CrowdStrike: Powerful Business Model And Strong Execution

CrowdStrike (CRWD) is a growth leader in cybersecurity; the company has a great business model, outstanding execution, and abundant room for further growth in the years ahead. The stock is priced for aggressive expectations, and this can be a source of volatility if there is any disappointment down the road. That being acknowledged, the upside potential is clearly attractive for long-term investors in CrowdStrike's stock.

A Powerful Business Model

CrowdStrike has a disruptive business model in endpoint security. The company's cloud-native Falcon platform uses Artificial Intelligence to learn from the data it collects, permanently improving the effectiveness of the platform to provide the best solutions in an always changing cybersecurity environment.

When a client gets attacked, the company gathers information from that attack and learns from it, generating better solutions for all of CrowdStrike clients based on one single event experienced by one client.

In a sense, CrowdStrike and its clients are benefiting from the network effect, which means that the value of the platform increases as it grows in size. The more users CrowdStrke has, the more information it collects from those users, which makes the platform more effective for all of the users. This creates a self-sustaining virtuous cycle of consistent growth and enlarged competitive strength for CrowdStrike over time.

Besides, a cloud-native platform such as Falcon is much more easily scalable and easy to implement, which is a crucial advantage in times of work from home and expanding needs for endpoint protection in cybersecurity.

From a financial perspective, the business model should scale very well, too. Most of the costs of providing the service are relatively fixed in comparison to revenue, so profit margins can be expected to expand as revenue grows over the years. Vigorous revenue growth in combination with a larger share of revenue being retained as profits should provide a double boost to earnings over the years.

CrowdStrike Is Firing On All Cylinders

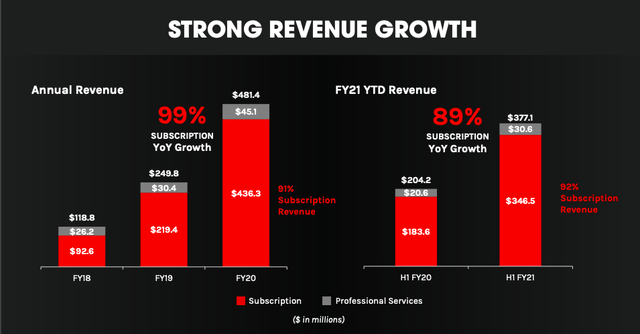

CrowdStrike's innovative approach to endpoint security is resonating well with customers, even during a recession. Total revenue last quarter reached $199 million, an 84% increase year-over-year. Subscription revenue was $184.3 million, an 89% increase versus the same quarter a year ago.

Source: CrowdStrike

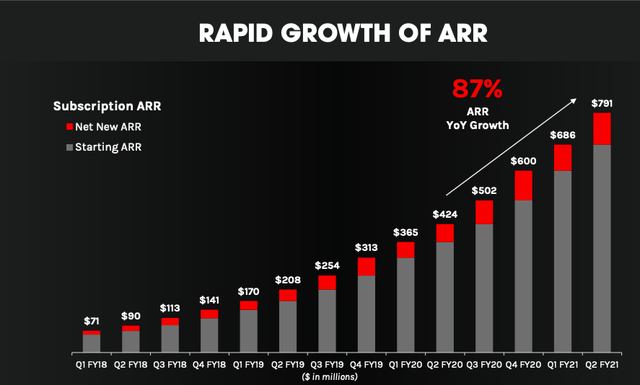

Annual Recurring Revenue - ARR - increased 87% year-over-year and grew to $790.6 million as of July 31, 2020. Of this amount, $104.5 million was net new ARR added in the quarter.

Source: CrowdStrike

The company added 969 net new subscription customers in the quarter, for a total of 7,230 subscription customers at the end of the period, representing a 91% growth rate year-over-year.

