CZR Stock Forecast: Caesars Entertainment, Inc. Is A Worthy Bet To Hold

Highlights:

- The effects of the new COVID mutation – Omicron variant on the tourism industry seems unpredictable for now

- CZR, with a good business avenue and strong revenue growth, is a recommended hold during these turbulent covid times and a certain buy after its expected downside due to the pandemic effects

- The 3-year Revenue Growth Rate is 7.1 that better than 86.27% of companies in the Travel and Leisure industry

Overview

Caesars Entertainment, Inc. is a gaming and hospitality company that owns and operates gaming facilities. One of the world’s most diversified casino-entertainment providers and the most geographically diverse U.S. casino-entertainment company, Caesars Entertainment Corporation owns and operates about 50 casinos. Properties include some of the biggest names on the Las Vegas Strip, including Caesars Palace and Planet Hollywood. Operations, which comprise hotels, riverboat casinos, and gaming establishments, boast millions of square feet of casino space and thousands of hotel rooms. The company owns the World Series of Poker brand and tournaments through Caesars Interactive.

Caesars Entertainment has already established itself as a premier gaming operator in the tri-state area through its retail casino and sports-book footprint, including the Company’s state-of-the-art retail sports-book at the Oneida Nation’s three casino properties. The company operates sports betting in 20 jurisdictions, 14 of which are mobile. As of June-2021, 64 hedge funds hold stock of Caesars Entertainment, Inc., while the highest number of funds invested in this stock had peaked at 76 in the past. On October 25, 2021, Wells Fargo added Caesars Entertainment, Inc. to its list of the Signature Picks, noting the company’s potential to become the leader in the iGaming sector.

The Ongoing Down-Turn for Hotel Industry and What Lies Ahead?

The effects of the new COVID mutation omicron variant on the tourism industry seem unpredictable for now since many countries shown above announce lockdown. Casino stocks such as Caesars Entertainment closed lower on Friday, 26-Nov-2021 as concerns over a new, heavily mutated variant of Covid-19 triggered new travel restrictions. Caesars (CZR) fell almost 3% to $91.20, Las Vegas Sands (LVS) dropped 5.35% to $37.87, Wynn Resorts (WYNN) slipped 6.04% to $85.69, and MGM Resorts (MGM) fell 2.36% to $41.82.

Pfizer and BioNTech said on Dec. 8 that a booster Covid shot is necessary to tackle the omicron variant. While there is some news that the Omicron might not have as severe an effect as the earlier Covid variants, the first batches of vaccines against Omicron can be produced and ready for shipment within the next 100 days as per a statement by Pfizer and BioNTech. Since the announcement of the outbreak of Omicron on Nov. 26, the market started showing nervous signs of negative sentiments, as did CZR.

The downtrend in CZR stock has continued from Oct. 4 since the company declared Q3, 2021 results. This was a result of high market expectations and the company missing its market target expectations. The Net Loss rose to 0.68 mn in Q3 compared to a profit of 1.07 million in Q2 of 2021. According to the FactSet analyst consensus, the market expected a profit of 16 cents a share while CZR got a net loss of $1.10 a share for the third quarter.

Expansion during an Opportune Risky Environment

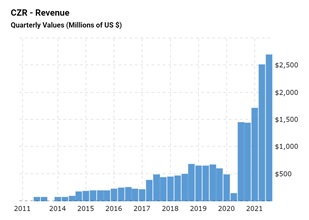

Despite the pessimism around the hotel industry, CZR has shown promising signs in its recovery and growth. The company posted a Net revenue of $2.69 billion, almost doubling from $1.38 billion a year earlier. It also reported a considerable reduction in a net loss of $233 million (-75%) for the third quarter of the year, compared with a net loss of $926 million in the third quarter of 2020. According to GuruFocus, the 3-year Revenue Growth Rate is 7.1 that better than 86.27% of companies in the Travel and Leisure industry.

The company reported encouraging revenues, adjusted EBITDA, and margin performance in the third quarter. During the quarter, net revenues in the segment were $1,492 million growing at 41% compared with $1,055 million in the third quarter a year ago. The segment’s adjusted EBITDA was $554 million compared with $350 million reported in the prior-year quarter, a growth of 58%. Despite the low turnout in the hotel industry and concerns over lockdown, Caesar properties in Las Vegas managed an industry-high occupancy ratio of 89.60%. These factors coupled with steady revenue from its new ventures in Sports Betting ensured steady revenue growth through the quarter. Although the company still grapples with high-interest costs and high book debt ratios compared to the industry. The interest coverage of the company is 0.61 which is ranked worse than 93.65% of 378 companies in the Travel & Leisure industry.

Ray of Hope for Caesars: Sale Proceeds from Strip Property to Boost Debt Reduction and Enable Further Expansion Plans

Caesars Entertainment would be looking to effectively put to use sale proceeds from its strip property coming next year. It has committed to reducing debt from these proceeds and is taking up a formidable make-over for Caesar’s Palace entrance. The debt-equity ratio of the company is currently at 551% compared to an industry average of 396%.

Caesars narrowed the date to sell a Las Vegas Strip property to “early 2022” from its August projection of sometime in 2022. According to a recent interview of independent director, David Tomick, on a conference call to MarketWatch, the company would be in a position to deploy $ 5 billion cash in 2022. Some of that will be spent in the digital business, and some will be spent on capital projects that drive considerable returns in the portfolio. But the vast majority of that cash is expected to be used to pay down its debt. It would look to drive growth by further business expansion and a diversified gaming business.

The company also intends to divest William Hill’s non-U.S. business for about $3 billion and unload shares in NeoGames, NGMS. The company expects to have about $ 5 billion in cash available to deploy in 2022. By paying off half of its conventional debt next year, the company will lower its cash interest expense by $300 to $400 million a year. With considerable resources and also additional credit lines available, the company is expected to put them to effective use to generate revenues by further business expansion plans in the casino and sports betting business, and improve its financial health. With the added risk of Omicron looming over the industry, the company would have to face additional challenges in the completion of these sale deals and effectively reducing debt.

Wall Street’s Take on Stock Forecast

The above ratings indicate a stronghold call by major rating agencies and financial institutions since Apr-2021. Strong financials during 2021 and promising new ventures and projects ensured that CZR maintained a strong upside momentum during 2021. CZR with a good book value and market cap is a recommended hold during these turbulent covid times and a certain buy after its expected downside due to the pandemic effects. The company is showing promising signs to expand its existing business in new avenues even in this unfriendly macro-economic environment, hence warranting new revenue streams.

Conclusion

With analysts’ past expectations for the company to return positive Net Profit results sooner rather than later, the company seems to be on the right path to recovery. With gaining access to new sports betting and casino markets, it has a promising portfolio to deliver business growth. Considering Caesars Entertainment, Inc. manages to wither off temporary downsides during the pandemic, it would have to navigate through challenges posed due to the Omicron situation in the completion of sale deals and reduction of debt.

Overall, I predict an upside run of at least 15% in the one-year horizon, possibly crossing $ 105 and upwards as a normal course of business resumes. The stock is bound to see a downside given the widespread of the new variant, while its full effects are still to be discovered. Thus presenting the right opportunity to enter it.

It is worth paying attention that our stock-picking AI has a high signal on the one-year market trend forecasts, supporting my position for the CZR stock forecast. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

I Know First has been bullish on the CZR stock forecast in the past. On July 6th, 2021 the algorithm issued a forecast for CZR stock price and recommended CZR as one of the best stocks to buy. The AI-driven CZR stock prediction was successful on a 3-months time horizon resulting in more than 11.65%.