CSX: Operating Ratio Hit A New Record; Waiting For A Better Entry Point

Shares holders of CSX Corporation (CSX) have enjoyed a near 94% return over the past five years, vastly outperforming the S&P 500’s 51% return. The railroad has also been a solid dividend growth stock, increasing its dividend for more than a decade, including a high single-digit increase earlier in 2019.

I feel that investors looking to purchase shares of CSX Corporation are better off waiting for a better entry point.

Third Quarter Earnings - Record Operating Ratio, But Weak Revenue Growth

CSX reported third quarter earnings results on 10/16/2019.

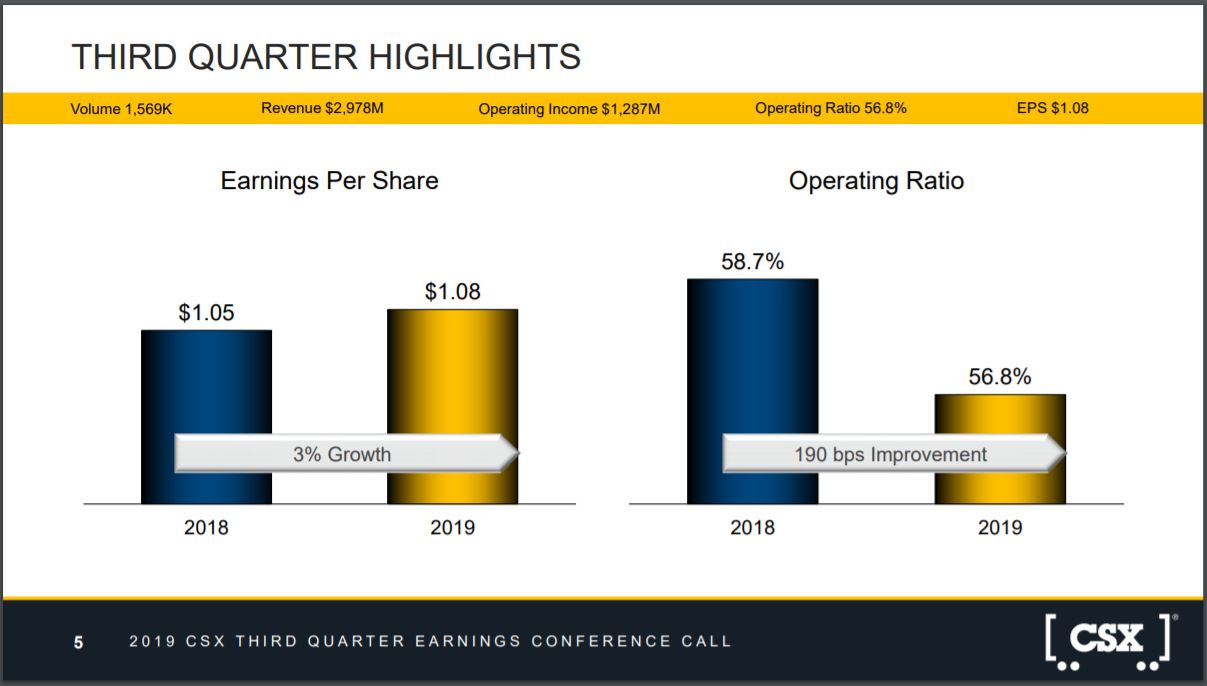

Source: CSX Third Quarter Earnings Presentation, slide 5.

Revenue declined 5% to $3 billion, missing consensus estimates by just $3.5 million. EPS grew 3% to $1.08 for the quarter, topping estimates by $0.06. Operating ratio improved 190 bps to a new company record of 56.8%.

Nearly every product category that CSX ships saw year-over-year declines.

