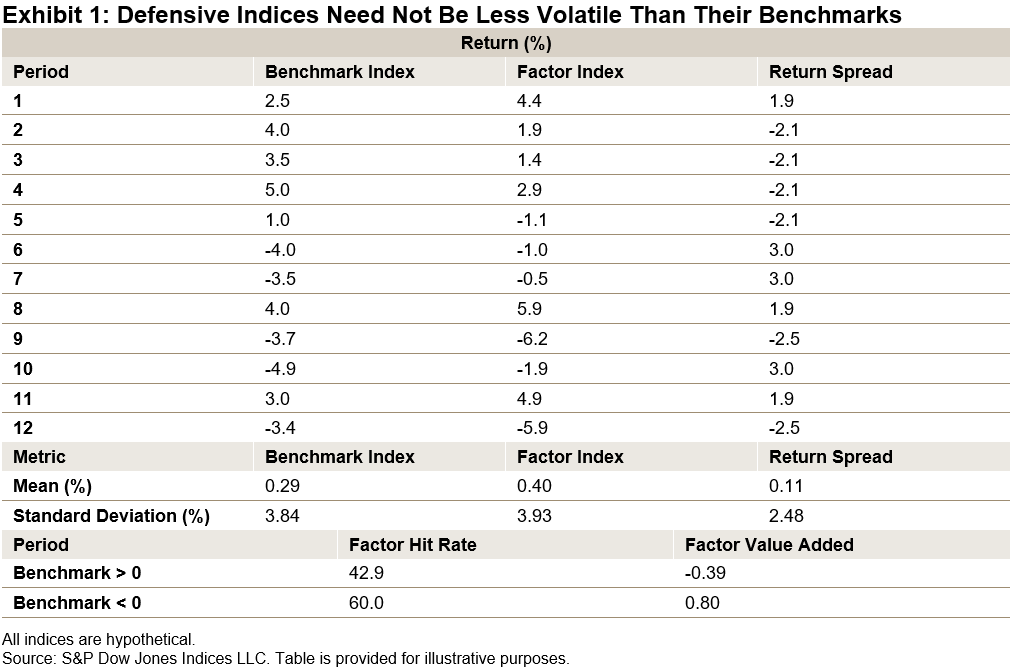

Importantly (and counterintuitively), defensive indices are not necessarily less volatile than the benchmark from which they are derived, as Exhibit 1 illustrates.

The hypothetical factor index in the exhibit outperformed its hypothetical benchmark, although with higher volatility. Yet it is clearly a defensive index. When the benchmark rises, the factor is more likely to underperform than to outperform, and its average value added is negative. When the benchmark declines, the factor is more likely to outperform, and its average value added is positive. It delivers, in other words, on both Ps, participating in up markets and protecting in down markets.

Defensive indices will typically be less volatile than their parents. But not always. Investors seeking a defensive profile should take care not to rely on volatility statistics alone.

More By This Author:

Tucking In To The SPIVA Australia Mid-Year 2022 ScorecardNet Zero: Time Is Of The Essence

Commodities Take A Break Over The Northern Hemisphere Summer

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.