Dataram: Hidden Junior Miner Opportunity

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

After struggling for years in the memory sector, Dataram (DRAM) made a bold acquisition into the mining sector for diversification. The move has mostly gone unnoticed by the market.

The stock sits around $1.20 and near the lows as some of the initial excitement surrounding the purchase of the mining assets of U.S. Gold Corp. wear off. Is the market overlooking a key recent hire that highlights a hidden opportunity?

Past Struggles

Dataram sells customized memory solutions, but the company has struggled to generate a profit. The sector is just too competitive for a small player to break through.

For FY16 that ended last April 30, Dataram lost $1.2 million on sales of $25.2 million. The losses in the following quarters haven't improved and the company has minimal assets.

Enter the decision to buy U.S. Gold Corp. The move was precarious considering the drastic shift in business fields. What does a technology company know about mining?

Enter the key to the story: David Mathewson. The former exploration head of Newmont Mining (NEM) recently built up Gold Standard Ventures Corp. (GSV) and now plans to do the same for U.S. Gold Corp.

While the company doesn't appear to have an advantage in memory solutions, the scenario could be different in gold mining with proven leadership.

Shareholder Vote

Back on March 30, shareholders made the following votes on the outstanding company requests surrounding the merger with U.S. Gold Corp. and Copper King LLC:

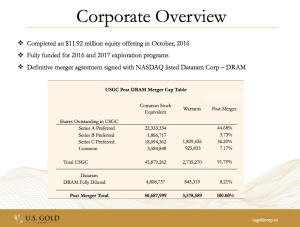

- Approved the issuance of 45,880,820 shares, options to purchase 925,833 shares of common stock at an exercise price of $0.90 per share, and warrants to purchase up to 1,809,436 shares of common stock at an exercise price of $0.66 per share.

- Approved a certificate of amendment to the company's articles of incorporation to increase the authorized number of common shares to 200,000,000 shares from 54,000,000 shares and preferred stock to 50,000,000 shares from 5,000,0000 shares.

- Approved granting the Board of Directors the authority to implement a reverse merger of up to 1-for-10 prior to March 2018.

The new company will have slightly over 50 million shares outstanding after the merger plus roughly 3.6 million warrants. At a closing price of $1.20, Dataram is worth over $60 million now. The stock popped above $2 on the mining news that would've placed the valuation in excess of $100 million.

(Click on image to enlarge)

The company plans to move forward aggressively with the junior mining business with the intent to at least maintain a diversified business for now.

Enter David Mathewson

The key to the whole story is the inclusion of David Mathewson with the acquisition of U.S. Gold Corp. Mr. Mathewson was hired around the time of the merger announcement with Dataram to become the Vice President, Lead Geologist and Head of Exploration for the below discussed Keystone Project in Nevada.

Mathewson was best known for being head of Newmont Nevada's exploration team from 1989 through 2001 during a career that spans 35 years of mining experience. Newmont Mining is now a gold mining stock worth $17.5 billion.

More important to the discussion with Dataram and U.S. Gold Corp. was the recent work at Gold Standard Ventures. Mr. Mathewson started at Gold Standard Ventures back in 2009 and his work led to the consolidation of the Railroad-Pinion district and several discoveries of gold deposits that ultimately increased the valuation of the junior minor.

The stock went from a funding of $15 million to a market valuation in excess of $600 million recently. After a big pullback, the current market cap is listed at nearly $400 million.

During this time period, the gains in Gold Standard Ventures far exceeded the gains in the price of gold. In fact, the dips in the stock were in part related to the gold prices dropping precipitously in 2013, but the stock recently rallied back to the previous highs despite stagnant gold prices over the last couple of years showing the value of exploration.

U.S. Gold Corp.

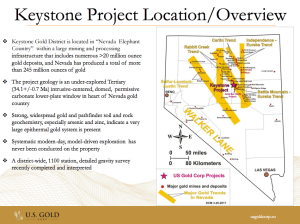

The junior miner controls the Copper King Project, an advanced stage gold exploration project based in Wyoming, and recently acquired the mining claims related to the Keystone Project in Nevada.

For Copper King, the Preliminary Economic Assessment by Mine Development Associates shows measured, indicated, and inferred resources of 1.1 million oz. of gold and 285 million lbs. of copper showed an NPV of Copper King of $160 million at $1,100 gold. The project is more advanced in development, but not the key to growing the valuation of the stock.

The true excitement is with the recently acquired Keystone property that now consists of over 11 square miles and approximately 7,500 acres following the addition of 71 new claims. The goal is to achieve an initial target of 1 million ounces with a potential to exceed 10 million ounces of gold.

(Click on image to enlarge)

The project runs along a well established gold district in Nevada where David Mathewson has spent the majority of his career in exploration. Keystone has geological similarities to the Cortez Gold District that has produced more than 245 million ounces of gold.

The project is so interesting that David Mathewson had the following to say in regards to Keystone:

Keystone is a true district-scale opportunity. In the past 40 years, I have been on and off various portions of the Keystone property during this time. This is the first time that one company has controlled the entire Keystone district, and this control will be conducive to comprehensive, systematic, and modern-day exploration applications.

No Guarantees

Despite the promising mining projects and the leadership of David Mathewson, an investment in Dataram is no guarantee. The market might not reward the diversified business approach and continuing losses at the memory solutions business could weigh on the stock regardless of the success at the U.S. Gold subsidiary.

In addition, a junior mining company is highly speculative. While the company has enough funding after raising nearly $12 million last October to complete 2017 exploration plans, Dataram will ultimately need to raise additional funds or find a partner in order to complete mining activities. Any failure in the exploration program or in fund raising would be very detrimental to shareholders.

The potential rewards are high, but the risks are meaningful.

Takeaway

The key investor takeaway is that the recent acquisition of U.S. Gold Corp and the involvement of legendary geologist Dave Mathewson sets up Dataram for potential success. Positive results aren't guaranteed, but the stock offers a reasonable reward scenario while the new developments remain hidden for investors able to handle the risk.

Mark Holder is article writer. It's interesting that after reading this article, I know details Dataram. Its organized. Thank you so much

Great and A+ Service! They are very Professional and Punctual! Thank You!!!