Deciphering Market Dynamics: From Instacart’s IPO To The $100 Oil Scare

As the trading world anticipates Instacart’s IPO and the looming threat of $100 oil, the financial landscape witnesses profound shifts that could dictate economic trajectories for years to come.

Instacart’s Debut: A Boon or a Bane?

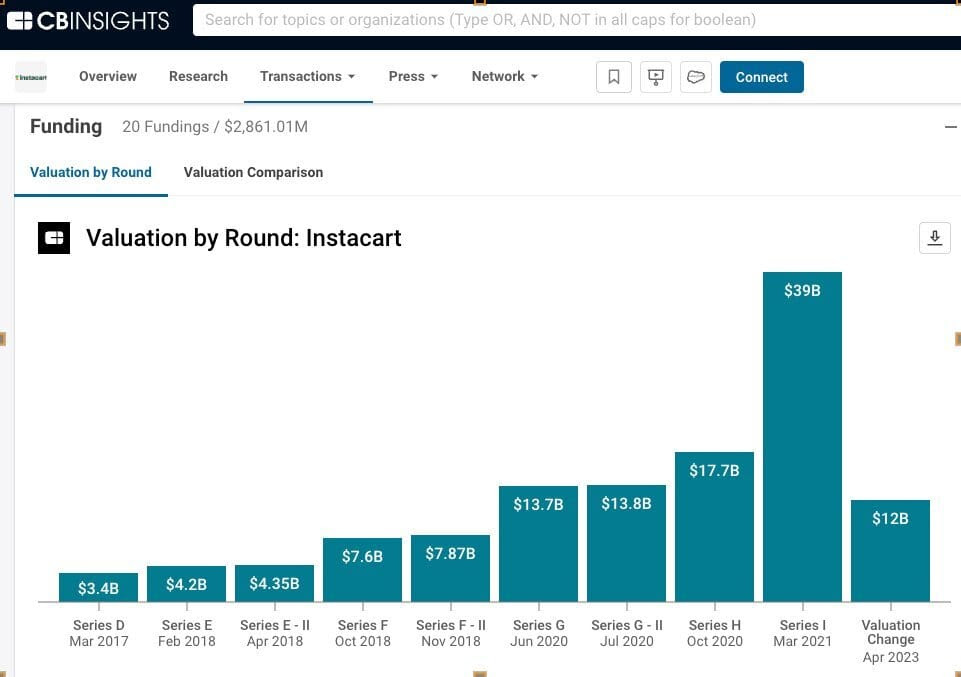

With Instacart prepping to launch its IPO under the ticker “CART”, market watchers compare its potential to Arm Holdings’ stellar performance last week. Instacart’s transformation from a company enduring losses to reporting a whopping $242 million profit this year has been commendable. Their aggressive growth, especially in the ad segment, is noteworthy. However, the shadows of past valuation cuts and changes in market dynamics put a question mark on the IPO’s potential success. The company’s strategic move to involve major players like PepsiCo and Sequoia to pick up a significant chunk of the IPO shares is worth monitoring.

Student Loans Return: The Economic Implications

October marks the end of the student loan moratorium introduced by the Education Department in March 2020. This financial hiatus allowed borrowers to allocate funds to luxuries, providing a temporary boost to the economy. As loan repayments resume, a potential outflow of $100 billion from consumer funds may result. Retail magnates like Walmart and Macy’s are bracing for possible impacts. Despite representing a small fraction of total consumer spending, this shift could significantly affect the economy given other ongoing financial pressures.

The Looming Oil Crisis: A Ticking Bomb for the Fed

With global oil demands surging and strategic petroleum reserves dwindling, OPEC’s non-committal stance on production cuts is worrisome. The significant rise in oil prices has made investors bullish, yet its contribution to inflation, particularly through gasoline, remains alarming. The grim prediction of $100 oil becomes a potential reality that could throw economic stability into jeopardy.

What’s Next on the Financial Horizon?

Various important announcements and decisions are lined up for the coming week. From the Housing Market Index data and Business Activity results to critical rate decisions by international banks, the week promises to keep traders and investors on their toes.

More By This Author:

The Financial Forecast: U.S. Inflation, ARM’s IPO Spectacle, And Europe’s Rate DilemmaThe Mighty U.S. Dollar & The Apple Tumble: A Financial Dive

Unpacking Financial Phenomena: From Tech Fund Inflows To Global Equity Outflows

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more