DAX And NIKKEI Are Trading At Support

Image Source: Unsplash

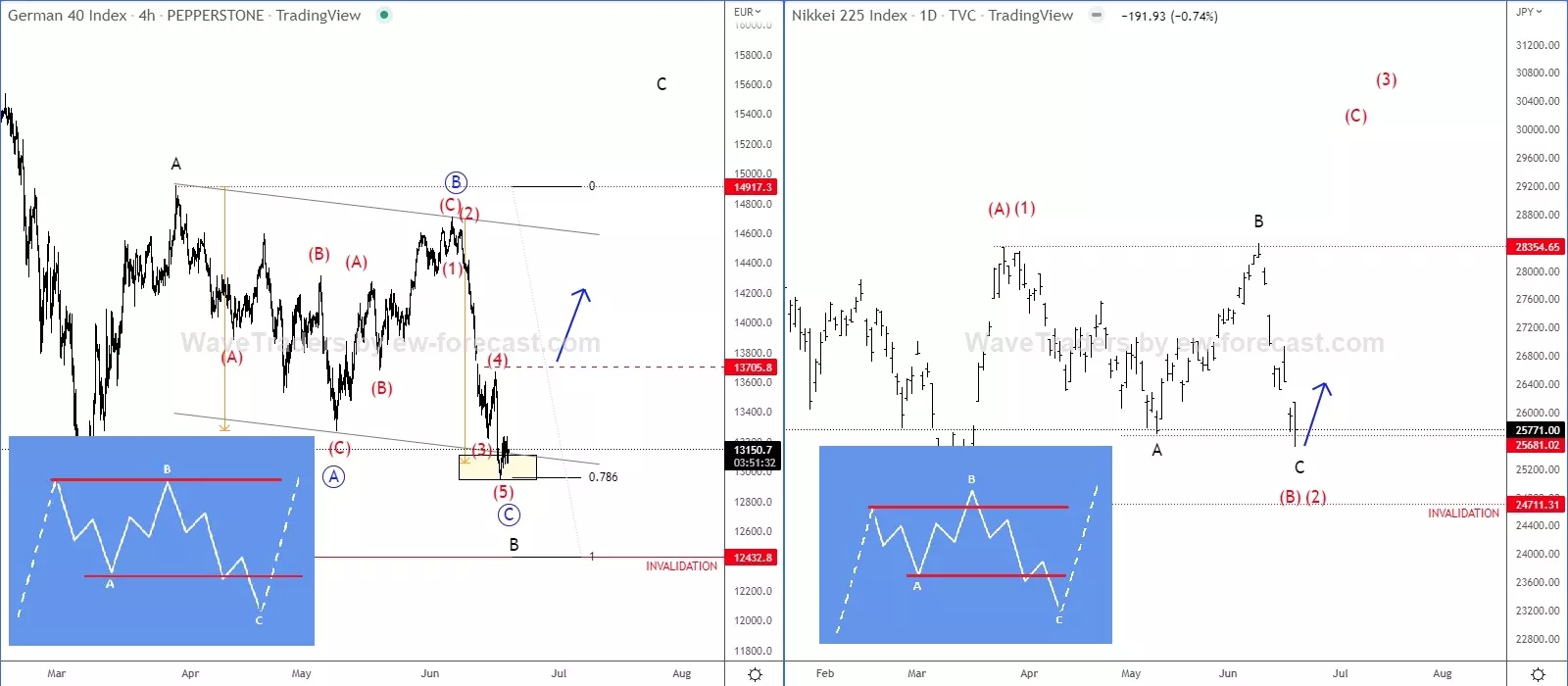

Today we will talk about the German (DAX) and Japanese (NIKKEI) stock indexes. We actually see a pretty nice and clean bullish setup formation from Elliott's wave perspective after we noticed flat corrections on both charts.

Two types of 3-3-5 flat corrections have been identified by differences in their overall shape. In a regular flat correction, wave B terminates about at the level of the beginning of wave A. And wave C terminates a slight bit past the end of wave A. Far more common, however, is the variety called an expanded flat, which contains a price extreme beyond that of the preceding impulse wave. In expanded flats, wave B of the 3-3-5 pattern terminates beyond the starting level of wave A, and wave C ends more substantially beyond the ending level of wave A.

(Click on image to enlarge)

As you can see, both DAX40 and NIKKEI225 can be now finishing A-B-C flat corrections. The only difference is that DAX is in a regular 3-3-5 flat formation, while NIKKEI can be finishing an irregular/expanded flat pattern.

Well, despite the recent sell-off, we still think that stocks can stabilize again. So, if we are on the right path, then risk-on sentiment can be around the corner. However, only if we see a strong and impulsive rebound this week, only then we can confirm bulls are back in play.

Happy trading!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.