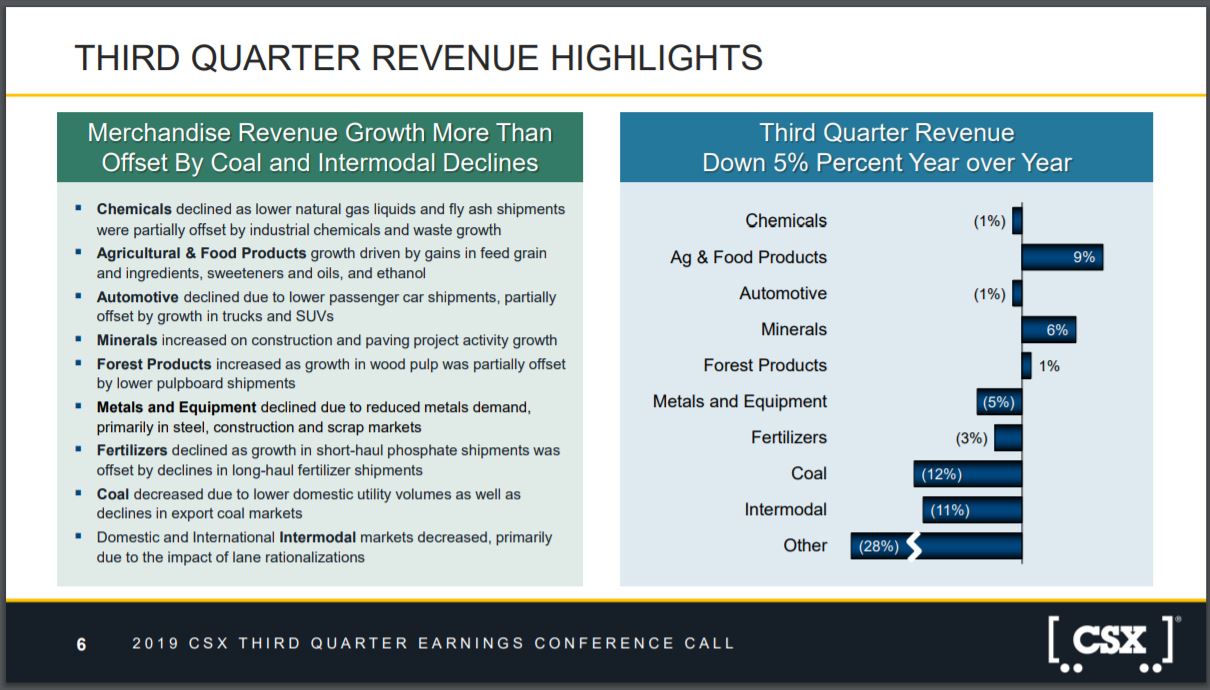

Source: CSX Third Quarter Earnings Presentation, slide 6.

The largest declines were in the Intermodal and Coal categories. Intermodal volumes decreased 9% with revenues were lower by 11% as CSX saw lower demand in both domestic and international business. Coal experienced a 9% drop in volumes and a 12% decrease in revenues. Coal exports were down 18% year-over-year while domestic tonnage was down 3% due to competition from natural gas.

On the other hand, volumes for Agricultural and Food Products both improved 6% while revenue was higher by 9%. This product saw increased demand for ethanol, feed grain and ingredients. Minerals saw a 6% increase in both volumes and revenues due to demand for construction and paving projects.

Overall, 1% growth in merchandise revenue, which accounts for nearly two-thirds of total revenues, was offset by intermodal and coal.

While CSX was able to beat bottom-line estimates, this was mostly due to a lower share count. Average shares outstanding declined 7.3% from Q3 2018 to Q3 2019. Net earnings were actually lower by 4% from the previous year. Adjusting for the reduction in shares outstanding, EPS would have actually declined from the previous year.

There were some bright spots for the company. CSX did do an excellent job of controlling expenses, which were lower by 8% from the previous year. Much of this decline was attributed to lower labor and materials costs. Average train velocity increased to 20.3 mph while fuel usage improved as well. CSX also had a 4% decrease in capital investments from the previous year.

Expense control help lead to adjusted free cash flow before dividends of $2.8 billion for CSX. The railroad is not shy about returning cash to shareholders. Including The company bought back $1.1 billion of shares during the quarter at an average price of ~$69. CSX has now bought back $2.8 billion worth of stock through the end of the third quarter. dividends, CSX has returned $3.3 billion of capital to investors.

Dividend Analysis & Valuation – Solid Dividend Growth, But Multiple Is Slightly Elevated

CSX last raised its dividend 9.1% for the 3/15/2019 payment. This gives the company 15 consecutive years of dividend growth. The company has increased its dividend by an average of:

- 7.9% per year over the past three years.

- 8.3% per year over the past five years.

- 13.1% per year over the 10 years.

Shares yield just 1.3%, but this is due in large part to the tremendous gains that CSX’s stock has made in recent years. For comparison purposes, the average yield of the S&P 500 is 1.8% and the railroad’s 10-year average yield is 2.1%.

Dividend safety is of a paramount importance to dividend growth investors. Looking at CSX, investors searching for income from the transportation sector will be reassured by the company’s payout ratios.

CSX offers an annualized dividend of $0.96 per share while analyst expect CSX to earn $4.20 per share in 2019, for a payout ratio of 23%. This compares very favorably to the company’s 10-year average payout ratio of 33%.

Using free cash flow, CSX’s dividend looks extremely safe as well. Dividends paid totaled $189 million during the third quarter while realizing $1.05 billion of free cash flow, giving the company a payout ratio of 18%

CSX has distributed $758 million of dividends over the past four quarters while generating free cash flow of $3.3 billion during this time. This equates to a payout ratio of just 23% over the last year.

Longer-term, the payout ratio is slightly higher, but still very much in a safe range. From 2015 through 2018, CSX paid out $2.8 billion of dividends to shareholders. The company produced $5.8 billion of free cash flow over this same period of time, giving CSX an average payout ratio of 48%.

Despite share price returns, I find that CSX is overvalued against its long-term historical averages. Based off the most recent closing price of $71.54 and EPS estimates for the year, shares of CSX have a P/E of 17. This is in-line with the five-year average P/E of 17.2, but above the 10-year average P/E of 15.2.

Included in the 10-year average valuation are the years proceeding the last recession. Like most railroads, both the stock and business did not do very well during the last recession. Given this, I think it is appropriate to believe that the company will repeat a similar performance during the next recession.

Outside of its operating ratio, CSX also did not perform well in the most recent quarter either. As such, I am willing to pay a slightly higher multiple, say 16x EPS, for shares of CSX. My price target is therefore $67, 6.3% below the current price.

Final Thoughts

CSX managed to reach a new company record for operating ratio in the third quarter, but this was done largely due to a lower employee headcount and improved efficiencies. Only two product categories saw an improvement in volumes and just three product categories had higher revenues.

Using either earnings or free cash flow, CSX’s dividend looks healthy and offers plenty of room to further increase its dividend. The stock’s valuation is slightly ahead of its historical average.

However, with the company’s susceptibility to recessions and struggles in the recent quarter, I am waiting for a lower price before considering opening a position in CSX Corporation.

Disclosure: I/We are not long CSX.

Impressive. I've added you to my follow list.

Glad you enjoyed the article and thanks for commenting.

Thanks for the kind words. I think ~$67 is a decent entry point. This would give you a P/E slightly above its average, which I think CSX deserves given the improvements in its operating ratio.

Good article on $CSX. What kind of price did you have in mind?