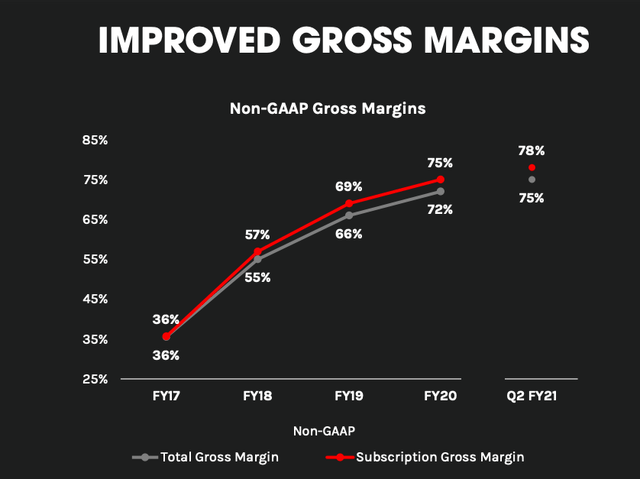

Management explicitly said in the conference call that profit margins should be expected to fluctuate over time, but the numbers are clearly moving in the right direction. Non-GAAP gross margin improved to 75% from 73% a year ago, and non-GAAP subscription gross margin increased to 78% compared with 76% in Q2 of last year and 78% last quarter.

Source: CrowdStrike

CrowdStrike is aggressively investing in sales and marketing to fuel top-line growth, and those investments are paying off. The magic number is a widely used metric in the software-as-a-service sector used to measure the efficiency of sales and marketing investments to drive revenue growth.

The formula to calculate the magic number shows quite eloquently the logic behind this indicator:

Source: The SaaS CFO

CrowdStrike ended the second quarter with a magic number of 1.3, which is exceptionally high by industry standards and a new record for the company. This is indicating that CrowdStrike is doing the right thing by aggressively investing in sales and marketing to drive recurrent revenue growth.

Abundant Room For Long-Term Growth

CrowdStrike's stock is trading at a forward price to sales ratio of 26.7 times revenue estimates for the fiscal year ending in January of 2022. This is a demanding valuation that doesn't leave any room for disappointment. The stock is clearly vulnerable to the downside from current price levels if financial performance fails to meet expectations.

On the other hand, the company still has enormous room for expansion, and current revenue numbers are not telling the whole story when it comes to CrowdStrike's potential.

Market capitalization currently stands at $29.4 billion, and CrowdStrike could easily surpass $150 billion in market value, or even more if the company keeps executing well and capitalizing on its opportunities over the long term.

All kinds of organizations on a global scale are moving beyond outdated security solutions and accelerating the transition towards cloud-native technologies that can meet current demands and easily scale to satisfy future demands in the years ahead.

The recession has obviously affected corporate spending across all kinds of areas, but a more distributed workforce under the work from home paradigm and the shift of workloads towards the cloud has accelerated the need for superior endpoint security solutions. Cybersecurity is mission-critical and more important than ever during the pandemic.

In the first half of 2020, CrowdStrike has seen a 154% increase in distinct and sophisticated intrusions, and the company has stopped 41,000 potential breaches; this is more than the potential breaches stopped during the complete year of 2019.

Companies are looking for efficient solutions that are agile, easy to deploy, and easy to manage, even if their security teams are working remotely. Based on the main industry trends, CrowdStrike is in a position of strength to continue delivering vigorous growth rates for many years into the future. The stock is expensively valued, but the business has the strength to grow into its valuation and then some more over the long term.

Risk And Reward Going Forward

The company operates in a very dynamic industry that is always prone to technological disruption, so it is important to keep an eye on the competitive landscape going forward. CrowdStrike is currently the disruptor in the industry, but management can't afford to rest on their laurels, because things can change very rapidly in endpoint security.

It is not so much about the risk that other industry players could beat CrowdStrike at its own game in the short term, but rather the chance that an increasingly aggressive landscape could force CrowdStrike to continue making huge investments in marketing and advertising in the future, which would ultimately hurt the company's ability to continue expanding its profit margins.

Even at these prices, CrowdStrike should deliver attractive returns for shareholders in the years ahead if management keeps playing its cards well. But current valuation leaves no room for disappointment, and the company needs to continue executing at the highest level in order to justify the current stock price and further gains in the future.

In other words, CrowdStrike is not a "buy and forget" company; it is a company that should be bought with a long-term horizon, but permanently followed and monitored in order to make sure that the investment thesis remains intact.

Those factors being acknowledged, a position in CrowdStrike provides exposure to an explosive growth company with a powerful business model, outstanding financial performance, and abundant room for growth in the long term. As long as the company keeps executing well, the stock is on the right path to delivering attractive returns in the years ahead.

Disclosure: I am/we are long CRWD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with ...

more

Quite a bit of information and insight in this article. And useful information. Certainly a worthwhile reading.