Daily Update: Netflix's Negative Free Cash Flow Doubles

STOCK NEWS

Goldman Sachs (GS) : reported Q3 EPS of $4.88 which beat expectations by $1.09. Revenue of $8.17 billion beat estimates by $750 million and was up 19.1% year over year. Investment banking revenues were $1.54 billion which was unchanged from last year.Financial advisory revenue was $658 million which was down 19%. Underwriting revenue was $879 million which was up 18%. Investment & Lending revenue of $1.40 billion was more than double last year’s number.

Netflix (NFLX) : reported Q3 EPS of $0.12 beat estimates by 7 cents. Revenue was $2.3 billion which was up 32.2% and beat estimates by $20 million. Netflix beat estimates for U.S. and international subscriber growth. It grew U.S. subscribers by 370,000 which beat estimates for 304,000. It grew international subscribers by 3.2 million which beat the consensus of 2.0 million. The big negative of the quarter was the ballooning negative free cash flow which reached negative $506 million which more than doubled last year’s negative $252 million.

Domino’s Pizza (DPZ) : reported Q3 EPS of $0.96 which beat estimates by 7 cents. Revenues of $566.67 million grew by 16.9% and beat estimates by $25.2 million. U.S. comparable store sales grew 13% and international comparable store sales grew 6.6%. Net income increased 25%. The CEO Patrick Doyle stated "We continued to execute at a very high level during the third quarter, as our unprecedented momentum, steady strategy and alignment with our outstanding franchisees is helping to take the business to new heights."

Phillip Morris (PM) : reported Q3 EPS of $1.25 which beat estimates by a penny. Revenue of $6.98 billion was up 0.7% year over year and missed expectations by $30 million. Volume fell 5.4% to 207.1 billion units. Chesterfield volumes were down 14%. The firm reiterates its 2016 EPS of $4.53 to $4.58.

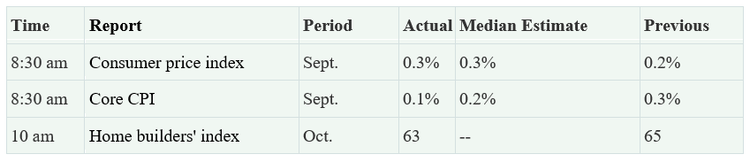

ECONOMIC NEWS

The economic news will take a back seat to earnings and politics this week. The presidential debate is on Wednesday. Currently Hillary Clinton is winning by mid-single digits. This is bullish for equities over the near term. If Trump does well in the debate, it will increase the uncertainty over who will win which will send stocks lower. Netflix, the first of the TFAANG momentum stocks, reported. While the negative free cash flow was terrible, the fact that the stock went higher is good news for the others (Tesla, Facebook, Apple, Amazon, and Google).

(Click on image to enlarge)

Disclosure: None.

thanks for sharing