DAX Outlook: Stocks Drop On China

Image Source: Unsplash

Thanks to weakening Chinese manufacturing data, we have seen fresh falls in crude oil and some base metals, hurting energy stocks and miners. Our short-term DAX outlook is therefore bearish given growing worries over the health of the world's second-largest economy.

Following Tuesday’s reversal, we have seen further downside follow-through in European stock markets in the first half of Wednesday’s session. Friday’s big rally seems like a distant memory already. Though US markets have held their own relatively better, as A.I. optimism keeps technology stocks supported, most European indices, which had already been under-performing Wall Street, have more than given up Friday’s gains. Here, investor sentiment has been impacted more by the plunging Chinese stock markets, which fell further overnight on the back of more disappointing manufacturing data. We have also seen fresh falls for crude oil and some base metals, hurting energy stocks and miners. Our short-term DAX outlook is therefore bearish given growing worries over China.

China’s manufacturing falls deeper into contraction

The risk-off sentiment gathered pace as fresh signs of economic weakness emerged overnight. The latest manufacturing PMI disappointed again falling to 48.8, the lowest since December 2022. When China sneezes, Asia catches a cold. We have seen the Aussie and kiwi extend their plunge, as metals and energy prices have weakened on demand concerns. On Tuesday, a gauge of Chinese shares traded in Hong Kong fell into a bear market. Overnight, the Hang Seng index also extended its losses to 20% below recent highs, putting it officially in a bear territory. China’s weakness is also starting to hurt European markets. This is because China is a big export destination for European companies, from luxury brands to carmakers.

Will US markets also catch a cold from China?

US equities have been quite immune to the Chinese weakening story so far. In the US, A.I. optimism has kept tech stocks supported while other sectors have not done so well, albeit not too poorly either thanks to optimism over a debt deal being achieved soon. However, the increasing probability of another Fed rate hike in June is something that could hold markets back here. That said, we haven’t yet seen any major bearish reversal signals, like those witnessed for Chinese and some European markets. Let’s see if that changes in light of the fresh weakness observed here in Europe, today.

DAX outlook: European data weakens further

Dragged lower by China and underpinned by the US, European markets have been somewhere in between. But incoming data from Europe have also turned weaker in recent weeks. This was again highlighted by a bigger-than-expected 1% drop in French consumer spending. We also had a much weaker retail sales figure from Switzerland, where spending fell by an eye-catching 3.7% month over month following a 1.1% drop the month before. The weakness in data is going to put downward pressure on inflation in the region, which may see the ECB walk back on its strong hawkish rhetoric. That may help limit the downside risks in the DAX outlook somewhat.

Meanwhile, we will have a host of inflation reports from Europe released throughout today, with German CPI likely to be the most important one which can help set the tone and expectations for Eurozone overall CPI tomorrow.

DAX Outlook: Technical Analysis

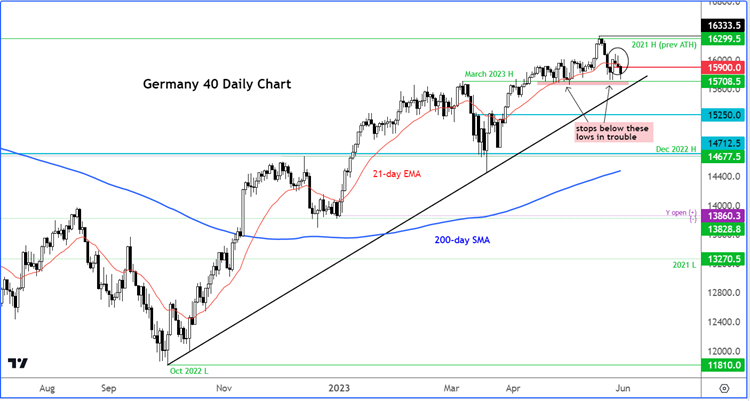

The DAX recently hit a new all-time high but price action over the past couple of days argues against a sustained rally, as we head to the summer months.

On Tuesday, the Germany 40 index, which is based on the underlying DAX index, turned lower to settle near the lows, giving back about 150 points worth of gains from the day’s highs. The reversal means the popular index created an inverted hammer on the daily time frame, which correctly signaled more losses would be on the way as we saw earlier today.

The DAX has bounced off its lows but needs to reclaim 15900 to tilt the balance back in the bulls’ favor. Failure to do so means there is a good chance it will continue to search for liquidity on the downside and potentially break the recent lows where the bulls’ sell-stop orders are likely to be resting.

Therefore, if the bulls fail to hold their ground here then we could see the DAX stage a much deeper correction. As a minimum, I would then expect to see the index then drop to test the bullish trend line that comes in below the shaded horizontal support area on my chart. But the potential for a deeper correction is there.

(Click on image to enlarge)

Source: TradingView.com

More By This Author:

Gold Rebounds As Dollar And Yields FallDollar Off Best Levels Ahead Of Key Events

Dow Forecast: Debt Limit Impasse And Bear Trend Continue

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more