Crude Awakening: 2 Top Ranked Oil Stocks With Huge Dividend Yields

Image Source: Unsplash

The price of crude oil has cratered over the last two months, falling from a high of $95 to $69. While this move has shifted many speculators to the bearish side, I think they are late, and risk reward favors the long side here.

Barring a full-blown recession in the very near future, I believe the market will soon realize that demand for oil will remain robust, while supply is constrained, which should put a bid below the price of crude.

To make this trade even more appealing, many oil stocks are quite cheap, with some approaching deep value territory, giving investors considerable downside protection.

For investors looking to add exposure to oil stocks with top Zacks Ranks, and generous dividend yields read ahead.

Image Source: Zacks Investment Research

CrossAmerica Partners

CrossAmerica Partners (CAPL) is a leading US wholesale distributor of motor fuels, operator of convenience stores, and owner and lessee of real estate used in the retail distribution of motor fuels. With a geographic footprint of 34 states, CrossAmerica Partners distributes branded and unbranded petroleum for motor vehicles to approximately 1,800 locations and owns or leases approximately 1,100 sites. CAPL has 7 convenience store brands offering food, essentials, and car washes at more than 250 locations across 10 states.

Formed in 2012, the Partnership has well-established relationships with several major oil brands, including Exxon, Mobil, BP, Shell, Valero, Citgo, Marathon, and Phillips 66. CrossAmerica Partners ranks as one of ExxonMobil’s largest U.S. distributors by fuel volume and in the top 10 for additional brands. The convenience stores are also paired with prominent national brands, such as Dunkin’, Subway, and Arby’s.

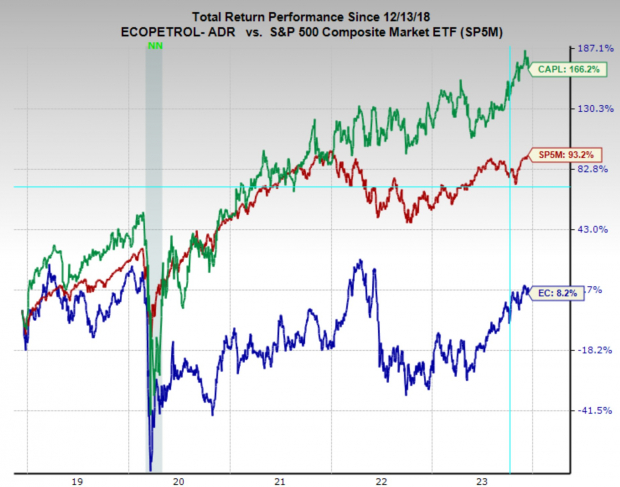

CrossAmerica Partners has experienced some hefty revisions higher to its earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have been revised higher by 47%, FY23 by 25%, and FY24 by 19%.

CrossAmerica Partners, as a part of the Oil and Gas - Refining and Marketing - Master Limited Partnerships is in the Top 6% (16 out of 251) of the Zacks Industry Rank.

Image Source: Zacks Investment Research

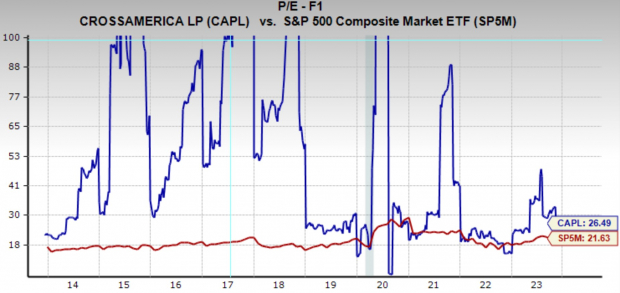

Today, CAPL is trading at a one-year forward earnings multiple of 26.5x, which is above the broad market average, and below its 10-year median of 33.5x. Additionally, the company pays an annual dividend yield of 9.3%, giving investors a nice income for holding the stock.

Image Source: Zacks Investment Research

Ecopetrol

Ecopetrol (EC) is a Colombia-based petroleum company. The Company is focused on identifying opportunities primarily within the eastern Llanos Basin of Colombia, as well as in other areas in Colombia and northern Peru. Ecopetrol’s operation includes the extraction, collection, treatment, storage, and pumping or compression of hydrocarbons.

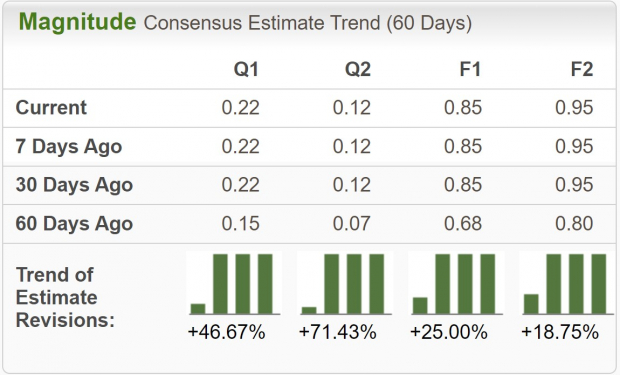

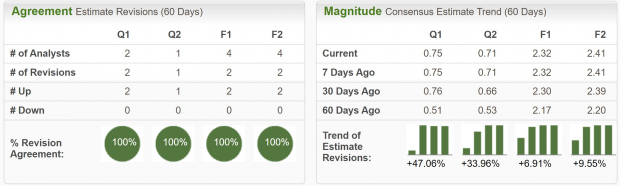

Ecopetrol has enjoyed some upgrades to its earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have been boosted by 47%, while FY23 has jumped by 7%.

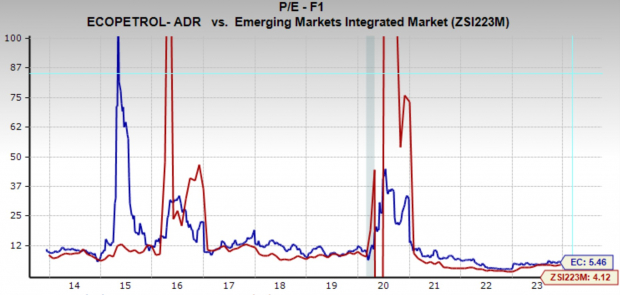

EC also sits in the Top 1% (3 out of 251) of the Zacks Industry Rank as a part of the Oil and Gas – Integrated – Emerging markets industry.

Image Source: Zacks Investment Research

Ecopetrol is trading at a one-year forward earnings multiple of 5.5x, just above the industry average and well below its 10-year median of 10.7x. It also has one of the highest dividend yields in the industry at 16.1%.

Image Source: Zacks Investment Research

Bottom Line

Although sentiment in the oil market has fallen near its lowest of the year, for contrarian investors, that should be a signal to start looking for opportunities.

More By This Author:

Time To Buy These Top-Rated Stocks With Dividend Yields Over 5%BlackRock Outperforms Broader Market: What You Need to Know

Bull Of The Day: Crispr Therapeutics

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more