CTBI: A Regional Bank With Solid Dividend Growth

Image Source: Pixabay

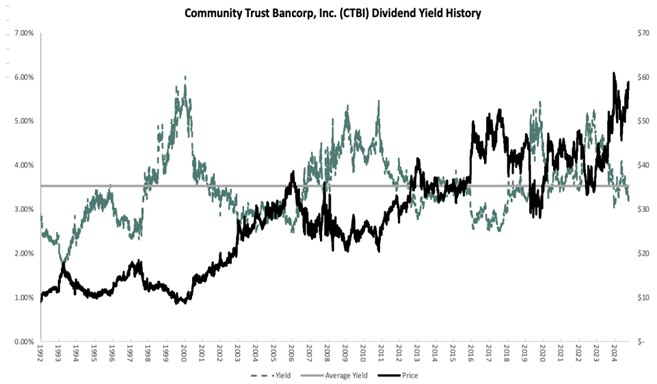

Community Trust Bancorp Inc. (CTBI) is a regional bank with 84 branch locations in Kentucky, Tennessee, and West Virginia. Overall, the stock is expected to return 7.8% per year over the next five years thanks to 4% growth in earnings per share, a dividend yield of 3.7%, and a 0.6% expected valuation tailwind.

CTBI is the second-largest bank in Kentucky, with a recent market capitalization of $1 billion. Due to its smaller size, Community Trust Bancorp does not belong to the S&P 500 Index (SPX) and is therefore not considered a Dividend Aristocrat – even though it has raised its dividend for 45 consecutive years.

On July 16, CTBI reported financial results for the second quarter. Net interest income grew 18% over the prior year’s quarter, as net interest margin improved from 3.38% to 3.64% and loans grew 10%. Provisions for loan losses decreased from $3 million to $2.1 million. Overall EPS grew 27% from $1.09 to $1.38, exceeding the analyst consensus by $0.12.

Community Trust is a conservatively managed bank that has proved resilient to all kinds of downturns. The bank has grown its deposits 10% over the last twelve months. It has also proven resilient to the downturn caused by the impact of high interest rates on the net interest margin of most banks via high deposit costs. The bank recently raised its dividend by about 13%.

Shares of CTBI have a 10-year average price-to-earnings ratio of 11.6. We find this to be a fair value target for the stock. With shares trading at 11.3 times expected EPS, this implies a tailwind to annual returns from multiple expansion.

More By This Author:

AIQ And CHAT: Are These ETFs Vulnerable Amid AI Bubble Talk?AUR: Driving Innovation In The Driverless Trucking Business

COST And KMX: Two Consumer Stocks On Divergent Paths