D-Wave Quantum Investment Check Before Q3 Earnings: Liquidity Solid Amid Risks

Image: Bigstock

Key Takeaways

- D-Wave Quantum's cash and assets surged in 2025, with $819.3 million in cash and low near-term liabilities.

- Funding gains stemmed from $675 million raised via ATM offerings, warrant exercises, and other financing.

- Q3 results are expected to show 36.4% earnings and 66.8% revenue growth, though valuation remains elevated.

Ahead of third quarter 2025 earnings, D-Wave Quantum’s (QBTS - Free Report) balance sheet is materially stronger than a year ago, implying low near-term liquidity and solvency risk as compared to the year-ago period. But can this capital strength translate into sustainable operational momentum and shareholder value in Q3? Let’s delve deeper.

Ahead of Q3 Release: Balance Sheet Strong but Operational Efficiency a Challenge

The improvement in D-Wave Quantum’s balance sheet has been fueled largely by equity financing rather than by internal cash generation. As of June 30, 2025, the company held $819.3 million in cash and cash equivalents and total assets of $843.6 million, providing ample liquidity that comfortably exceeds near-term obligations.

Current liabilities were limited to $19.3 million, while total liabilities were $149.3 million, resulting in stockholders’ equity of $694.3 million — a structure that underscores low leverage and solid solvency fundamentals.

This strengthened cash position primarily reflects the company’s aggressive capital-raising initiatives in the first half of 2025. Through a combination of at-the-market (ATM) equity offerings, warrant exercises, and other financings, D-Wave Quantum generated approximately $675.0 million in financing cash flows during the six months ended June 30, 2025, including roughly $390.6 million from a $400 million ATM program and $99.3 million from warrant exercises.

From an operational standpoint, however, its performance remains mixed. Net cash used in operating activities totaled $34.6 million during the first half, and the company continues to post GAAP losses, largely driven by non-cash items, including a significant negative change in the fair value of warrant liabilities.

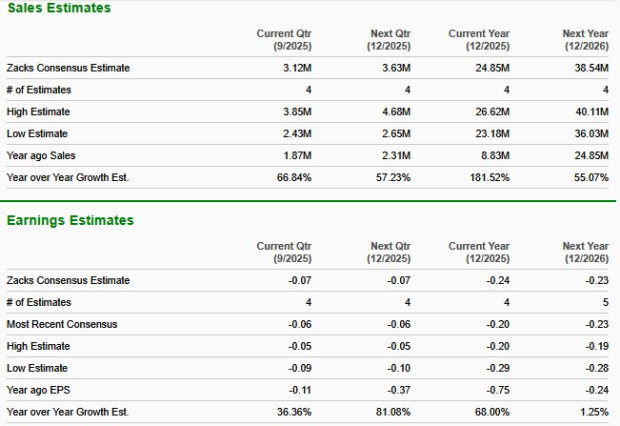

What Results Can Q3 Bring?

Ahead of third-quarter 2025 results, with ample liquidity and a multi-quarter cash runway, the market expects narrowing losses and steady revenue growth from the company’s quantum cloud and annealing offerings. The company’s cash burn trends and its ability to limit further dilution amid continued R&D spending may be crucial.

Any uptick in recurring revenues or new enterprise partnerships could indicate early leverage of its capital base, while recurring non-cash swings, especially from warrant revaluations, may blur true performance.

For the third quarter, the company is expected to report an improvement in earnings of 36.4% on revenue growth of 66.8%.

Image Source: Zacks Investment Research

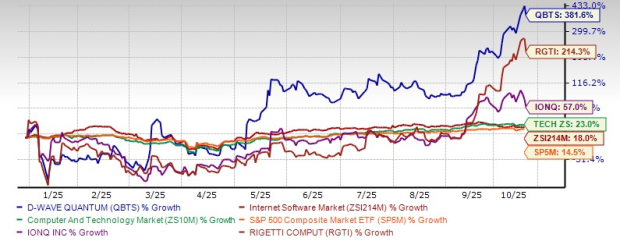

Year-to-date, shares of D-Wave Quantum have rallied 381.6%, outperforming the broader industry, the sector, and the S&P 500’s 18%, 23%, and 14.5% growth, respectively. During this period, the company’s direct peers, such as Rigetti Computing (RGTI - Free Report) and IonQ (IONQ - Free Report), have gained 214.3% and 57%, respectively.

Year-to-Date Stock Comparison

Image Source: Zacks Investment Research

Stock Valuation has Remained Stretched

D-Wave Quantum’s shares are overvalued, as suggested by the stock's Value Score of F.

In terms of the forward 12-month price/sales (P/S), D-Wave Quantum has recently been trading at 387.37X, which is significantly higher than its one-year median of 118.53X and the Zacks Computer and Technology sector’s 6.62X. The stock has also been trading at a premium to IonQ’s reading of 128.12X. However, the stock's reading is still discounted compared to Rigetti Computing’s P/S of 772.30X.

Price/Sales Ratio (Forward 12-Months)

Image Source: Zacks Investment Research

Bottom Line

Despite a strong position in liquidity, D-Wave Quantum has remained burdened by operating losses, dilution risk, and stretched valuation. Its forward P/S multiple far exceeds sector and peer medians, implying that much of the optimism has already been priced in.

With profitability still distant and shares sensitive to non-cash swings, D-Wave Quantum, a Zacks Rank #4 (Sell) rated stock, does not appear to offer an ideal entry point at the moment. Investors may be better off taking profits or waiting for a more attractive valuation reset.

More By This Author:

Will Netflix Stock Reach New Heights As Q3 Results Approach?What's Next For Gold ETFs: A Pullback Or Buying Opportunity?

Buy The Surge In First Solar Stock Before It's Too Late?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more